What You Can Learn From GURU Organic Energy Corp.'s (TSE:GURU) P/S

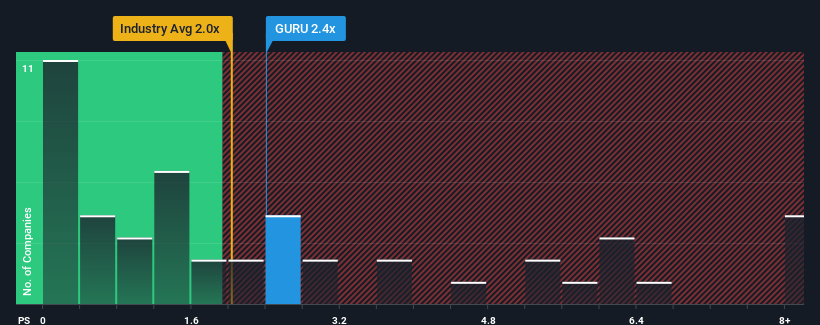

When you see that almost half of the companies in the Beverage industry in Canada have price-to-sales ratios (or "P/S") below 1.4x, GURU Organic Energy Corp. (TSE:GURU) looks to be giving off some sell signals with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for GURU Organic Energy

How Has GURU Organic Energy Performed Recently?

While the industry has experienced revenue growth lately, GURU Organic Energy's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GURU Organic Energy.Is There Enough Revenue Growth Forecasted For GURU Organic Energy?

The only time you'd be truly comfortable seeing a P/S as high as GURU Organic Energy's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 7.7% decrease to the company's top line. Even so, admirably revenue has lifted 42% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 16%. That would be an excellent outcome when the industry is expected to decline by 4.1%.

In light of this, it's understandable that GURU Organic Energy's P/S sits above the majority of other companies. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

What We Can Learn From GURU Organic Energy's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we anticipated, our review of GURU Organic Energy's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

You always need to take note of risks, for example - GURU Organic Energy has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

- KULR

- 1.360

- +1.49%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal