Ambipar Participações e Empreendimentos S.A. (BVMF:AMBP3) Investors Are Less Pessimistic Than Expected

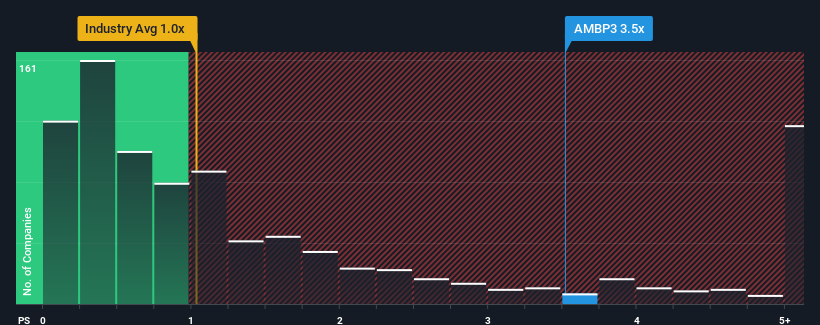

When you see that almost half of the companies in the Commercial Services industry in Brazil have price-to-sales ratios (or "P/S") below 0.7x, Ambipar Participações e Empreendimentos S.A. (BVMF:AMBP3) looks to be giving off strong sell signals with its 3.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

We check all companies for important risks. See what we found for Ambipar Participações e Empreendimentos in our free report.See our latest analysis for Ambipar Participações e Empreendimentos

How Has Ambipar Participações e Empreendimentos Performed Recently?

Recent revenue growth for Ambipar Participações e Empreendimentos has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ambipar Participações e Empreendimentos will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Ambipar Participações e Empreendimentos' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. Pleasingly, revenue has also lifted 235% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 7.7% per year as estimated by the three analysts watching the company. With the industry predicted to deliver 13% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Ambipar Participações e Empreendimentos' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Ambipar Participações e Empreendimentos' P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see Ambipar Participações e Empreendimentos trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Ambipar Participações e Empreendimentos with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal