European Penny Stocks: S.C. Romcarbon And 2 Promising Picks

As European markets experience a boost from the ECB's rate cuts and easing trade tensions, investor sentiment has improved, with major indexes like the STOXX Europe 600 Index seeing gains. Amidst these developments, penny stocks—typically smaller or newer companies—continue to offer intriguing opportunities for investors seeking growth at lower price points. Despite being an older term, penny stocks remain relevant by potentially providing significant returns when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.08 | SEK1.99B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.63 | SEK239.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.80 | SEK231.19M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.60 | PLN122.02M | ✅ 3 ⚠️ 2 View Analysis > |

| FAE Technology (BIT:FAE) | €2.27 | €45.46M | ✅ 4 ⚠️ 3 View Analysis > |

| Cellularline (BIT:CELL) | €2.51 | €52.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €32.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.03 | €23.33M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.15 | €296.84M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 428 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

S.C. Romcarbon (BVB:ROCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: S.C. Romcarbon S.A., along with its subsidiaries, operates as a plastic processor across Romania, Europe, China, Israel, Taiwan, and Panama with a market capitalization of RON90.33 million.

Operations: The company's revenue is primarily derived from Plastics Processing (RON117.96 million), Recycled Polymers & Compounds (RON34.42 million), and Other Activities including the sale of goods, utilities, and services (RON66.70 million), as well as Other Productive Sectors like protection materials and industrial filters (RON6.55 million).

Market Cap: RON90.33M

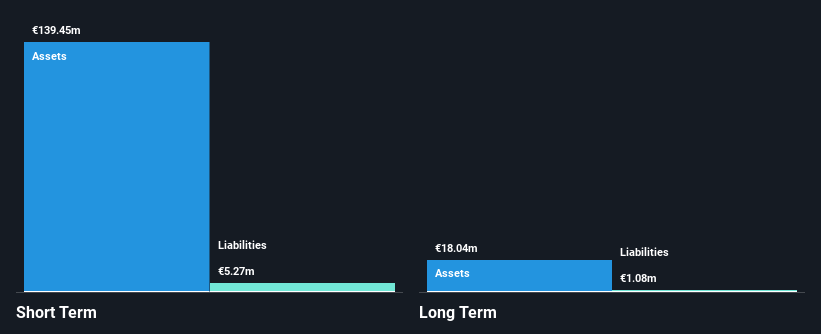

S.C. Romcarbon S.A., with a market cap of RON90.33 million, reported sales of RON307.32 million for 2024, reflecting slight revenue growth despite a net loss increase to RON12.05 million from the previous year. The company’s seasoned management and board bring stability, with short-term assets exceeding both long-term and short-term liabilities, indicating sound financial health in those areas. However, its debt is not well covered by operating cash flow and it remains unprofitable with negative return on equity at -8.78%. Despite high volatility, the stock trades at good value relative to peers in the industry.

- Unlock comprehensive insights into our analysis of S.C. Romcarbon stock in this financial health report.

- Gain insights into S.C. Romcarbon's future direction by reviewing our growth report.

NX Filtration (ENXTAM:NXFIL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NX Filtration N.V. develops, produces, and sells hollow fiber membrane modules across various regions including the Netherlands, Europe, North America, and Asia with a market cap of €188.10 million.

Operations: The company's revenue is divided into two segments: Clean Municipal Water, generating €3.72 million, and Sustainable Industrial Water, contributing €6.36 million.

Market Cap: €188.1M

NX Filtration N.V., with a market cap of €188.10 million, reported 2024 revenue of €11.08 million, up from €8.05 million the previous year, while net losses remained substantial at €23.09 million. Despite its unprofitability and removal from the Netherlands ASCX AMS Small Cap Index, NX Filtration anticipates significant revenue growth between 50% and 70% for 2025. The company's financial position is bolstered by short-term assets exceeding liabilities and sufficient cash runway for over three years if free cash flow trends continue. However, increasing debt levels may pose challenges moving forward amidst stable weekly volatility in stock performance.

- Navigate through the intricacies of NX Filtration with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into NX Filtration's future.

Maha Energy (OM:MAHA A)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Maha Energy AB (publ) is involved in the exploration, development, and production of crude oil and natural gas across Brazil, the United States, and Oman with a market capitalization of SEK741.28 million.

Operations: There are no specific revenue segments reported for Maha Energy AB (publ).

Market Cap: SEK741.28M

Maha Energy AB, with a market cap of SEK741.28 million, has demonstrated significant revenue growth, reporting US$1.83 million in Q4 2024 compared to the previous year. Despite being unprofitable and not expected to achieve profitability in the near term, the company benefits from a strong financial position with short-term assets of $106.3 million exceeding both short and long-term liabilities. Recent executive changes include Roberto Marchiori's appointment as CEO, focusing on cost optimization and strategic investments in energy and minerals industries. The stock remains highly volatile but undiluted over the past year with no debt burden impacting its operations.

- Jump into the full analysis health report here for a deeper understanding of Maha Energy.

- Gain insights into Maha Energy's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Access the full spectrum of 428 European Penny Stocks by clicking on this link.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal