UK Penny Stocks To Watch In April 2025

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors often seek opportunities in smaller or less-established companies that might be undervalued yet poised for growth. While the term "penny stocks" may seem outdated, it still signifies an investment area where strategic choices can uncover potential value in companies with strong fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Central Asia Metals (AIM:CAML) | £1.602 | £279.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.20 | £159.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.41 | £386.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.67 | £353.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.364 | £174.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.612 | £999.84M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £155.66M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.866 | £2.13B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 387 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

everplay group (AIM:EVPL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Everplay Group PLC, along with its subsidiaries, develops and publishes independent video games for both digital and physical markets in the United Kingdom and internationally, with a market cap of £377.27 million.

Operations: The company's revenue is primarily generated from its segment that focuses on developing and publishing games and apps, which accounted for £166.62 million.

Market Cap: £377.27M

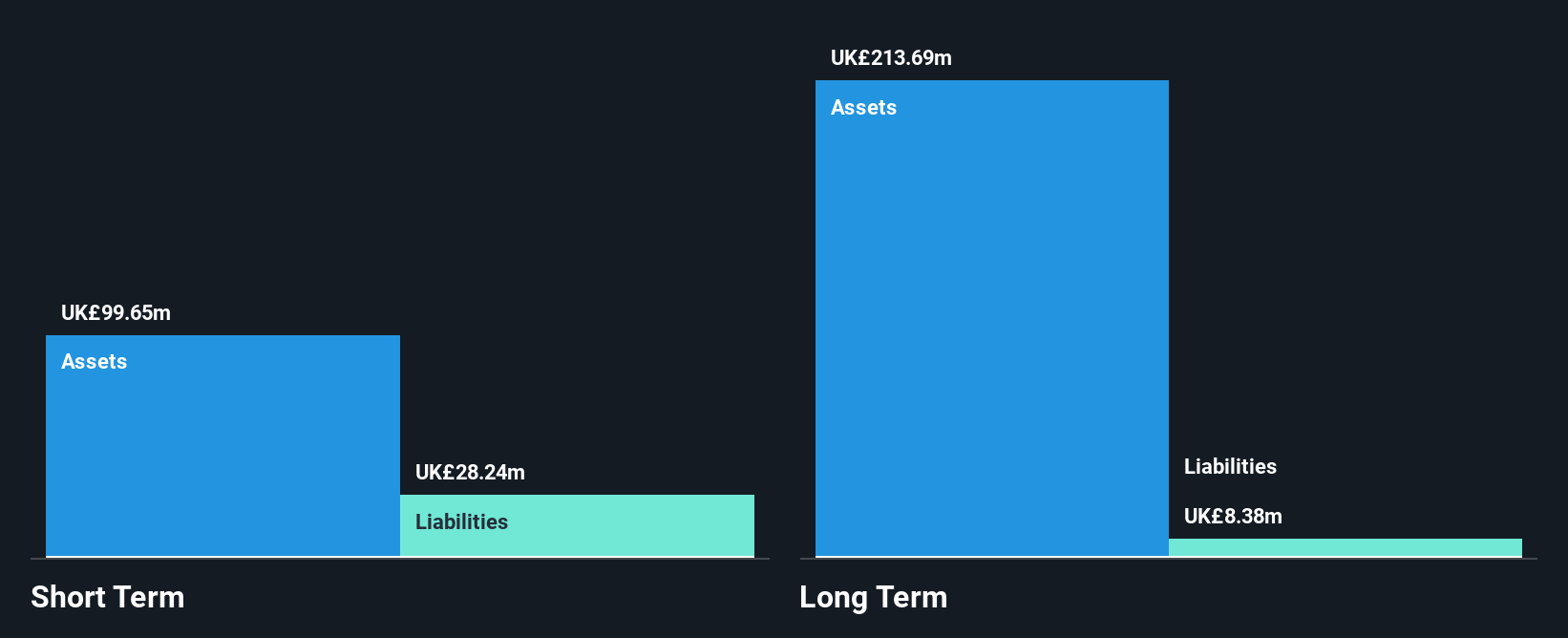

Everplay Group PLC has recently turned profitable, reporting a net income of £20.19 million for 2024, a significant turnaround from the previous year's loss. The company is debt-free and its short-term assets comfortably cover both short and long-term liabilities. Despite this financial stability, Everplay's share price remains volatile and trades below estimated fair value by 22.7%. The board's average tenure is relatively new at 1.5 years, which may impact strategic decisions like its active pursuit of M&A opportunities to enhance growth further in the gaming sector.

- Take a closer look at everplay group's potential here in our financial health report.

- Assess everplay group's future earnings estimates with our detailed growth reports.

ITM Power (AIM:ITM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ITM Power Plc designs and manufactures proton exchange membrane (PEM) electrolysers across several regions including the United Kingdom, Germany, Australia, the rest of Europe, and the United States, with a market cap of £178.11 million.

Operations: The company generates £23.16 million in revenue from its electric equipment segment.

Market Cap: £178.11M

ITM Power's current financial landscape is marked by unprofitability, with losses increasing over the past five years. Despite this, the company remains debt-free and boasts a strong cash runway exceeding three years. Recent collaborations, such as those with Deutsche Bahn AG and EDF Renewables UK, underscore ITM's strategic focus on green hydrogen initiatives. These partnerships aim to bolster decarbonization efforts across various sectors. Although ITM's share price has been volatile, its revenue is anticipated to grow significantly at 37.51% annually. The management team is experienced; however, the board lacks tenure depth which might influence governance dynamics.

- Jump into the full analysis health report here for a deeper understanding of ITM Power.

- Understand ITM Power's earnings outlook by examining our growth report.

Mercia Asset Management (AIM:MERC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mercia Asset Management PLC is a private equity and venture capital firm that focuses on various stages of investment, including incubation and growth capital, with a market cap of £129.40 million.

Operations: Mercia Asset Management's revenue is primarily derived from its Proactive Specialist Asset Management segment, which generated £33.30 million.

Market Cap: £129.4M

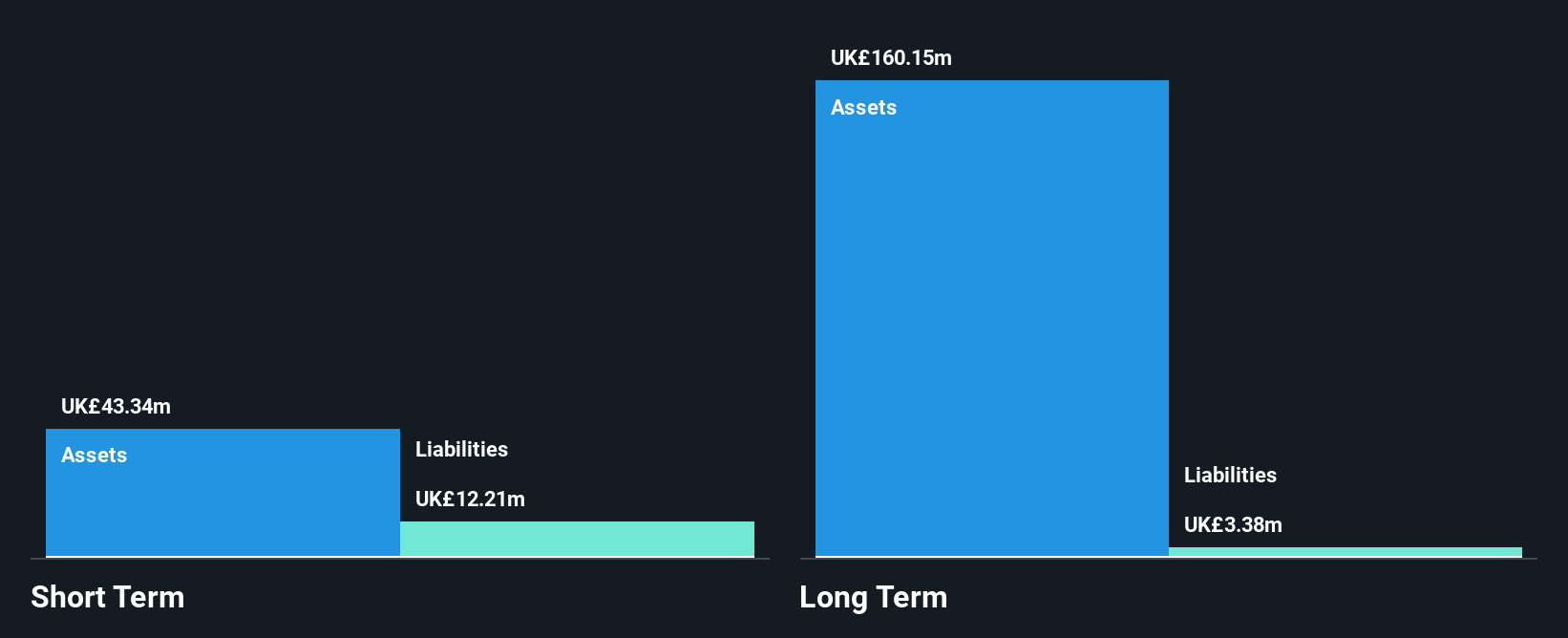

Mercia Asset Management, despite being unprofitable with increasing losses over the past five years, maintains a debt-free status and has strong short-term assets of £49.4 million that exceed its liabilities. The company's seasoned board and management team provide stability, though its negative return on equity reflects ongoing financial challenges. Recent strategic appointments, such as Dean Heaney as Head of Institutional Distribution, aim to enhance Mercia's market reach across various investment strategies. While volatility remains stable at 6%, analysts predict significant earnings growth and a potential stock price increase by 101.1%.

- Click to explore a detailed breakdown of our findings in Mercia Asset Management's financial health report.

- Examine Mercia Asset Management's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Access the full spectrum of 387 UK Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

- CRK

- 23.34

- +3.41%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal