Further Upside For MEDIROM Healthcare Technologies Inc. (NASDAQ:MRM) Shares Could Introduce Price Risks After 25% Bounce

Those holding MEDIROM Healthcare Technologies Inc. (NASDAQ:MRM) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 88% share price decline over the last year.

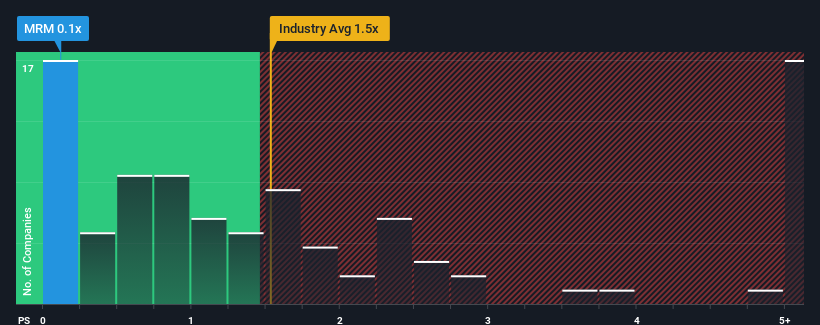

In spite of the firm bounce in price, when close to half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider MEDIROM Healthcare Technologies as an enticing stock to check out with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for MEDIROM Healthcare Technologies

What Does MEDIROM Healthcare Technologies' Recent Performance Look Like?

MEDIROM Healthcare Technologies could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MEDIROM Healthcare Technologies.What Are Revenue Growth Metrics Telling Us About The Low P/S?

MEDIROM Healthcare Technologies' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 2.8% gain to the company's revenues. The latest three year period has also seen an excellent 74% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 22% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

In light of this, it's peculiar that MEDIROM Healthcare Technologies' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does MEDIROM Healthcare Technologies' P/S Mean For Investors?

MEDIROM Healthcare Technologies' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

MEDIROM Healthcare Technologies' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with MEDIROM Healthcare Technologies.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

- LOW

- 222.89

- -0.71%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal