Currys And 2 Other UK Penny Stocks Worth Watching

The UK market has recently faced challenges, with the FTSE 100 index slipping due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, investors often look to penny stocks for their potential growth opportunities at lower price points. Though considered a somewhat outdated term, penny stocks—typically smaller or newer companies—can still offer significant upside when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.06M | ✅ 4 ⚠️ 3 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.21 | £160.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.40 | £385.22M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.665 | £353.29M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.36 | £173.77M | ✅ 2 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.612 | £999.84M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.972 | £155.02M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.962 | £2.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 388 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Currys (LSE:CURY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Currys plc is an omnichannel retailer of technology products and services across the UK, Ireland, and several Nordic countries with a market cap of approximately £1.10 billion.

Operations: The company generates revenue through its operations in the Nordics (£3.43 billion) and the UK & Ireland (£5.15 billion).

Market Cap: £1.1B

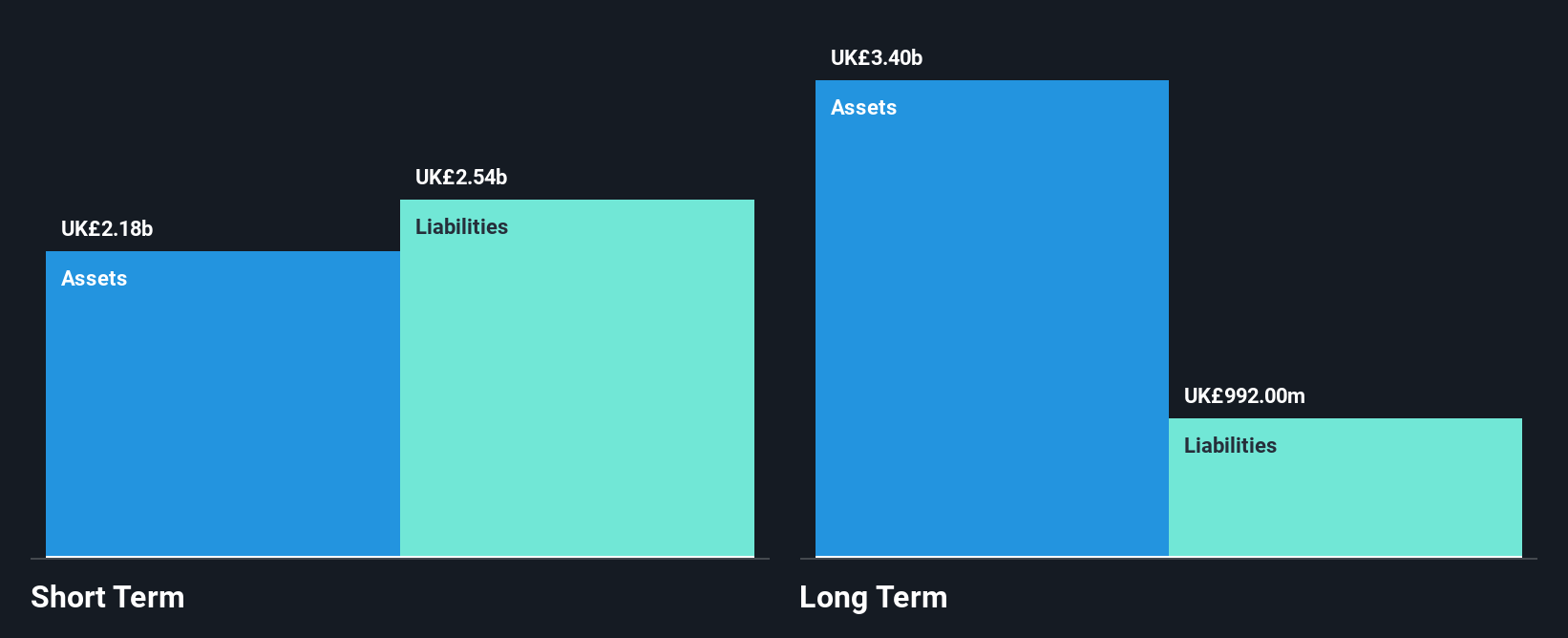

Currys plc, with a market cap of £1.10 billion, has shown significant earnings growth over the past year at 121.2%, surpassing the industry average. However, its Return on Equity remains low at 2.7%, and interest payments are not well covered by EBIT. Despite these challenges, Currys benefits from a seasoned management team and strong cash flow coverage of debt (39500%). The company's net profit margins have improved to 0.7% from last year's 0.3%. While short-term liabilities exceed short-term assets (£2.5B vs £2.2B), long-term liabilities are well covered by assets (£992M).

- Click here to discover the nuances of Currys with our detailed analytical financial health report.

- Explore Currys' analyst forecasts in our growth report.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £385.22 million.

Operations: The company's revenue is derived from three main segments: Infrastructure (£87.79 million), Private Equity (£50.78 million), and Foresight Capital Management (£8.10 million).

Market Cap: £385.22M

Foresight Group Holdings, with a market cap of £385.22 million, has demonstrated robust earnings growth of 45.9% over the past year, outperforming the industry average. The company trades at a significant discount to its estimated fair value and maintains strong financial health with short-term assets exceeding both short-term and long-term liabilities. Its debt is well-covered by operating cash flow, and it holds more cash than total debt. Recent developments include an increased equity buyback plan totaling £17 million and a new role as sub-investment manager for Liontrust Diversified Real Assets fund, enhancing its investment capabilities.

- Jump into the full analysis health report here for a deeper understanding of Foresight Group Holdings.

- Assess Foresight Group Holdings' future earnings estimates with our detailed growth reports.

Watches of Switzerland Group (LSE:WOSG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry, operating in the United Kingdom, Europe, and the United States with a market cap of approximately £833.70 million.

Operations: The company generates revenue from its operations in the US (£718.9 million) and UK & Europe (£842.4 million).

Market Cap: £833.7M

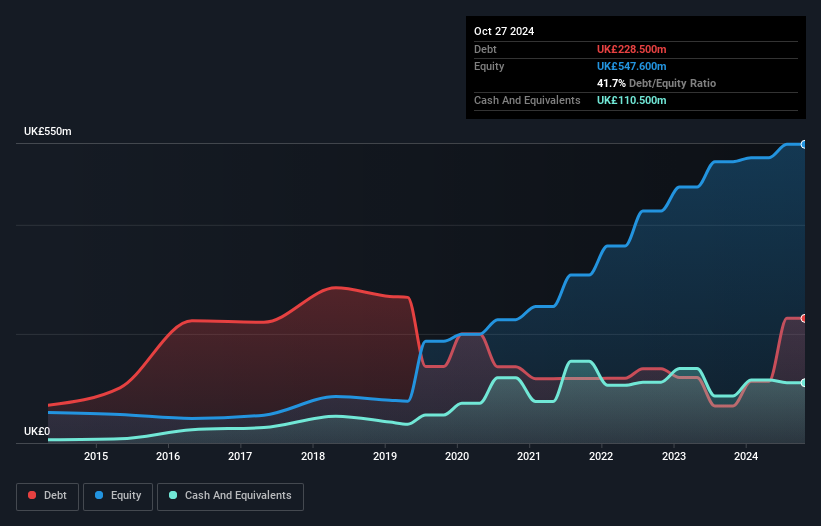

Watches of Switzerland Group, with a market cap of £833.70 million, is engaged in a share buyback program authorized to repurchase up to 10% of its issued share capital. The company shows financial stability with short-term assets (£649.9M) exceeding short-term liabilities (£331.8M), although long-term liabilities remain slightly uncovered by these assets. Debt management is prudent, supported by operating cash flow covering 73.9% of debt and interest payments covered 4.5 times by EBIT. However, recent earnings have been impacted by a £46M one-off loss, and profit margins have decreased from last year’s figures.

- Get an in-depth perspective on Watches of Switzerland Group's performance by reading our balance sheet health report here.

- Evaluate Watches of Switzerland Group's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Investigate our full lineup of 388 UK Penny Stocks right here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal