European Dividend Stocks To Consider For Your Portfolio

As trade tensions escalate, the European market has experienced fluctuations, with major indices like Germany's DAX and France's CAC 40 seeing declines. In such a volatile environment, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate market uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.28% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.80% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.52% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.57% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.02% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.10% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.26% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.33% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.71% | ★★★★★☆ |

Click here to see the full list of 245 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

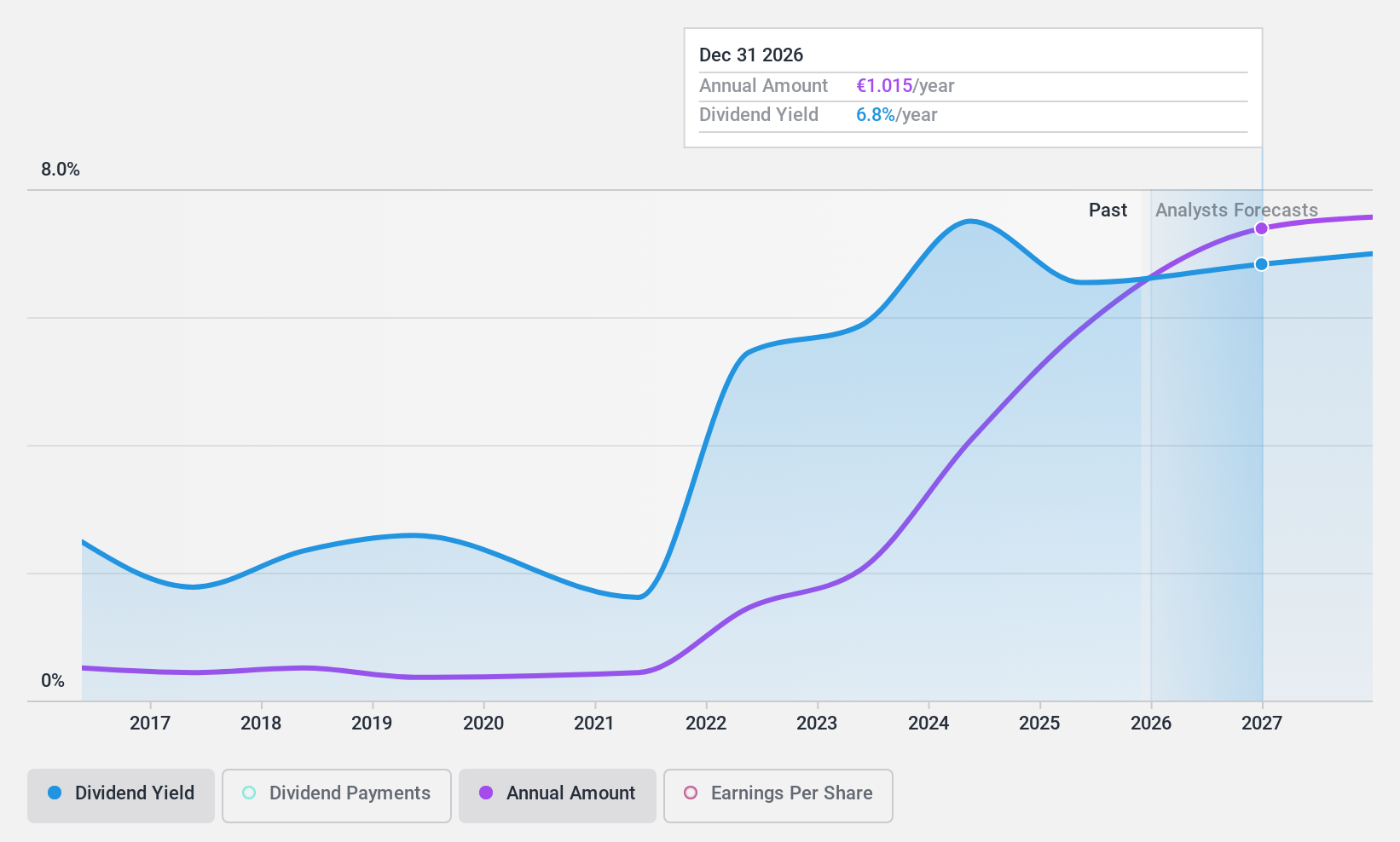

Banca Popolare di Sondrio (BIT:BPSO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Popolare di Sondrio S.p.A. is an Italian bank offering a range of banking products and services through its subsidiaries, with a market cap of €4.68 billion.

Operations: Banca Popolare di Sondrio S.p.A.'s revenue segments include €363.44 million from Companies, €708.35 million from Central Structure, €130.99 million from the Securities Sector, and €261.04 million from Individuals and Other Customers.

Dividend Yield: 7.7%

Banca Popolare di Sondrio offers a dividend yield of 7.7%, placing it in the top 25% of Italian dividend payers. Despite a volatile and unreliable dividend history, recent increases signal potential growth. The bank's payout ratio is currently 62.6%, suggesting dividends are covered by earnings and forecasted to remain sustainable at 78.5% in three years. However, with earnings expected to decline by an average of 1.4% annually over the next three years, stability remains uncertain.

- Get an in-depth perspective on Banca Popolare di Sondrio's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Banca Popolare di Sondrio's share price might be too optimistic.

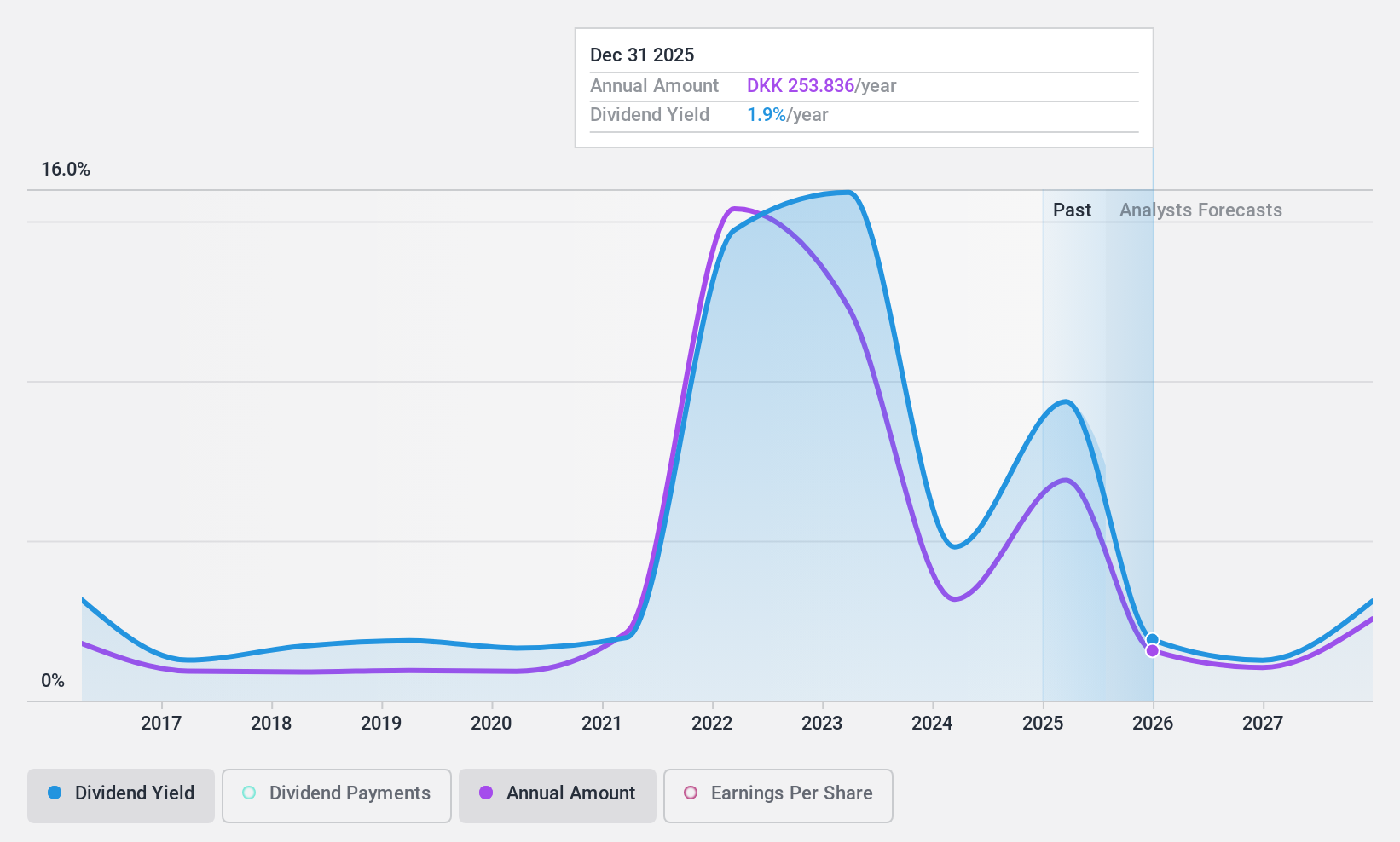

A.P. Møller - Mærsk (CPSE:MAERSK B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: A.P. Møller - Mærsk A/S operates as an integrated logistics company both in Denmark and internationally, with a market capitalization of DKK166.28 billion.

Operations: A.P. Møller - Mærsk A/S generates revenue from its key segments, including Ocean at $37.39 billion, Terminals at $4.47 billion, and Logistics & Services at $14.92 billion.

Dividend Yield: 9.4%

A.P. Møller - Mærsk's dividend yield of 9.42% ranks it among the top 25% in Denmark, although its dividend history has been volatile and unreliable over the past decade. Despite this, dividends are well covered by earnings (payout ratio: 40.1%) and cash flows (cash payout ratio: 33.3%). Recent strategic agreements, including a significant expansion at Brazil's Port of Santos, highlight ongoing efforts to bolster operational capacity amidst forecasted earnings declines over the next three years.

- Take a closer look at A.P. Møller - Mærsk's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that A.P. Møller - Mærsk is trading behind its estimated value.

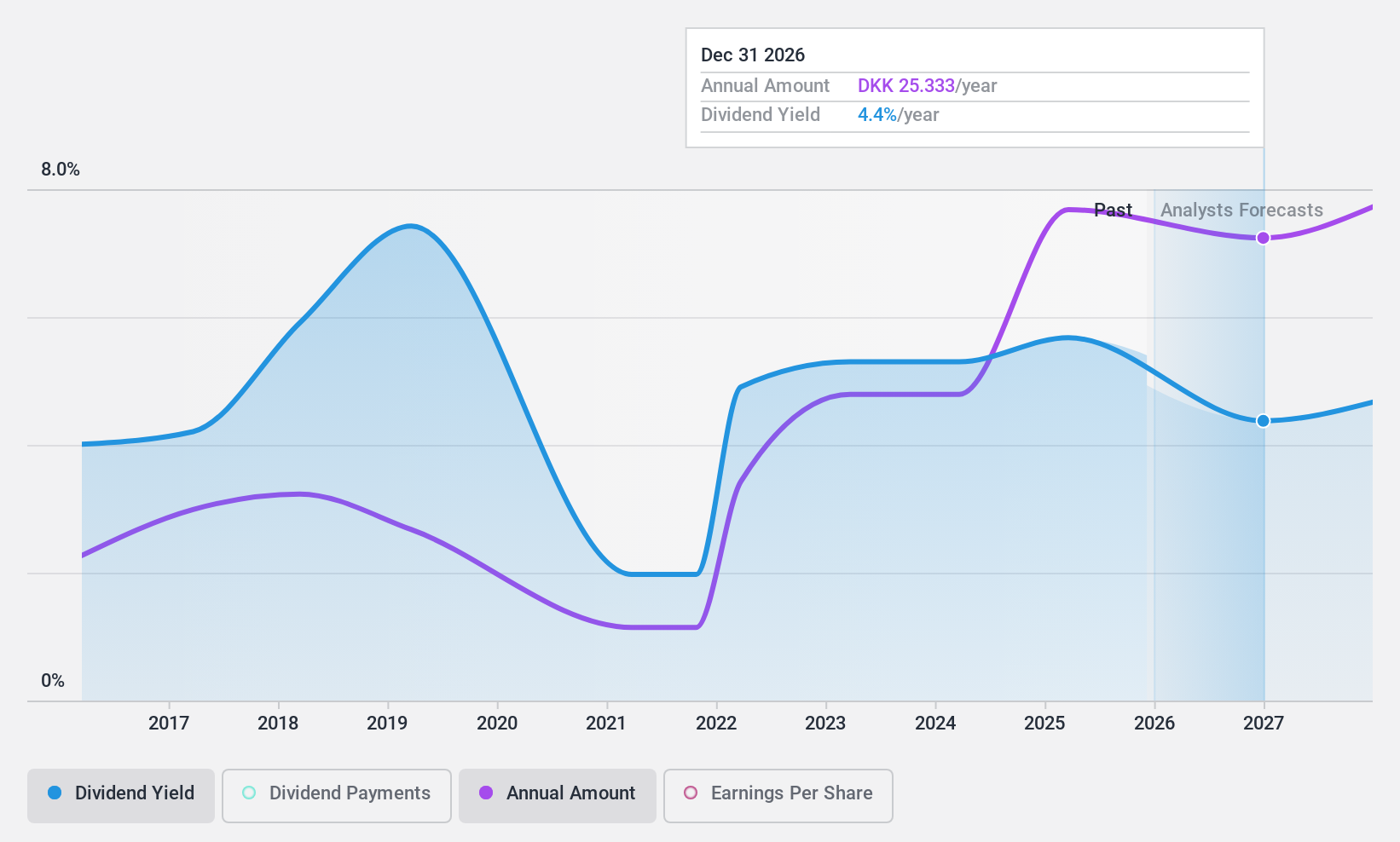

Sydbank (CPSE:SYDB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sydbank A/S, with a market cap of DKK20.80 billion, offers a range of banking products and services to corporate, private, retail, and institutional clients both in Denmark and internationally.

Operations: Sydbank A/S generates revenue through its main segments: Banking (DKK6.05 billion), Sydbank Markets (DKK384 million), Treasury (DKK87 million), and Asset Management (DKK457 million).

Dividend Yield: 6.6%

Sydbank's dividend yield of 6.58% places it in the top quartile of Danish dividend payers, yet its track record shows volatility with significant annual drops. Current dividends are covered by earnings (payout ratio: 52.6%) and are expected to remain so in three years (50.8%). Despite a recent reduction in net income to DKK 2.76 billion, the bank announced a share buyback program worth DKK 1.35 billion, indicating efforts to optimize capital structure amidst declining earnings forecasts.

- Navigate through the intricacies of Sydbank with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Sydbank shares in the market.

Next Steps

- Gain an insight into the universe of 245 Top European Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal