TSX Penny Stocks Under CA$600M Market Cap To Watch Now

The Canadian market has been navigating a landscape of heightened volatility, driven by global trade tensions and fluctuating tariffs. Amid this uncertainty, investors are increasingly looking beyond established giants to explore the potential of smaller companies. Penny stocks, often representing newer or smaller enterprises, continue to offer intriguing opportunities for those seeking affordability paired with growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.63 | CA$68.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.09 | CA$562M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$280.75M | ✅ 2 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.73 | CA$167.33M | ✅ 3 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.57 | CA$166.42M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$549.3M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.58 | CA$70.12M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.46 | CA$13.18M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.14 | CA$42.09M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 931 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Avino Silver & Gold Mines (TSX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avino Silver & Gold Mines Ltd. focuses on the acquisition, exploration, and development of mineral properties in Mexico with a market cap of CA$388.95 million.

Operations: The company generates revenue primarily from its Metals & Mining segment, specifically in Gold & Other Precious Metals, totaling $66.18 million.

Market Cap: CA$388.95M

Avino Silver & Gold Mines Ltd. has shown substantial growth, with earnings increasing by a very large 1394.5% over the past year, reflecting strong operational performance in its Metals & Mining segment. The company reported revenues of US$66.18 million for 2024 and net income surged to US$8.1 million from US$0.542 million the previous year, indicating improved profitability and efficient debt management with cash reserves of approximately $26 million at year-end 2024. With ongoing development at La Preciosa and a robust balance sheet, Avino is positioned to leverage its resources for future growth while maintaining low volatility in stock performance.

- Jump into the full analysis health report here for a deeper understanding of Avino Silver & Gold Mines.

- Understand Avino Silver & Gold Mines' earnings outlook by examining our growth report.

GoGold Resources (TSX:GGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoGold Resources Inc. is involved in the exploration, development, and production of silver, gold, and copper mainly in Mexico with a market cap of CA$579.20 million.

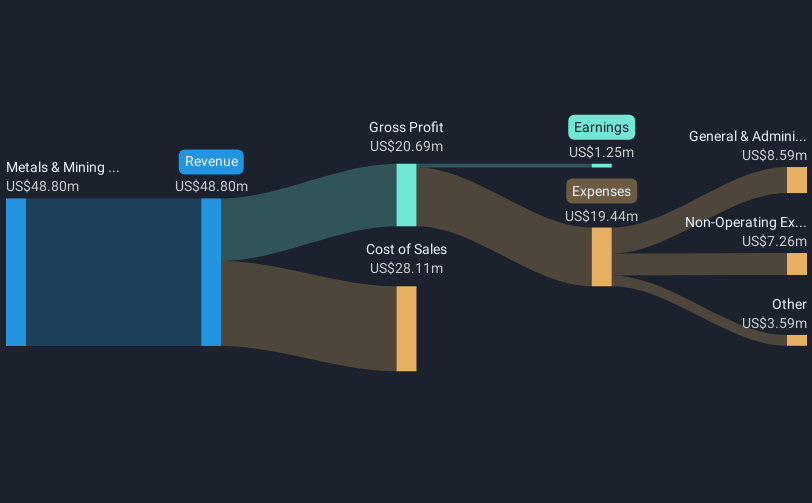

Operations: The company generates revenue from its Metals & Mining segment focused on Gold & Other Precious Metals, amounting to $48.80 million.

Market Cap: CA$579.2M

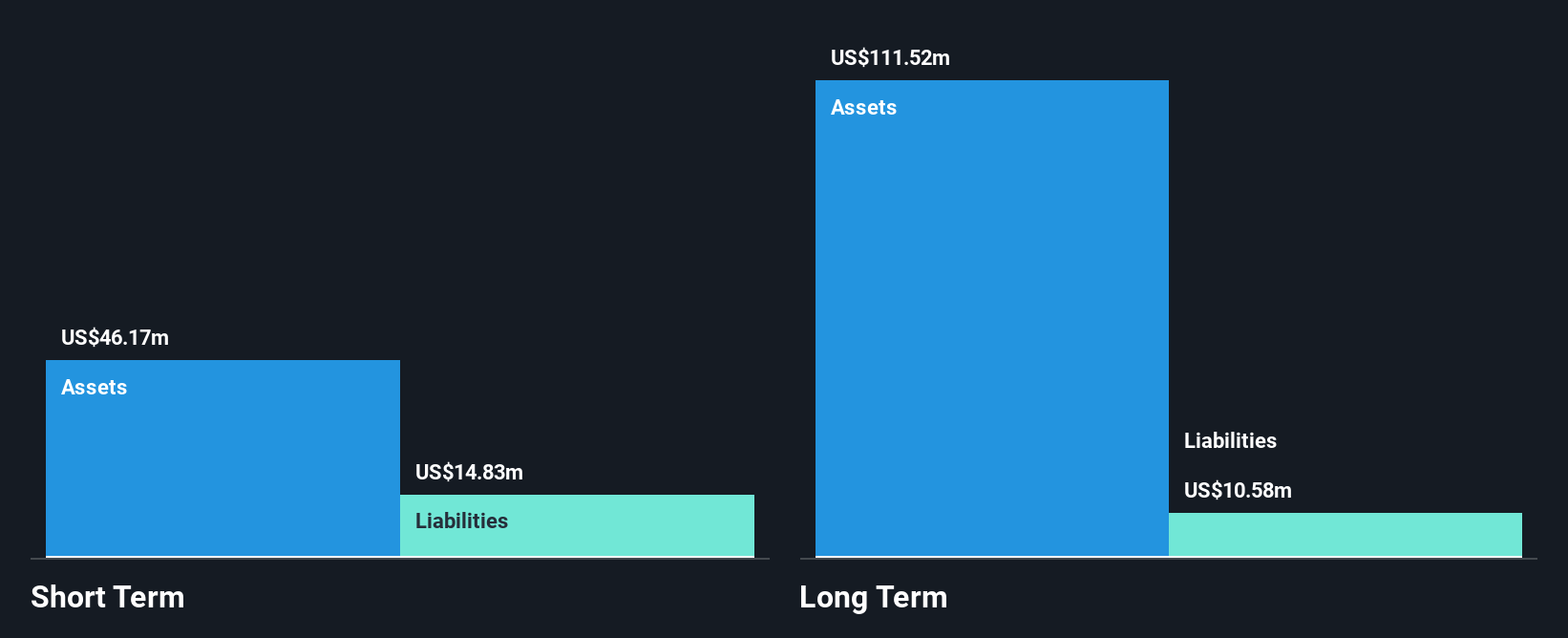

GoGold Resources Inc. has recently become profitable, with its short-term assets of $110.3 million comfortably covering both short and long-term liabilities, while maintaining a debt-free status. The company completed a CAD 75 million equity offering to support its Los Ricos South Project in Mexico, which boasts an after-tax NPV of USD 355 million and an IRR of 28% based on recent feasibility studies. Despite low return on equity at 0.4%, GoGold's seasoned management team is steering the company towards projected earnings growth of over 40% annually, leveraging strong asset positioning and strategic project developments.

- Click here to discover the nuances of GoGold Resources with our detailed analytical financial health report.

- Gain insights into GoGold Resources' future direction by reviewing our growth report.

Probe Gold (TSX:PRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Probe Gold Inc. is a precious metal exploration company focused on acquiring, exploring, and developing gold properties in Canada, with a market cap of CA$367.02 million.

Operations: Probe Gold Inc. does not report any revenue segments as it is primarily engaged in the exploration and development of gold properties in Canada.

Market Cap: CA$367.02M

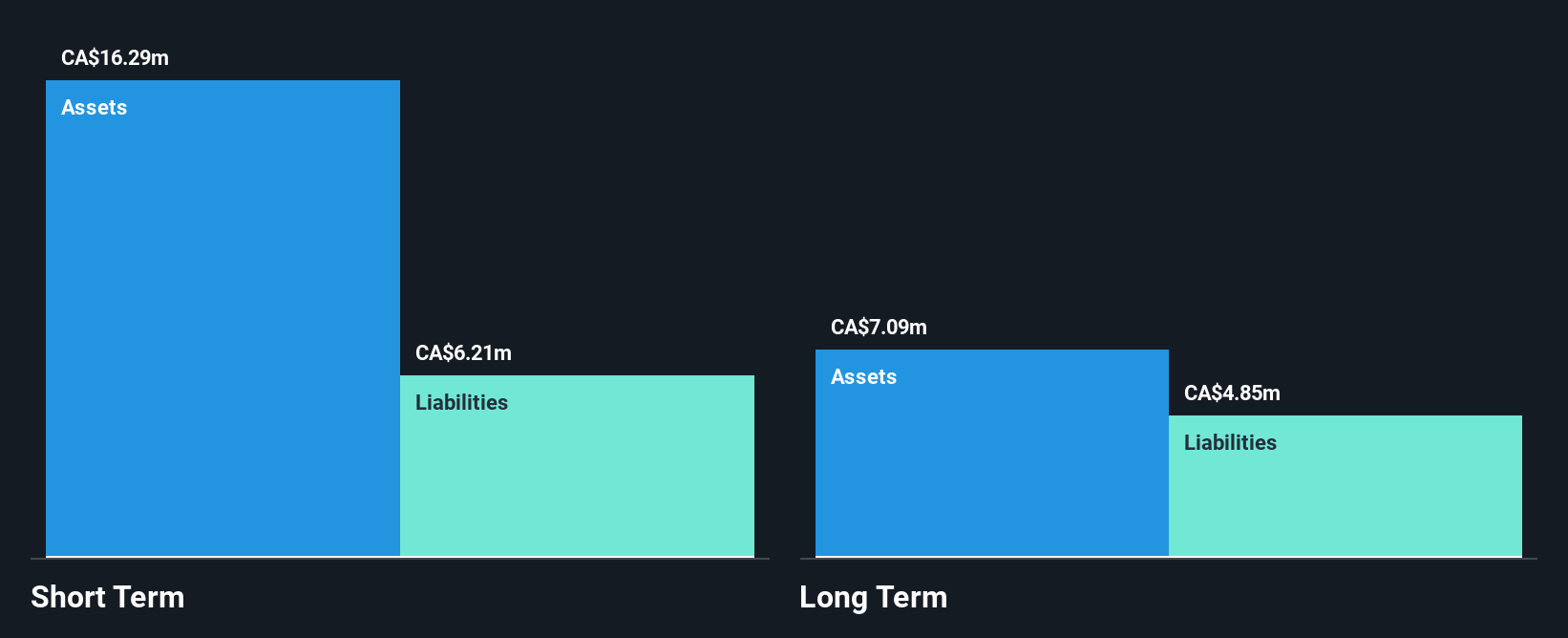

Probe Gold Inc., with a market cap of CA$367.02 million, remains pre-revenue as it focuses on gold exploration and development in Canada. The company is debt-free and has not experienced significant shareholder dilution over the past year. Recent capital raised through private placements enhances its cash runway beyond nine months, supporting continued project advancement. Notably, Probe's Novador project in Quebec shows promising drilling results and favorable environmental geochemistry assessments, indicating non-acid-generating materials that lower infrastructure costs. Analysts anticipate a potential stock price increase of 87.5%, though profitability is not expected within the next three years due to ongoing exploration activities.

- Get an in-depth perspective on Probe Gold's performance by reading our balance sheet health report here.

- Learn about Probe Gold's future growth trajectory here.

Turning Ideas Into Actions

- Discover the full array of 931 TSX Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

- PYCT

- 0.0000

- 0.00%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal