After Leaping 28% Freelancer Limited (ASX:FLN) Shares Are Not Flying Under The Radar

Freelancer Limited (ASX:FLN) shareholders have had their patience rewarded with a 28% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.4% in the last twelve months.

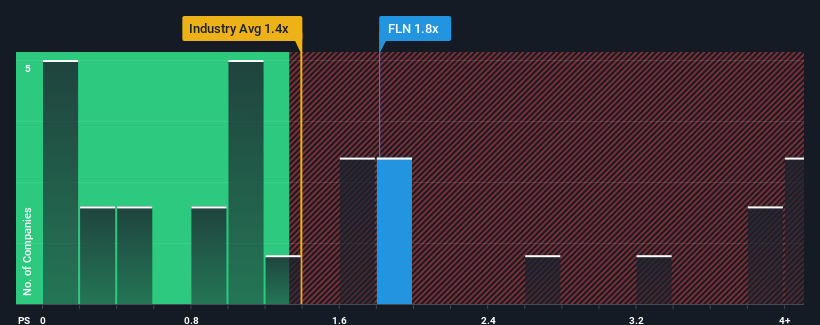

In spite of the firm bounce in price, there still wouldn't be many who think Freelancer's price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in Australia's Professional Services industry is similar at about 1.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Freelancer

What Does Freelancer's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Freelancer's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Freelancer .Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Freelancer's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.4% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 11% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 4.9% over the next year. Meanwhile, the rest of the industry is forecast to expand by 5.0%, which is not materially different.

In light of this, it's understandable that Freelancer's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Freelancer appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Freelancer maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Freelancer that you should be aware of.

If you're unsure about the strength of Freelancer's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal