Improved Revenues Required Before Whitehaven Coal Limited (ASX:WHC) Shares Find Their Feet

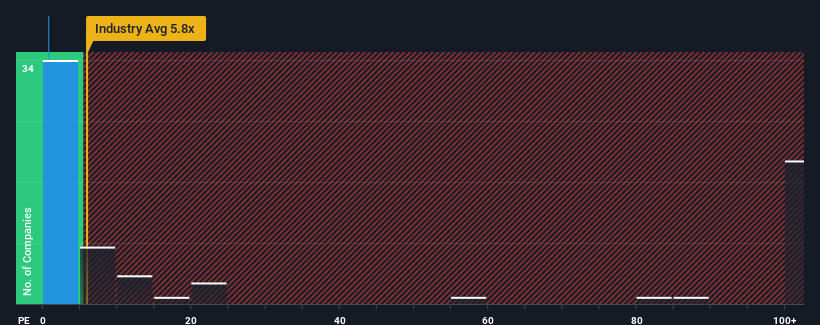

Whitehaven Coal Limited's (ASX:WHC) price-to-sales (or "P/S") ratio of 0.7x might make it look like a strong buy right now compared to the Oil and Gas industry in Australia, where around half of the companies have P/S ratios above 5.8x and even P/S above 128x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Whitehaven Coal

How Whitehaven Coal Has Been Performing

With revenue growth that's superior to most other companies of late, Whitehaven Coal has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Whitehaven Coal's future stacks up against the industry? In that case, our free report is a great place to start .Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Whitehaven Coal's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 47% last year. The strong recent performance means it was also able to grow revenue by 146% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 2.4% each year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 1,058% each year, which is noticeably more attractive.

In light of this, it's understandable that Whitehaven Coal's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Whitehaven Coal's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Whitehaven Coal maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Whitehaven Coal that you should be aware of.

If these risks are making you reconsider your opinion on Whitehaven Coal, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal