Stock Trend Capital And 2 Other TSX Penny Stocks To Watch

As the Canadian market navigates through a period of economic uncertainty marked by potential tariff impacts and fluctuating inflation expectations, investors are keeping a close eye on opportunities that might arise. Penny stocks, often representing smaller or newer companies, continue to intrigue investors with their potential for growth despite their somewhat outdated label. With this in mind, we explore three penny stocks that could hold promise due to their financial resilience and long-term potential amidst current market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.59 | CA$65.75M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.56 | CA$64.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.96 | CA$1.1B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.95 | CA$422.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.63 | CA$279.1M | ✅ 2 ⚠️ 2 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.62 | CA$168.97M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.59 | CA$549.46M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.48 | CA$70.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.46 | CA$14.32M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.09 | CA$40.24M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Stock Trend Capital (CNSX:PUMP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stock Trend Capital Inc. is an investment company that primarily focuses on the Canadian cannabis and artificial intelligence industries, with a market cap of CA$6.60 million.

Operations: The company's revenue segment for Corporate and Development reported a loss of CA$0.65 million.

Market Cap: CA$6.6M

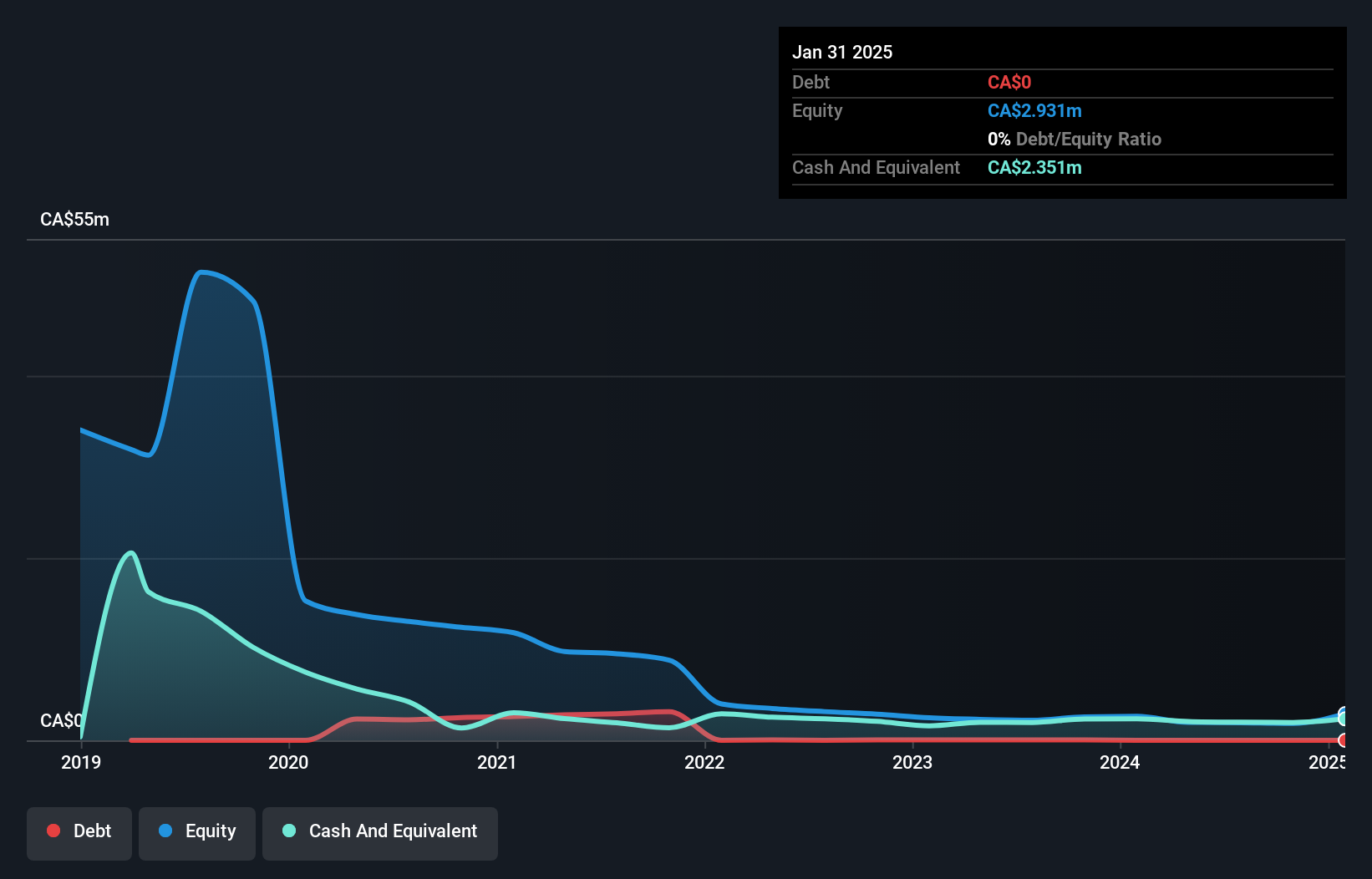

Stock Trend Capital Inc., with a market cap of CA$6.60 million, is pre-revenue, focusing on the cannabis and AI sectors. Despite negative revenue of CA$0.12 million in Q3 2025, the company achieved a net income of CA$1.07 million compared to a previous loss, indicating improved profitability. The firm benefits from being debt-free with no long-term liabilities and has experienced management and board teams with average tenures of 2.2 and 5.4 years respectively. However, its share price remains highly volatile over the past three months, posing potential risks for investors in this penny stock space.

- Click here to discover the nuances of Stock Trend Capital with our detailed analytical financial health report.

- Evaluate Stock Trend Capital's historical performance by accessing our past performance report.

Desert Mountain Energy (TSXV:DME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Desert Mountain Energy Corp. is involved in the exploration and development of oil, gas, helium, natural gas, hydrogen, and mineral properties in the Southwestern United States with a market cap of CA$20.31 million.

Operations: The company's revenue is derived entirely from its mineral exploration activities, amounting to CA$0.37 million.

Market Cap: CA$20.31M

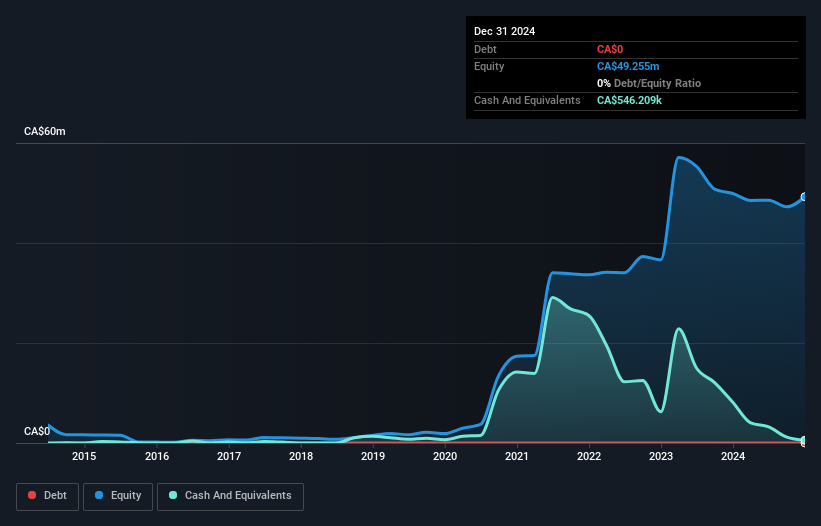

Desert Mountain Energy Corp., with a market cap of CA$20.31 million, is pre-revenue, focusing on mineral exploration activities in the Southwestern U.S. Recent legal victories and strategic licensing agreements for helium extraction highlight its adaptability and potential future revenue streams. Despite being debt-free, the company faces challenges with short-term assets not covering long-term liabilities and a limited cash runway. Management's experience averages 3.9 years, providing some stability amidst high share price volatility over the past three months. The company's recent private placement raised CA$514,000 to bolster its financial position temporarily as it navigates ongoing operational hurdles.

- Dive into the specifics of Desert Mountain Energy here with our thorough balance sheet health report.

- Explore Desert Mountain Energy's analyst forecasts in our growth report.

Snipp Interactive (TSXV:SPN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Snipp Interactive Inc. offers mobile marketing, rebates, and loyalty solutions across the United States, Canada, Ireland, and other international markets with a market cap of CA$20.03 million.

Operations: The company generates revenue of $24.03 million from its comprehensive mobile marketing and loyalty services.

Market Cap: CA$20.03M

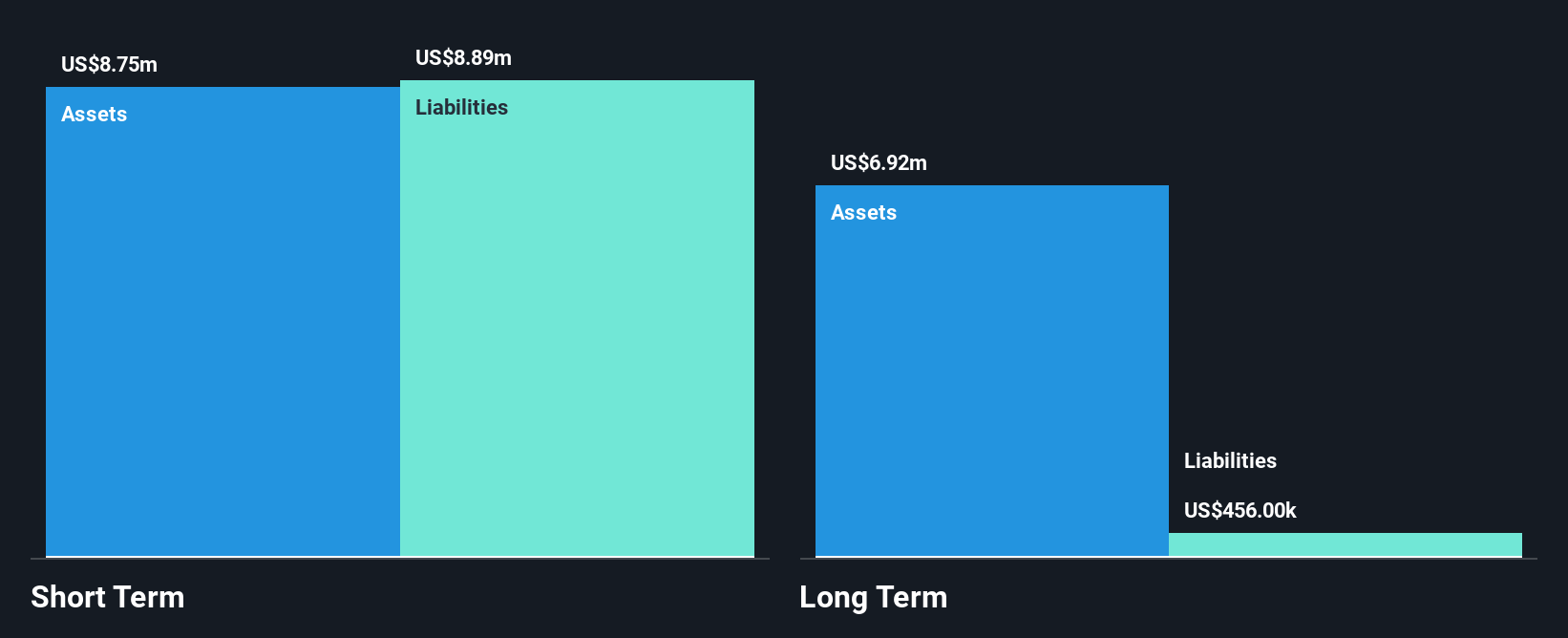

Snipp Interactive Inc., with a market cap of CA$20.03 million, is unprofitable but has reduced losses over the past five years. It boasts a robust cash runway exceeding three years and remains debt-free, demonstrating financial resilience. Recent strategic contracts, including partnerships with a multinational toy company and a global health brand, highlight Snipp's expanding client base and innovative solutions like SnippOFFERS and SnippCARE. These initiatives enhance consumer engagement through digital offers and loyalty programs, leveraging data analytics for optimized marketing strategies. The experienced management team supports these efforts amidst decreasing stock volatility over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Snipp Interactive.

- Learn about Snipp Interactive's future growth trajectory here.

Turning Ideas Into Actions

- Gain an insight into the universe of 935 TSX Penny Stocks by clicking here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

- S

- 19.15

- -1.34%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal