The Beauty Health Company (NASDAQ:SKIN) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, The Beauty Health Company (NASDAQ:SKIN) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 74% share price decline.

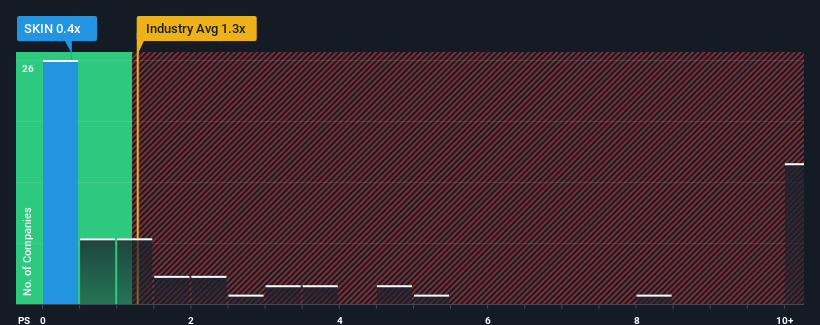

Following the heavy fall in price, given about half the companies operating in the United States' Personal Products industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider Beauty Health as an attractive investment with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Beauty Health

What Does Beauty Health's P/S Mean For Shareholders?

Beauty Health hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Beauty Health's future stacks up against the industry? In that case, our free report is a great place to start .Is There Any Revenue Growth Forecasted For Beauty Health?

Beauty Health's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. Regardless, revenue has managed to lift by a handy 29% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 2.7% per annum during the coming three years according to the eight analysts following the company. That's shaping up to be similar to the 3.7% each year growth forecast for the broader industry.

With this information, we find it odd that Beauty Health is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Beauty Health's recently weak share price has pulled its P/S back below other Personal Products companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Beauty Health's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Beauty Health (including 1 which is concerning).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal