It's Down 32% But Gerresheimer AG (ETR:GXI) Could Be Riskier Than It Looks

Gerresheimer AG (ETR:GXI) shares have had a horrible month, losing 32% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

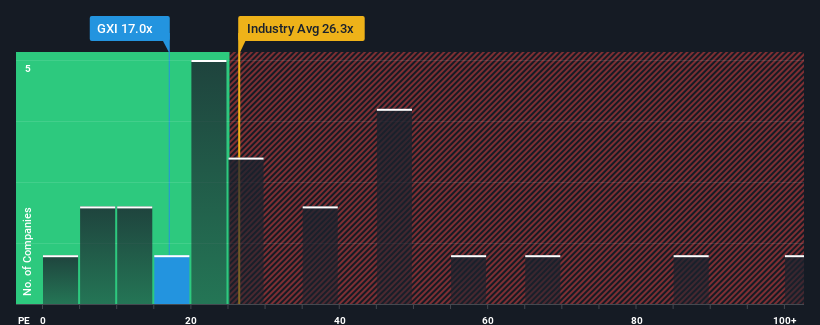

In spite of the heavy fall in price, it's still not a stretch to say that Gerresheimer's price-to-earnings (or "P/E") ratio of 17x right now seems quite "middle-of-the-road" compared to the market in Germany, where the median P/E ratio is around 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Gerresheimer hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Gerresheimer

Is There Some Growth For Gerresheimer?

The only time you'd be comfortable seeing a P/E like Gerresheimer's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 8.8% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 19% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 27% per year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 15% each year growth forecast for the broader market.

With this information, we find it interesting that Gerresheimer is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

With its share price falling into a hole, the P/E for Gerresheimer looks quite average now. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Gerresheimer currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Gerresheimer (at least 1 which is potentially serious), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Gerresheimer. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

- OWLT

- 4.145

- +5.74%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal