Low price-earnings ratio makes it difficult to overcome AI anxiety Google (GOOGL.US) is in a valuation dilemma

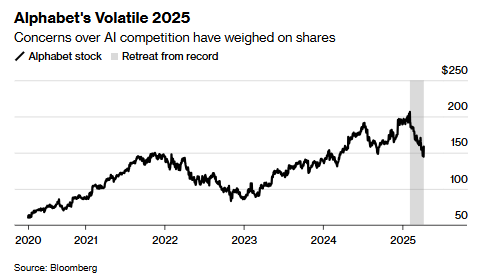

The Zhitong Finance App learned that even though the price-earnings ratio has fallen to a low level in nearly two years and the impact of tariffs is limited, market concerns about Google (GOOGL.US)'s backward position in the artificial intelligence (AI) field are still putting pressure on its stock price this year.

As a recognized leader in AI, it has always been difficult for Google to escape the haze that competitors such as ChatGPT may eat away at market share. Although it still dominates search engines, any loss of share could increase pressure on stock prices — especially as the company continues to invest heavily in AI.

“When market share is too high, the only direction of change is decline,” said Kevin Walkush, portfolio manager at Jensen Investment Management. “Although we are convinced that its search dominance will not waver, the market clearly amplifies this concern excessively, but this existential crisis rhetoric does influence investors' judgments.”

Even on Wednesday, when Trump suspended the tariff policy to stimulate a rebound in the general market, Google surged 9.7%, but the cumulative decline during the year still reached 16%, falling short of AI concept stocks such as Microsoft (MSFT.US) and Meta (META.US) and the Nasdaq 100 Index.

To maintain the upward trend in stock prices, the key is to revive investors' confidence in the search business. At the same time, the high cost of building AI models highlights the importance of return on investment. The company announced in February that capital expenditure in 2025 would reach $75 billion, far exceeding market expectations, and confirmed the plan again on Wednesday. According to the latest data from Statista, Google's global search engine share fell to 89.6% from 92.9% when ChatGPT was launched in January 2023.

Melius Research analyst Ben Reitzes believes that this moderate decline may indicate a bigger crisis. “The search business is about to face a full-scale siege, but market expectations have yet to fully reflect this,” he warned in the report. “As data accumulates, Google's valuation multiples may continue to be under pressure.” In particular, he pointed out the risk that younger users are speeding up the flow to services such as ChatGPT.

Although search ad revenue in the last quarter slightly exceeded expectations, weak performance in the cloud business (another AI-related core sector) triggered a sell-off of the stock. According to the data, Google search ads are expected to contribute more than 56% of total revenue this year, and Google Cloud accounts for about 14%.

Despite this, the company still has positive elements: revenue growth is expected to be around 16% this year, net profit will maintain double-digit growth until 2027, and revenue expectations for 2025 have continued to rise over the past month.

Compared to hardware vendors such as Apple (AAPL.US), the advertising-based business model makes Google less affected by tariffs. Currently, its valuation has fallen below the S&P 500 average, and its dynamic price-earnings ratio is less than 17 times, making it the cheapest target among the “Big Seven”. “This highlights significant investment value,” Walkush emphasized. “If the market can correctly perceive its growth and the sustainability of its cash flow, the valuation should have been higher.”

Wall Street remains generally positive. About 80% of analysts gave a “buy” rating, and the current stock price has 34% room to rise from the target price.

In addition to Google searches, several of the company's businesses are also considered undervalued. Needham assessed that YouTube's separate valuation could reach 666 billion US dollars, and DA Davidson believes that DeepMind and its TPU chip business may be worth 700 billion US dollars. Its AI pharmaceutical division recently raised $600 million, and Waymo's autonomous driving valuation surpassed $45 billion.

“In the field of AI search, Google still needs to prove itself with strength,” said Divyaunsh Divatia, a research analyst at Janus Henderson Investors. “But it has all the assets needed to succeed, and we expect the search business to grow overall, so even if it has a smaller share of the larger market, Google will grow well.”

“The popularity of AI products like Gemini is important, but consider everything you're getting from this stock: not only the growing search and cloud businesses, but YouTube, the world's largest media company, and Waymo, which has unlimited potential — getting these assets at a lower than market value is a real value investment.”

- SMWB

- 7.65

- +2.82%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal