We Ran A Stock Scan For Earnings Growth And Petra Energy Berhad (KLSE:PENERGY) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Petra Energy Berhad (KLSE:PENERGY). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Petra Energy Berhad Growing Its Earnings Per Share?

In the last three years Petra Energy Berhad's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Petra Energy Berhad's EPS soared from RM0.16 to RM0.22, over the last year. That's a impressive gain of 35%.

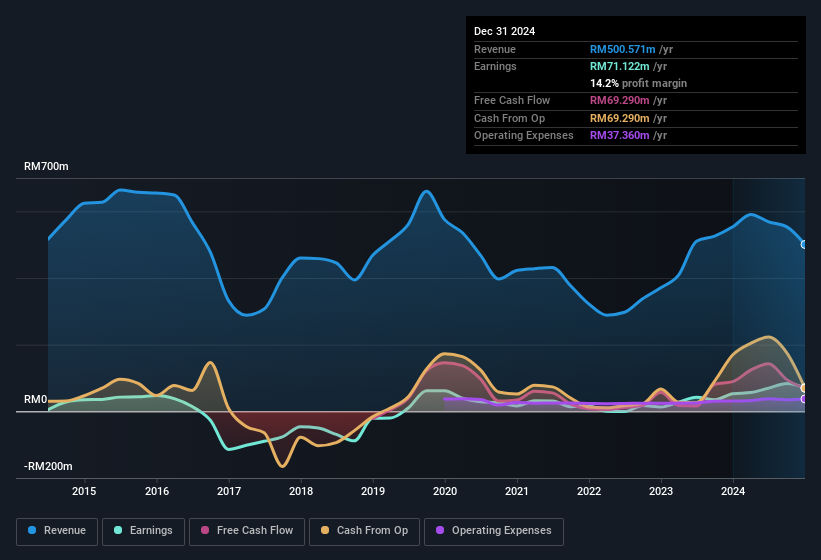

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. We note that while EBIT margins have improved from 15% to 19%, the company has actually reported a fall in revenue by 9.6%. While not disastrous, these figures could be better.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

See our latest analysis for Petra Energy Berhad

Since Petra Energy Berhad is no giant, with a market capitalisation of RM327m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Petra Energy Berhad Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Petra Energy Berhad shares worth a considerable sum. Indeed, they hold RM59m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 18% of the company; visible skin in the game.

Is Petra Energy Berhad Worth Keeping An Eye On?

For growth investors, Petra Energy Berhad's raw rate of earnings growth is a beacon in the night. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Petra Energy Berhad , and understanding these should be part of your investment process.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in MY with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal