Not Many Are Piling Into FreightCar America, Inc. (NASDAQ:RAIL) Stock Yet As It Plummets 37%

To the annoyance of some shareholders, FreightCar America, Inc. (NASDAQ:RAIL) shares are down a considerable 37% in the last month, which continues a horrid run for the company. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 13%.

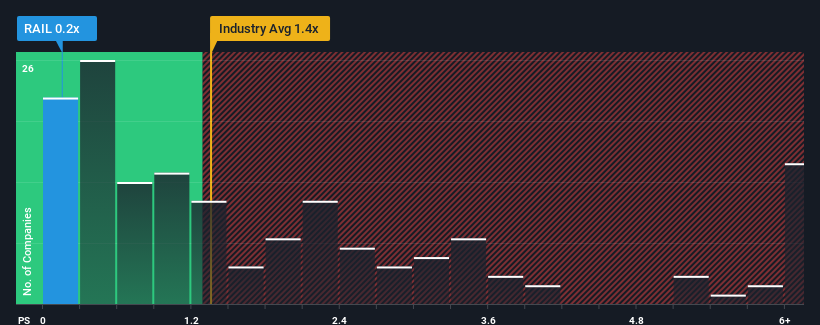

Following the heavy fall in price, given about half the companies operating in the United States' Machinery industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider FreightCar America as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for FreightCar America

What Does FreightCar America's P/S Mean For Shareholders?

Recent times have been pleasing for FreightCar America as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think FreightCar America's future stacks up against the industry? In that case, our free report is a great place to start .Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as FreightCar America's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 56% last year. Pleasingly, revenue has also lifted 176% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 4.5% per annum over the next three years. With the industry predicted to deliver 3.6% growth per year, the company is positioned for a comparable revenue result.

With this information, we find it odd that FreightCar America is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

The southerly movements of FreightCar America's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of FreightCar America's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 3 warning signs for FreightCar America (1 makes us a bit uncomfortable!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal