TSX Penny Stock Highlights: Angus Gold Among 3 Noteworthy Picks

As the Canadian market navigates through a period of economic uncertainty influenced by global trade dynamics and potential tariff impacts, investors are keenly observing opportunities that might arise. Penny stocks, often seen as remnants of past trading eras, continue to hold relevance for those seeking growth potential at lower price points. When backed by solid financials, these smaller or newer companies can offer significant upside, and this article will highlight three noteworthy penny stocks that exemplify this potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.53 | CA$65.34M | ✅ 4 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$1.02B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.79 | CA$407.32M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.63 | CA$280.75M | ✅ 2 ⚠️ 2 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.79 | CA$181.35M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.58 | CA$531.21M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.54 | CA$74.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.53 | CA$15.76M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.005 | CA$36.92M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 938 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Angus Gold (TSXV:GUS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angus Gold Inc. is a gold exploration company dedicated to acquiring, exploring, and developing mineral properties, with a market cap of CA$27.15 million.

Operations: Angus Gold Inc. does not report any revenue segments as it focuses on the exploration and development of mineral properties.

Market Cap: CA$27.15M

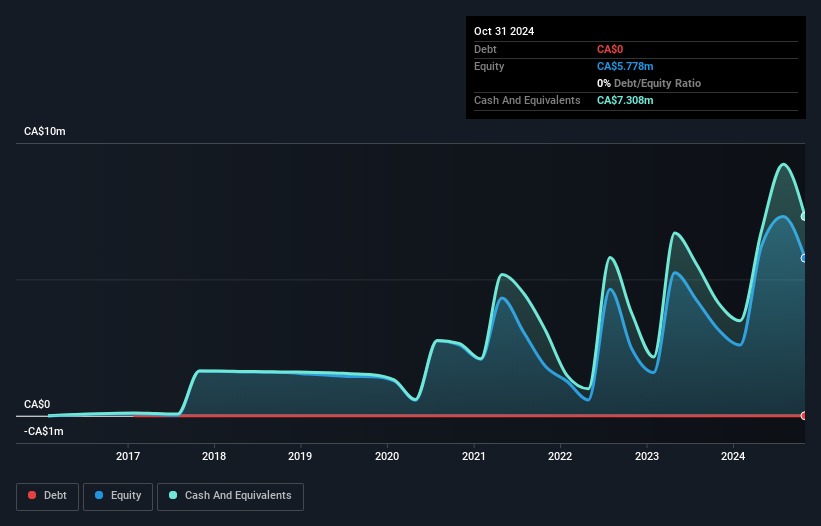

Angus Gold Inc., with a market cap of CA$27.15 million, is a pre-revenue gold exploration company focused on its Golden Sky Project in Wawa, Ontario. The recent announcement of Wesdome Gold Mines Ltd.'s acquisition offer highlights potential value realization for shareholders at CA$0.77 per share. Exploration results have been promising, particularly the extension of high-grade mineralization in the Dorset Zone, yet Angus remains unprofitable with increasing losses over five years and negative return on equity (-84.01%). Despite this, it benefits from no debt and sufficient cash runway to support ongoing exploration activities without shareholder dilution over the past year.

- Dive into the specifics of Angus Gold here with our thorough balance sheet health report.

- Gain insights into Angus Gold's past trends and performance with our report on the company's historical track record.

Orecap Invest (TSXV:OCI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Orecap Invest Corp. focuses on investing in the natural resource sector and has a market cap of CA$14.86 million.

Operations: Orecap Invest Corp. currently does not report any specific revenue segments.

Market Cap: CA$14.86M

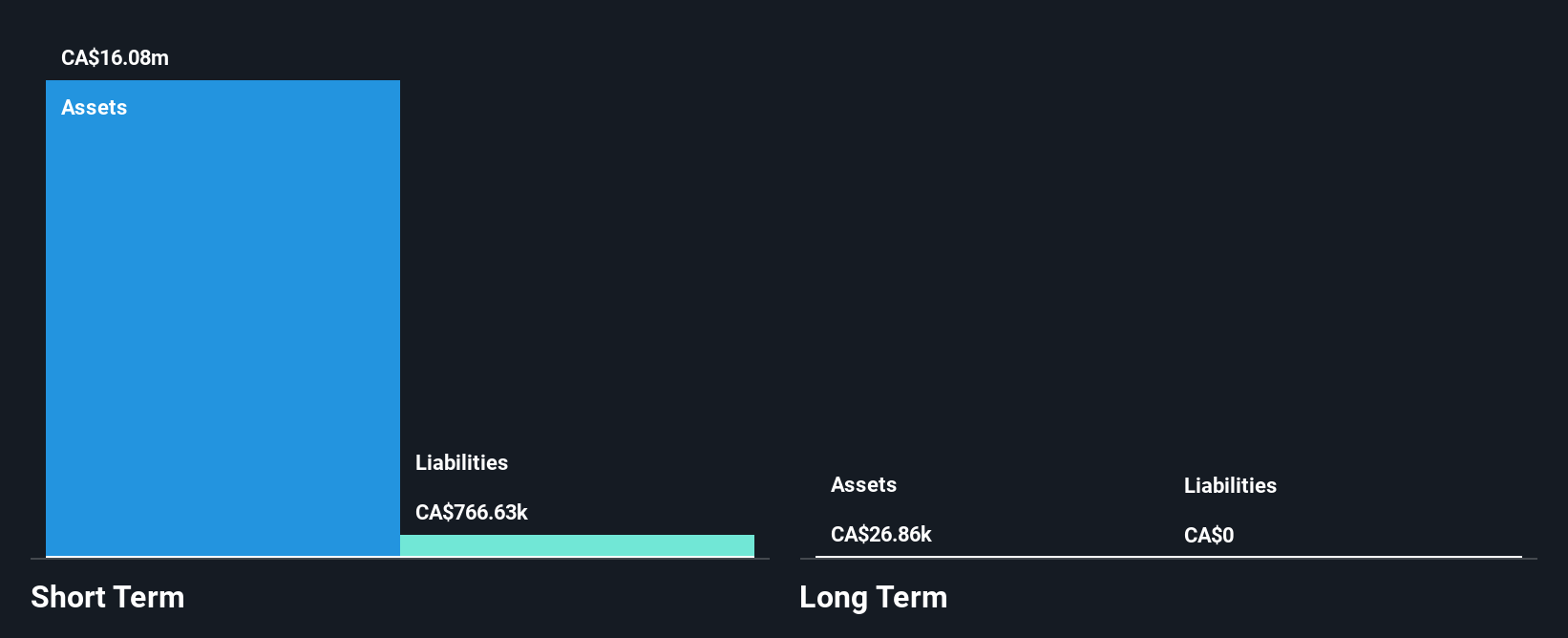

Orecap Invest Corp., with a market cap of CA$14.86 million, is a pre-revenue entity focusing on the natural resource sector. Despite its unprofitable status and negative return on equity (-14.38%), the company has reduced losses by 45.8% annually over five years and remains debt-free with short-term assets (CA$16.8M) surpassing liabilities (CA$797.3K). Recent initiatives include reprocessing historic tailings at the Kerr-Addison mine, aligning with Ontario's new simplified permitting regulations for mine waste projects launching July 2025, which could unlock economic value while emphasizing environmental sustainability and job creation in the mining sector.

- Click here to discover the nuances of Orecap Invest with our detailed analytical financial health report.

- Examine Orecap Invest's past performance report to understand how it has performed in prior years.

WELL Health Technologies (TSX:WELL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WELL Health Technologies Corp. is a digital healthcare company focused on serving practitioners in Canada, the United States, and internationally, with a market cap of CA$1.03 billion.

Operations: The company's revenue is generated from several segments, including CA$72.01 million from SaaS and Technology Services, CA$122.03 million from Specialized-provider Staffing, CA$179.11 million from Canadian Patient Services - Primary, CA$119.23 million from Canadian Patient Services - Specialized Myhealth, and in the U.S., CA$92.48 million from WELL Health USA Patient Services - Primary WISP, CA$127.25 million from WELL Health USA Patient Services - Primary Circle Medical, and CA$252.93 million from WELL Health USA Patient Services - Specialized CRH Medical.

Market Cap: CA$1.03B

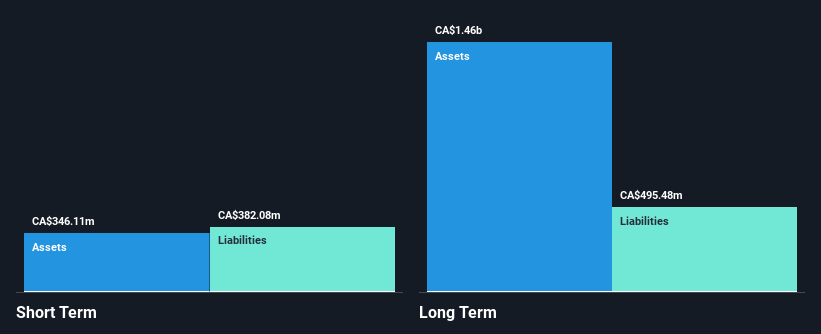

WELL Health Technologies, with a market cap of CA$1.03 billion, has transitioned to profitability this year, though its Return on Equity remains low at 10.3%. The company has not diluted shareholders recently and boasts an experienced board and management team. Despite stable weekly volatility at 7%, earnings are forecasted to decline by 9.1% annually over the next three years, although revenue is expected to grow by 11.81% per year. WELL's debt management shows improvement with a reduced debt-to-equity ratio now at 34.9%, yet interest coverage remains weak at only 1.6 times EBIT.

- Navigate through the intricacies of WELL Health Technologies with our comprehensive balance sheet health report here.

- Gain insights into WELL Health Technologies' future direction by reviewing our growth report.

Taking Advantage

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 935 more companies for you to explore.Click here to unveil our expertly curated list of 938 TSX Penny Stocks.

- Contemplating Other Strategies? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal