Golden Matrix Group And 2 Other Stocks That Might Be Trading Below Their Estimated Fair Value

In the midst of a turbulent trading environment, with major indices experiencing significant fluctuations due to tariff uncertainties, investors are increasingly on the lookout for stocks that may be undervalued and trading below their estimated fair value. In such volatile conditions, identifying stocks with strong fundamentals and potential resilience against economic headwinds can offer opportunities for those seeking to navigate the market's unpredictability.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (NasdaqGS:TOWN) | $30.51 | $61.00 | 50% |

| Oddity Tech (NasdaqGM:ODD) | $39.02 | $77.63 | 49.7% |

| Washington Trust Bancorp (NasdaqGS:WASH) | $26.08 | $51.60 | 49.5% |

| Heritage Financial (NasdaqGS:HFWA) | $21.34 | $42.07 | 49.3% |

| Afya (NasdaqGS:AFYA) | $16.99 | $33.15 | 48.7% |

| Atlanticus Holdings (NasdaqGS:ATLC) | $45.61 | $90.52 | 49.6% |

| BeiGene (NasdaqGS:ONC) | $220.54 | $436.41 | 49.5% |

| National Fuel Gas (NYSE:NFG) | $73.25 | $143.14 | 48.8% |

| CBIZ (NYSE:CBZ) | $70.99 | $140.08 | 49.3% |

| CNX Resources (NYSE:CNX) | $28.93 | $57.37 | 49.6% |

Let's dive into some prime choices out of the screener.

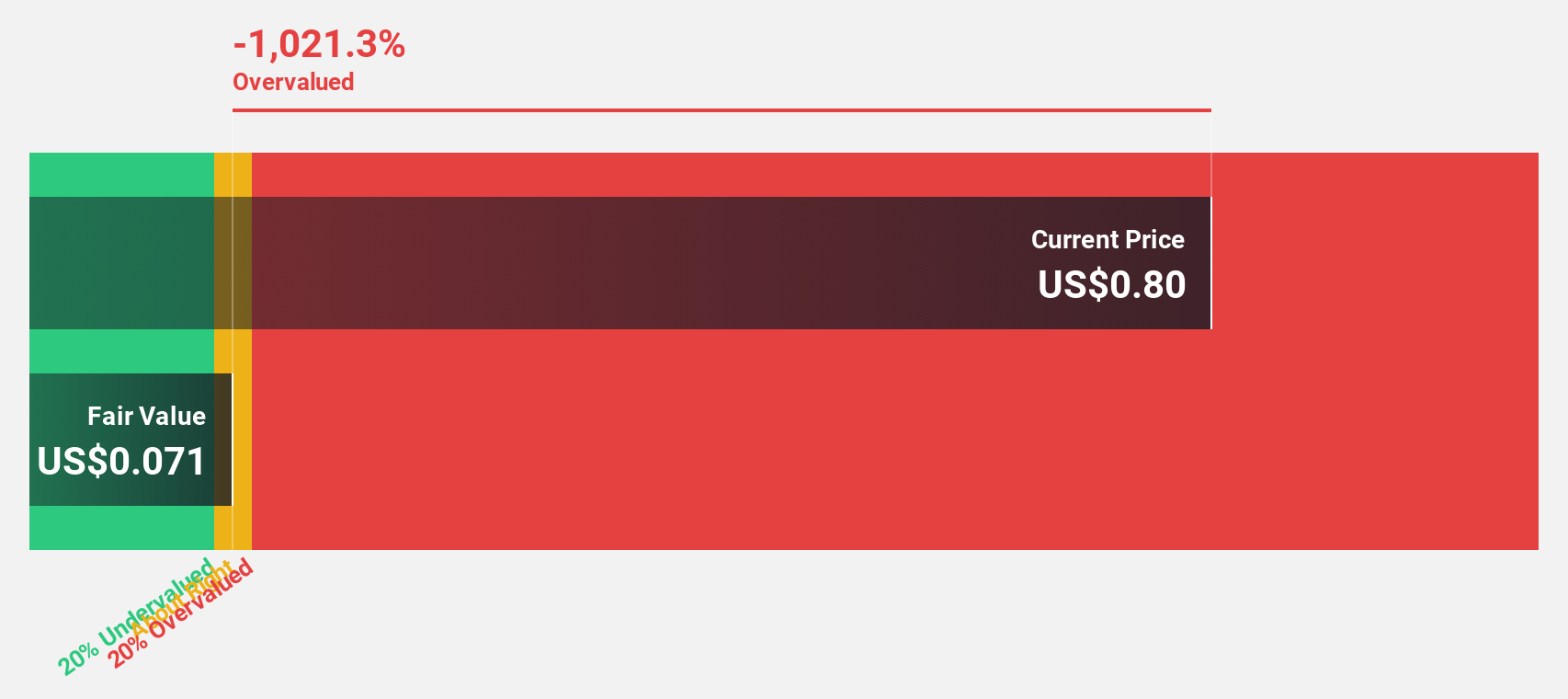

Golden Matrix Group (NasdaqCM:GMGI)

Overview: Golden Matrix Group, Inc. is a gaming technology company providing B2B and B2C solutions in Central and South America, Europe, and Africa with a market cap of $253.61 million.

Operations: The company's revenue is derived from three segments: Gmag with $12.48 million, Rkings & Cfac contributing $32.40 million, and Meridianbet Group generating $106.23 million.

Estimated Discount To Fair Value: 22.4%

Golden Matrix Group is trading at US$2.05, below its estimated fair value of US$2.64, suggesting potential undervaluation based on discounted cash flow analysis. Despite a recent net loss of US$1.48 million for 2024, the company has seen significant revenue growth from US$92.99 million to US$151.12 million year-over-year and is expected to achieve profitability within three years, with earnings forecasted to grow significantly annually.

- Insights from our recent growth report point to a promising forecast for Golden Matrix Group's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Golden Matrix Group.

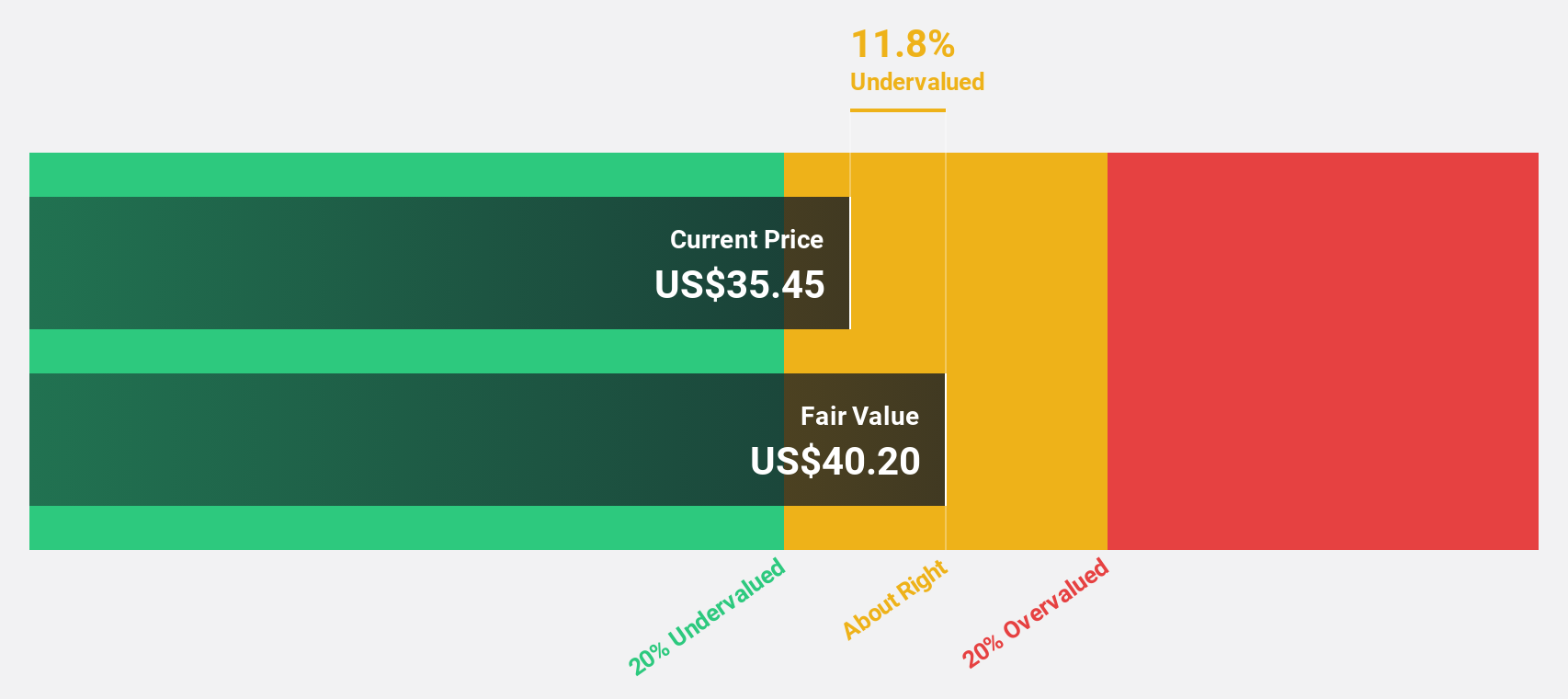

Vertex (NasdaqGM:VERX)

Overview: Vertex, Inc. offers enterprise tax technology solutions for the retail, wholesale, and manufacturing industries both in the United States and internationally, with a market cap of approximately $5.53 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $666.78 million.

Estimated Discount To Fair Value: 14.4%

Vertex is trading at US$35.75, below its estimated fair value of US$41.77, indicating potential undervaluation based on cash flows. Despite a net loss of US$52.73 million in 2024, revenue grew from US$572.39 million to US$666.78 million year-over-year, with further growth expected in 2025. The company aims for profitability within three years and explores M&A opportunities to expand market presence and product offerings while enhancing its e-invoicing solution for global compliance needs.

- In light of our recent growth report, it seems possible that Vertex's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Vertex's balance sheet health report.

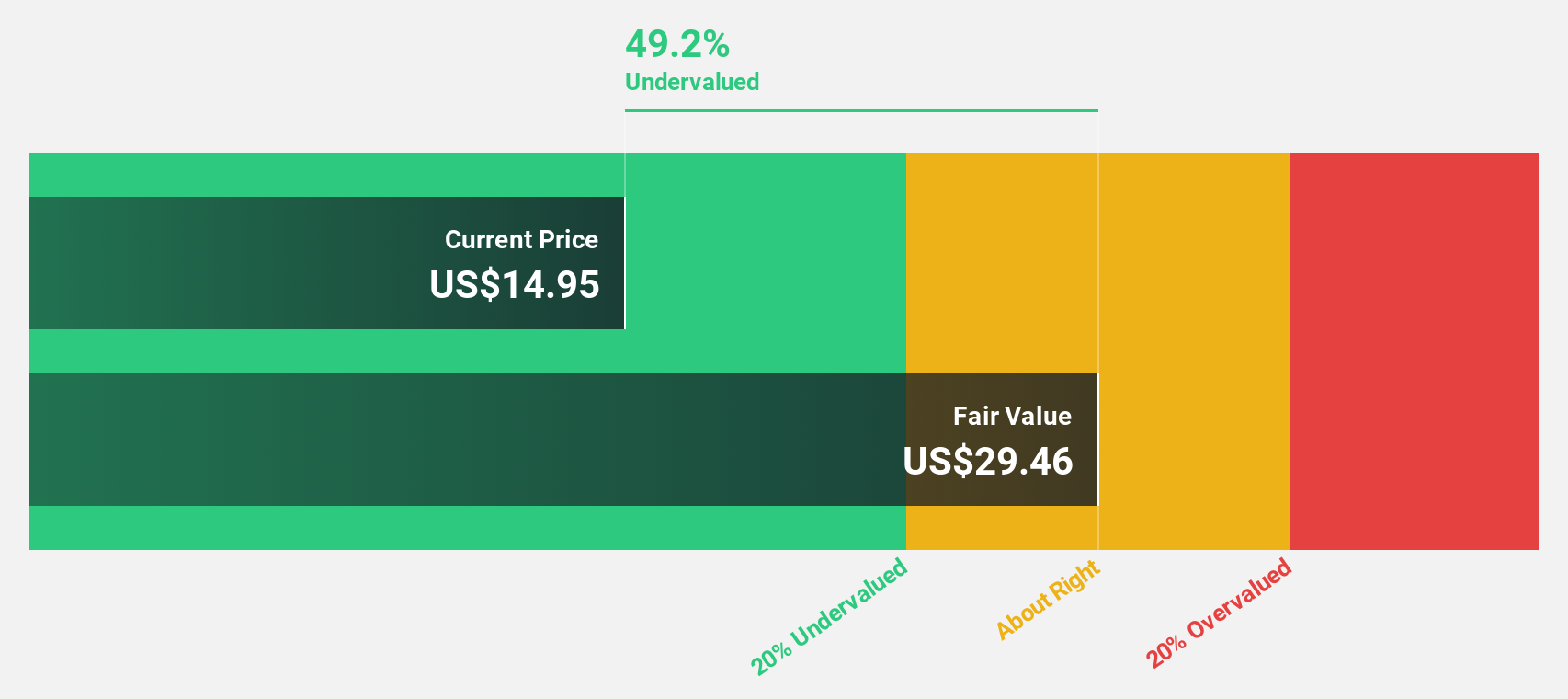

StoneCo (NasdaqGS:STNE)

Overview: StoneCo Ltd. offers financial technology and software solutions for electronic commerce across in-store, online, and mobile channels in Brazil, with a market cap of approximately $2.90 billion.

Operations: StoneCo's revenue segments include R$1.56 billion from Software and R$11.69 billion from Financial Services.

Estimated Discount To Fair Value: 47.8%

StoneCo, trading at US$10.62, is significantly undervalued with a fair value estimate of US$20.36. Despite recent financial challenges, including a net loss of BRL 1.52 billion in 2024 and declining earnings per share, the company is poised for profitability within three years with forecasted earnings growth of 71.88% annually. Although debt coverage by operating cash flow remains weak, StoneCo's revenue growth outpaces the broader U.S. market and offers good relative value against peers and industry standards.

- Our expertly prepared growth report on StoneCo implies its future financial outlook may be stronger than recent results.

- Take a closer look at StoneCo's balance sheet health here in our report.

Seize The Opportunity

- Navigate through the entire inventory of 161 Undervalued US Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal