Oil States International, Inc. (NYSE:OIS) Shares Slammed 29% But Getting In Cheap Might Be Difficult Regardless

The Oil States International, Inc. (NYSE:OIS) share price has fared very poorly over the last month, falling by a substantial 29%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

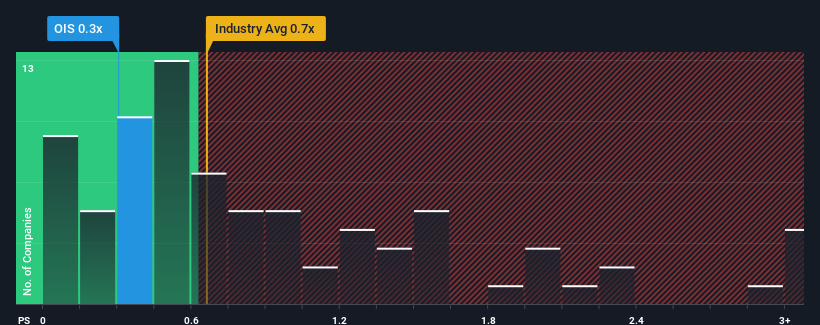

Although its price has dipped substantially, there still wouldn't be many who think Oil States International's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in the United States' Energy Services industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Oil States International

What Does Oil States International's P/S Mean For Shareholders?

Oil States International could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Oil States International's future stacks up against the industry? In that case, our free report is a great place to start .How Is Oil States International's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Oil States International's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 21% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 2.4% over the next year. Meanwhile, the rest of the industry is forecast to expand by 4.1%, which is not materially different.

In light of this, it's understandable that Oil States International's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Oil States International's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Oil States International's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Energy Services industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Oil States International with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal