3 UK Growth Companies With High Insider Ownership

In recent times, the United Kingdom's market has faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and its impact on globally interconnected sectors such as mining. Amid these broader market fluctuations, growth companies with high insider ownership can be appealing as they often indicate strong alignment between management and shareholder interests, potentially providing resilience during economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.3% | 62.5% |

| QinetiQ Group (LSE:QQ.) | 13% | 27.4% |

| Helios Underwriting (AIM:HUW) | 23.9% | 23.1% |

| Facilities by ADF (AIM:ADF) | 13.2% | 161.5% |

| Judges Scientific (AIM:JDG) | 10.7% | 24.4% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.7% | 21.4% |

| Audioboom Group (AIM:BOOM) | 27.8% | 175% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Getech Group (AIM:GTC) | 11.8% | 114.5% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 116.2% |

Let's review some notable picks from our screened stocks.

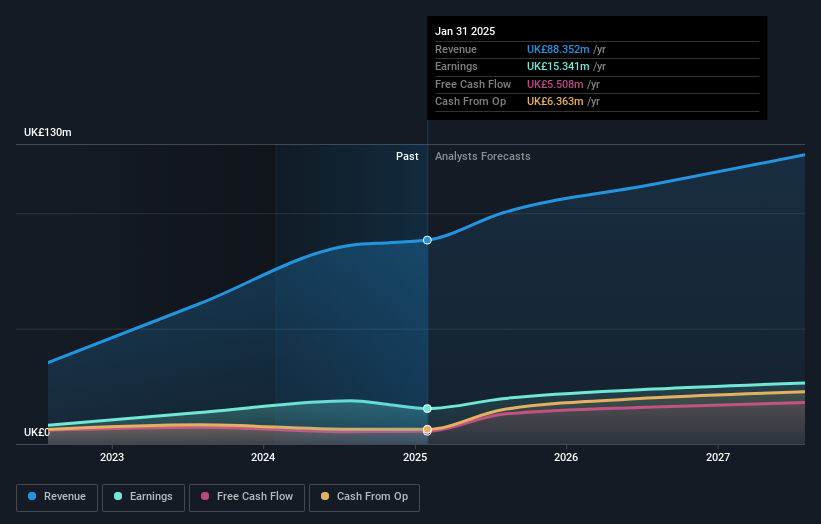

Applied Nutrition (LSE:APN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Applied Nutrition Plc manufactures, wholesales, and retails sports nutritional products in the United Kingdom and internationally with a market cap of £280 million.

Operations: Applied Nutrition Plc generates revenue through the manufacture, wholesale, and retail of sports nutritional products across domestic and international markets.

Insider Ownership: 35.5%

Applied Nutrition is forecasted to grow revenue at 11.9% annually, outpacing the UK market's 4%, with earnings expected to rise by 15.7%. Despite trading at a significant discount to its estimated fair value, recent earnings showed a decline in net income from £12.3 million to £8.9 million year-over-year for the half-year ending January 2025. The company was recently added to the S&P Global BMI Index, reflecting its growing industry presence.

- Delve into the full analysis future growth report here for a deeper understanding of Applied Nutrition.

- The valuation report we've compiled suggests that Applied Nutrition's current price could be quite moderate.

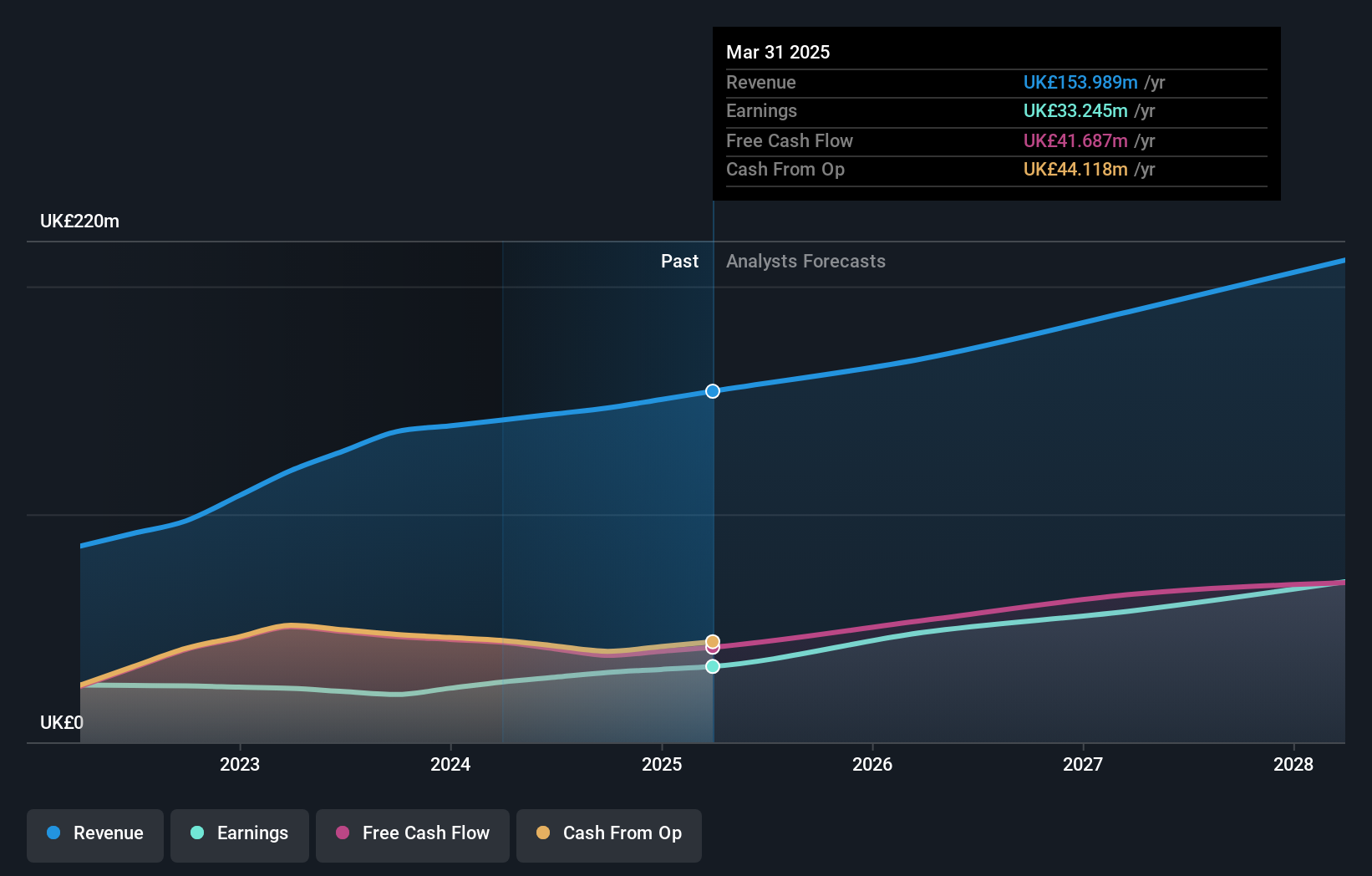

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £350.10 million.

Operations: The company's revenue is derived from three main segments: Infrastructure (£87.79 million), Private Equity (£50.78 million), and Foresight Capital Management (£8.10 million).

Insider Ownership: 35%

Foresight Group Holdings is poised for significant earnings growth, forecasted at 27% annually over the next three years, surpassing the UK market average. Despite revenue growth projections of 11.2% annually being slower than its earnings trajectory, it remains above market expectations. The company trades at a substantial discount to its estimated fair value and has seen increased insider buying recently. Additionally, Foresight expanded its equity buyback plan and secured a role as sub-investment manager for Liontrust Diversified Real Assets fund.

- Take a closer look at Foresight Group Holdings' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Foresight Group Holdings is priced lower than what may be justified by its financials.

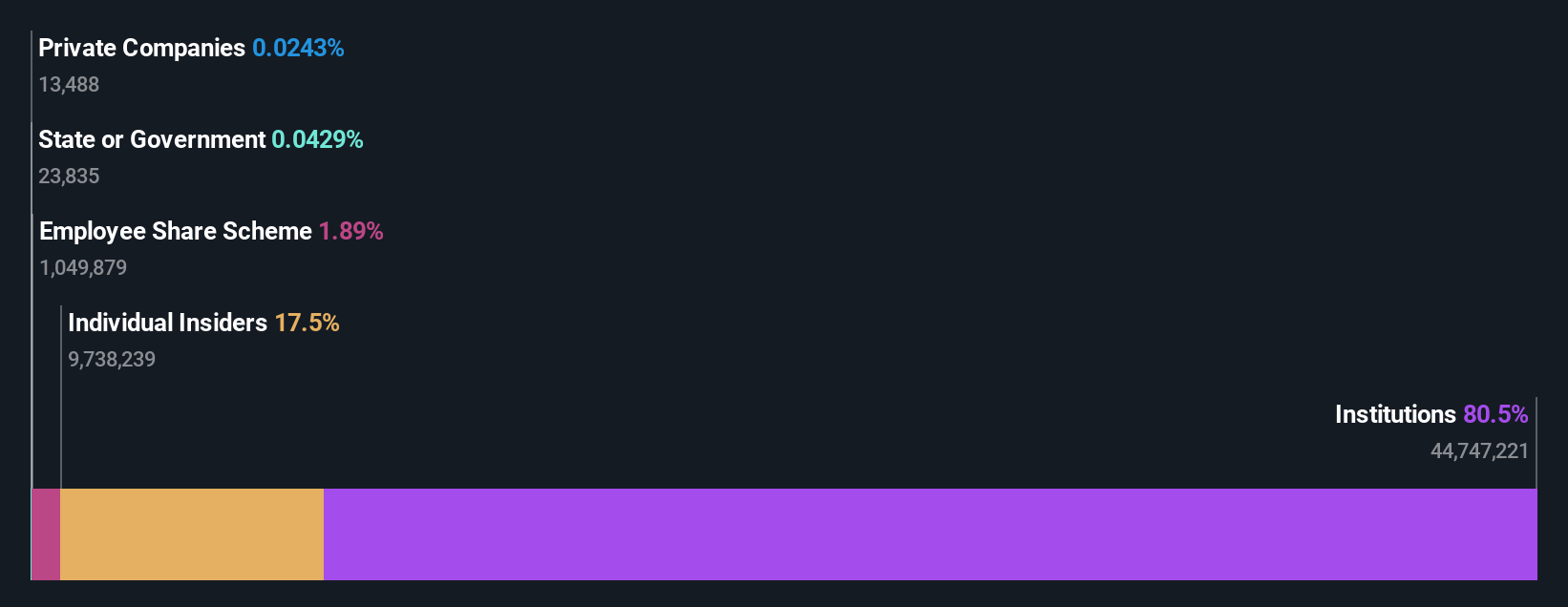

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TBC Bank Group PLC operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan with a market cap of £1.98 billion.

Operations: The company's revenue segments include Georgian Financial Services generating 2.28 billion GEL and Uzbekistan Operations contributing 336.77 million GEL.

Insider Ownership: 17.8%

TBC Bank Group's earnings are projected to grow at 16.5% annually, outpacing the UK market. Despite a high bad loans ratio of 2.3% and a low allowance for bad loans at 69%, it trades significantly below its estimated fair value. Recent executive changes include new committee appointments, while its net income rose to GEL 1.28 billion in 2024 from GEL 1.12 billion previously, alongside a proposed final dividend of GEL 5.55 per share.

- Navigate through the intricacies of TBC Bank Group with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that TBC Bank Group's share price might be on the cheaper side.

Next Steps

- Unlock our comprehensive list of 67 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? We've found 27 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal