What Nissan Chemical Corporation's (TSE:4021) P/E Is Not Telling You

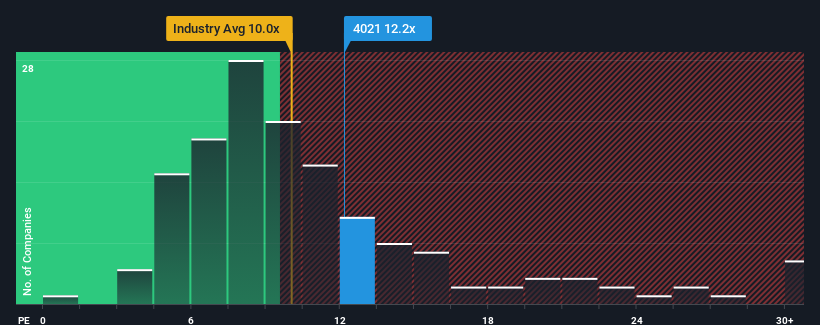

With a median price-to-earnings (or "P/E") ratio of close to 12x in Japan, you could be forgiven for feeling indifferent about Nissan Chemical Corporation's (TSE:4021) P/E ratio of 12.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Nissan Chemical certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Nissan Chemical

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Nissan Chemical's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 22%. As a result, it also grew EPS by 12% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 6.2% each year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the market is forecast to expand by 9.7% per annum, which is noticeably more attractive.

With this information, we find it interesting that Nissan Chemical is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Nissan Chemical's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Nissan Chemical's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Nissan Chemical with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Nissan Chemical. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal