Why Investors Shouldn't Be Surprised By 29Metals Limited's (ASX:29M) 34% Share Price Plunge

Unfortunately for some shareholders, the 29Metals Limited (ASX:29M) share price has dived 34% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 77% loss during that time.

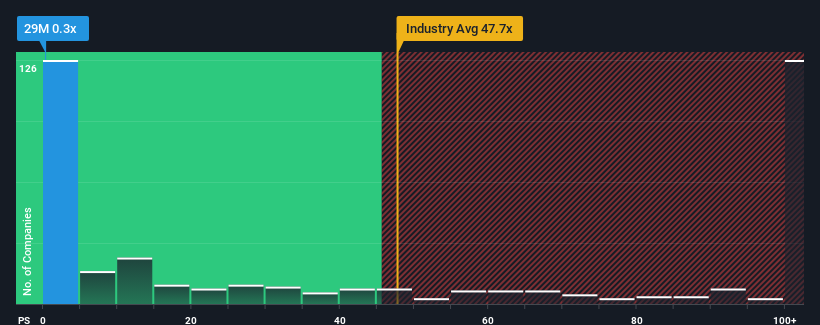

Following the heavy fall in price, 29Metals' price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the wider Metals and Mining industry in Australia, where around half of the companies have P/S ratios above 47.7x and even P/S above 332x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for 29Metals

What Does 29Metals' P/S Mean For Shareholders?

Recent times haven't been great for 29Metals as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think 29Metals' future stacks up against the industry? In that case, our free report is a great place to start .How Is 29Metals' Revenue Growth Trending?

29Metals' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. Still, revenue has fallen 8.3% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 10% per year as estimated by the nine analysts watching the company. With the industry predicted to deliver 91% growth per annum, the company is positioned for a weaker revenue result.

With this information, we can see why 29Metals is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From 29Metals' P/S?

Shares in 29Metals have plummeted and its P/S has followed suit. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that 29Metals maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware 29Metals is showing 2 warning signs in our investment analysis, and 1 of those is significant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal