United Company RUSAL, International Public Joint-Stock Company (HKG:486) Looks Inexpensive After Falling 31% But Perhaps Not Attractive Enough

The United Company RUSAL, International Public Joint-Stock Company (HKG:486) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 20%.

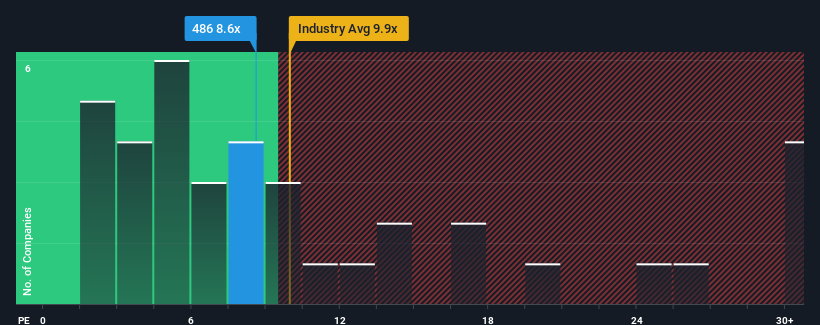

Even after such a large drop in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 11x, you may still consider United Company RUSAL International as an attractive investment with its 8.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

United Company RUSAL International certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for United Company RUSAL International

How Is United Company RUSAL International's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as United Company RUSAL International's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 185% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 75% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 18% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that United Company RUSAL International is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Key Takeaway

United Company RUSAL International's recently weak share price has pulled its P/E below most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of United Company RUSAL International revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 4 warning signs we've spotted with United Company RUSAL International (including 2 which are a bit concerning).

You might be able to find a better investment than United Company RUSAL International. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

- RILYL

- 2.400

- -6.57%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal