Why Investors Shouldn't Be Surprised By Lenovo Group Limited's (HKG:992) 40% Share Price Plunge

Lenovo Group Limited (HKG:992) shareholders won't be pleased to see that the share price has had a very rough month, dropping 40% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 14% share price drop.

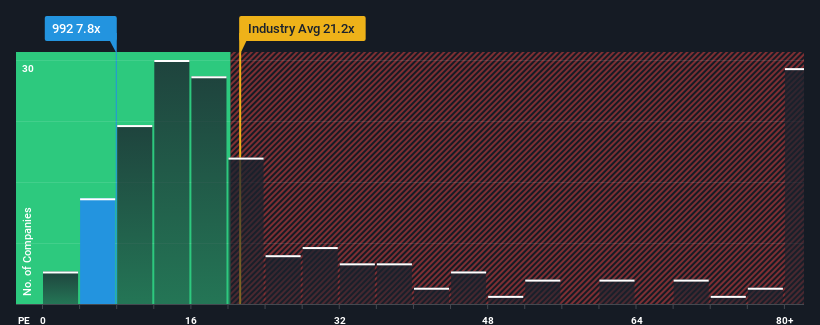

Although its price has dipped substantially, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 11x, you may still consider Lenovo Group as an attractive investment with its 7.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Lenovo Group as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Lenovo Group

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Lenovo Group would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 72% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 21% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 4.4% each year over the next three years. That's shaping up to be materially lower than the 14% per annum growth forecast for the broader market.

With this information, we can see why Lenovo Group is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Lenovo Group's P/E

Lenovo Group's recently weak share price has pulled its P/E below most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Lenovo Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Lenovo Group has 1 warning sign we think you should be aware of.

Of course, you might also be able to find a better stock than Lenovo Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

- NE

- 23.88

- +1.81%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal