3 Promising European Penny Stocks With Over €10M Market Cap

As European markets react to higher-than-expected U.S. trade tariffs, the STOXX Europe 600 Index has experienced its steepest decline in five years, reflecting broader economic uncertainties. Despite these challenges, penny stocks—often smaller or newer companies—continue to capture investor interest due to their potential for growth and value. While the term "penny stocks" may seem outdated, these investments can still offer significant opportunities when supported by strong financials and a clear path for growth.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.974 | SEK1.89B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.45 | SEK228.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.45 | SEK258.7M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.76 | SEK228.75M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.42 | PLN115.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.45 | €51.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.94 | €31.48M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.20 | €24.32M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.964 | €77.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €283.72M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 433 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

HF Company (ENXTPA:ALHF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: HF Company SA designs and distributes products and services for the home digital life market across Asia, Europe, and the United States, with a market cap of €14.20 million.

Operations: The company generates its revenue primarily from the Digital Broadband Excl. Industry segment, which accounts for €4.23 million, while the Corporate segment contributes €0.14 million.

Market Cap: €14.2M

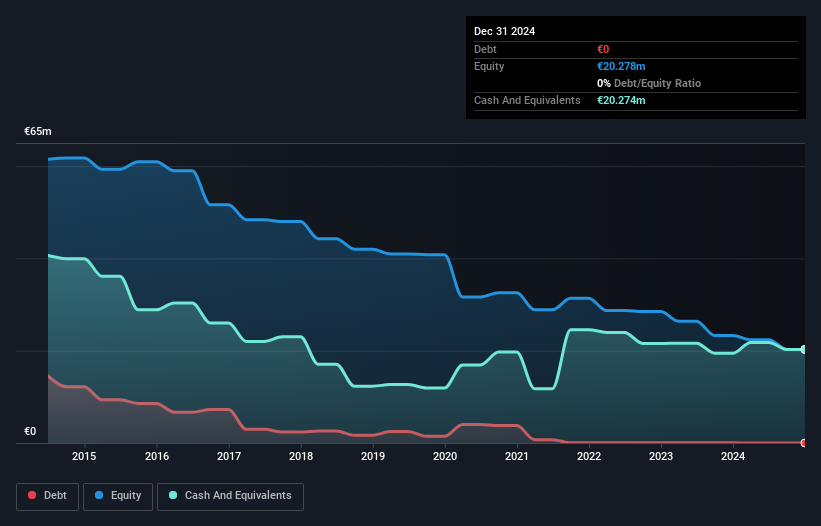

HF Company, with a market cap of €14.20 million, operates in the home digital life market and primarily generates revenue from its Digital Broadband segment (€4.23 million). Despite being unprofitable, it has reduced losses over the past five years by 37.9% annually. The company is debt-free and has short-term assets (€24.0M) that comfortably cover both short-term (€642K) and long-term liabilities (€2.1M). Its board of directors is highly experienced with an average tenure of 18.8 years, though management experience data is insufficient to assess stability further. Shareholder dilution hasn't been significant recently, maintaining investor confidence amidst volatility stability at 3%.

- Navigate through the intricacies of HF Company with our comprehensive balance sheet health report here.

- Explore HF Company's analyst forecasts in our growth report.

Level Bio (NGM:LEVBIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Level Bio AB (publ) is engaged in the design, development, and distribution of diagnostic products across the Nordic region and internationally, with a market cap of SEK23.60 million.

Operations: The company generates revenue of SEK23.74 million from its diagnostic kits and equipment segment.

Market Cap: SEK23.6M

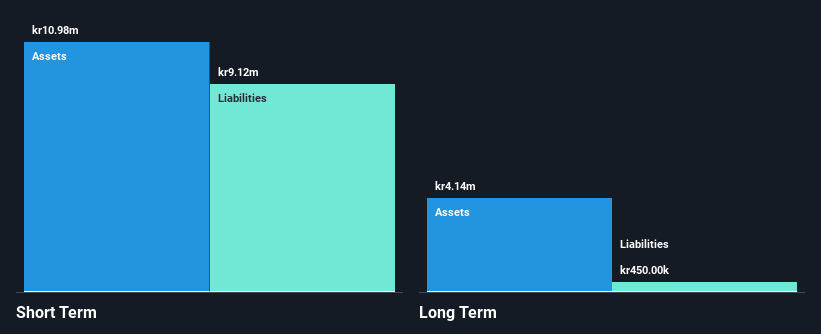

Level Bio AB, with a market cap of SEK23.60 million, is engaged in the diagnostic products sector but remains unprofitable and lacks meaningful revenue despite generating SEK23.74 million from its kits and equipment segment. The company faces financial challenges with less than a year of cash runway based on current free cash flow trends, though it benefits from being debt-free and having short-term assets (SEK11.0M) that exceed both its short-term (SEK9.1M) and long-term liabilities (SEK450K). Its board is experienced, averaging 5.3 years in tenure, yet the stock's high volatility presents additional risks for investors.

- Get an in-depth perspective on Level Bio's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Level Bio's track record.

TREX (WSE:TRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TREX S.A. operates in Poland, selling sports equipment under the TREX SPORT brand name, with a market cap of PLN19.31 million.

Operations: TREX S.A. has not reported any revenue segments.

Market Cap: PLN19.31M

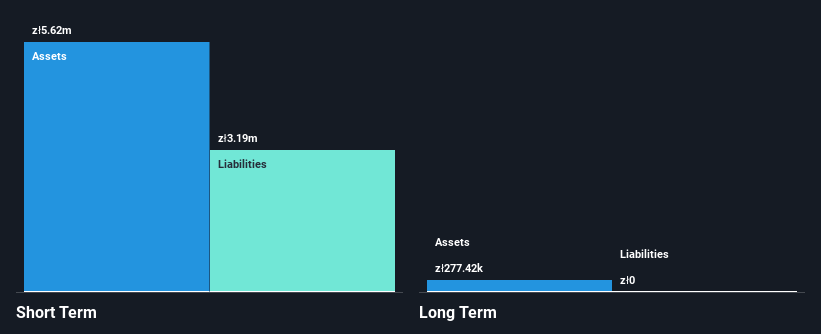

TREX S.A., with a market cap of PLN19.31 million, operates in Poland's sports equipment sector and has recently become profitable after years without significant revenue, reporting only PLN14 million. The company is debt-free and maintains high-quality earnings, with short-term assets of PLN5.6 million comfortably covering liabilities of PLN3.2 million. Despite trading at 96.8% below its estimated fair value, the stock exhibits high volatility compared to most Polish stocks. Shareholders have avoided dilution over the past year, but the company's return on equity remains low at 11%, indicating room for improvement in profitability metrics.

- Click here and access our complete financial health analysis report to understand the dynamics of TREX.

- Understand TREX's track record by examining our performance history report.

Next Steps

- Click here to access our complete index of 433 European Penny Stocks.

- Curious About Other Options? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal