Top European Dividend Stocks To Consider In April 2025

As European markets grapple with the impact of higher-than-expected U.S. tariffs, resulting in significant declines across major indices such as the STOXX Europe 600 and Germany's DAX, investors are increasingly seeking stability in dividend stocks. In times of economic uncertainty, dividend-paying stocks can offer a measure of resilience by providing consistent income streams, making them an attractive consideration for those looking to navigate turbulent market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.08% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.07% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.73% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.84% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.98% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.48% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.29% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.54% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.71% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 8.47% | ★★★★★☆ |

Click here to see the full list of 249 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

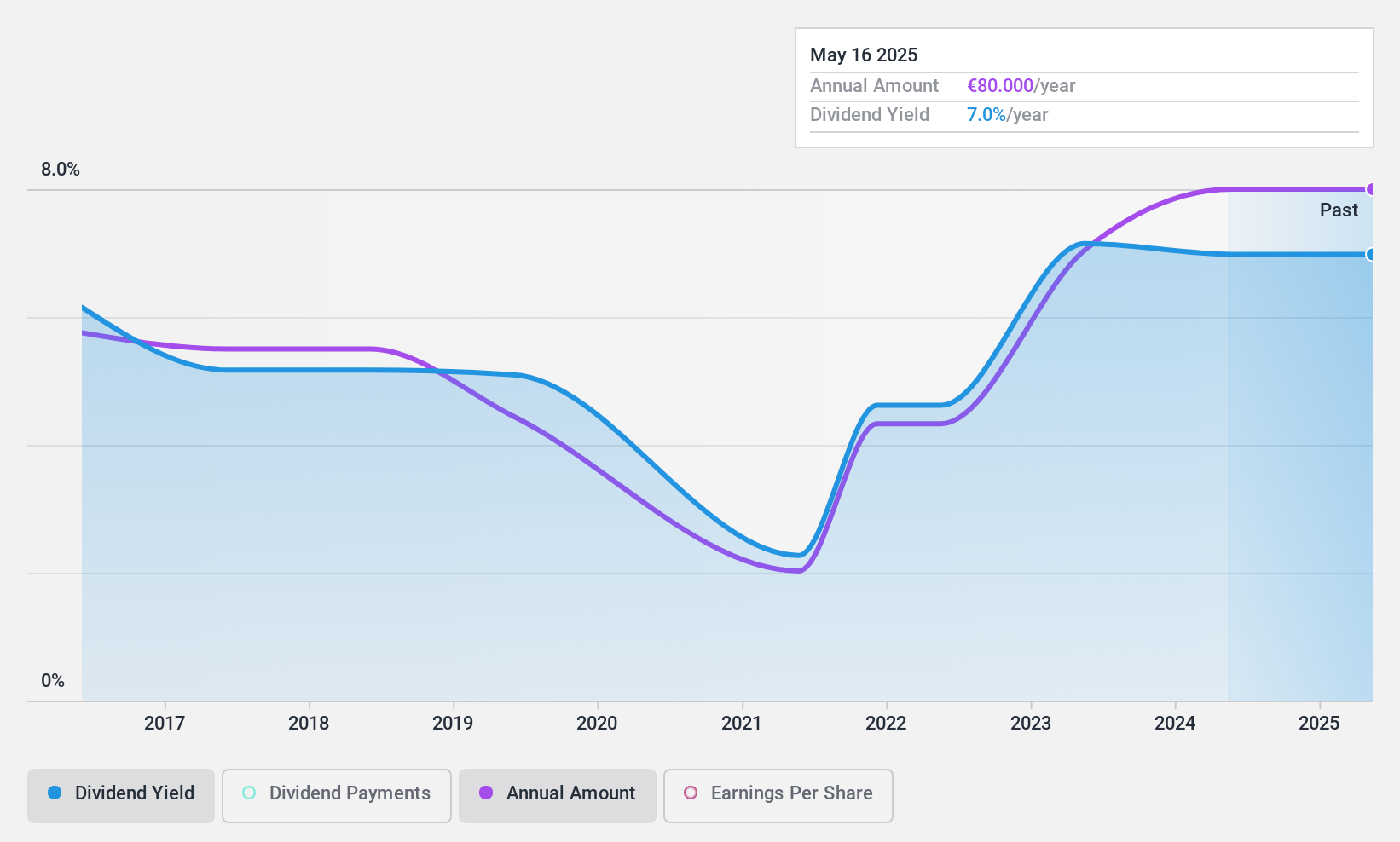

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CFM Indosuez Wealth Management SA, along with its subsidiaries, provides banking and financial solutions to private investors, businesses, institutions, and professionals both in Monaco and internationally, with a market cap of €716.25 million.

Operations: CFM Indosuez Wealth Management SA, through its subsidiaries, focuses on delivering comprehensive banking and financial services to a diverse clientele including private investors, businesses, institutions, and professionals across Monaco and international markets.

Dividend Yield: 6.4%

CFM Indosuez Wealth Management's dividend yield is competitive, ranking in the top 25% of French dividend payers. However, its dividends have been volatile over the past decade with a recent decrease to €78 per share. The payout ratio of 70.8% suggests dividends are currently covered by earnings, but past instability and a low allowance for bad loans (34%) raise concerns about sustainability. Its price-to-earnings ratio of 12.1x indicates good value relative to the French market average.

- Click to explore a detailed breakdown of our findings in CFM Indosuez Wealth Management's dividend report.

- The analysis detailed in our CFM Indosuez Wealth Management valuation report hints at an inflated share price compared to its estimated value.

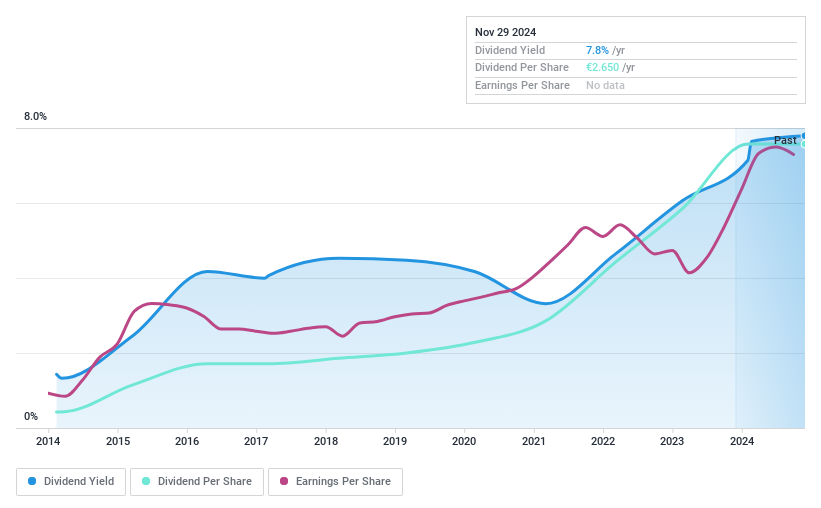

Ålandsbanken Abp (HLSE:ALBAV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ålandsbanken Abp operates as a commercial bank serving private individuals and companies in Finland and Sweden, with a market cap of €542.50 million.

Operations: Ålandsbanken Abp generates revenue through its IT segment (€54.33 million), Premium Banking (€71.40 million), Corporate and Other activities (€12.06 million), and Private Banking, including Asset Management (€95.00 million).

Dividend Yield: 7.7%

Ålandsbanken Abp offers an attractive dividend yield of 7.68%, placing it among the top 25% of Finnish dividend payers. The company recently affirmed a regular annual dividend of €2.40 per share and a special dividend of €0.35, both payable in early April 2025. Despite a slight decline in quarterly earnings, full-year net income improved to €52.3 million, supporting stable dividends over the past decade with a reasonable payout ratio of 70.5%.

- Get an in-depth perspective on Ålandsbanken Abp's performance by reading our dividend report here.

- According our valuation report, there's an indication that Ålandsbanken Abp's share price might be on the expensive side.

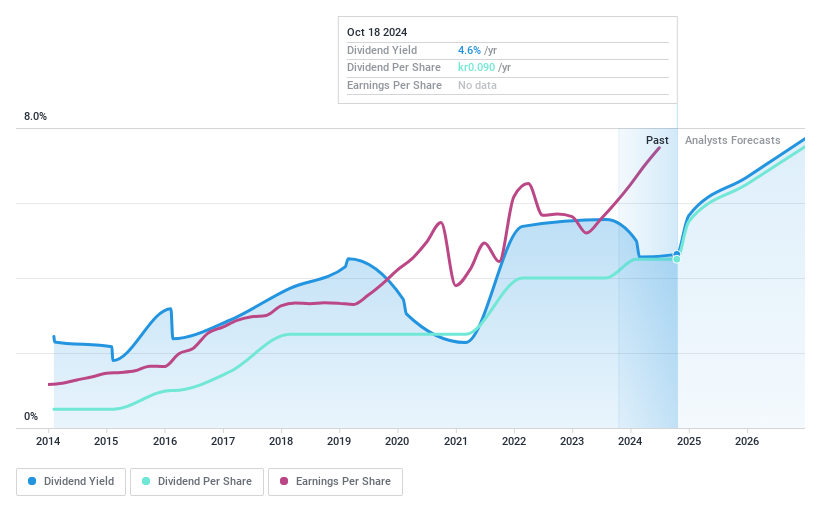

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of SEK1.89 billion.

Operations: Bredband2 i Skandinavien AB (publ) generates revenue from its National Broadband Service segment, amounting to SEK1.73 billion.

Dividend Yield: 5.1%

Bredband2 i Skandinavien offers a compelling dividend yield of 5.07%, ranking it in the top 25% of Swedish dividend payers. The company's dividends have been stable and growing over the past decade, supported by a payout ratio of 87.6% covered by earnings and a cash payout ratio of 43.8%. Recent financial results show an increase in net income to SEK 29.61 million for Q4, indicating continued earnings growth that supports its reliable dividend payments.

- Take a closer look at Bredband2 i Skandinavien's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Bredband2 i Skandinavien is priced lower than what may be justified by its financials.

Taking Advantage

- Take a closer look at our Top European Dividend Stocks list of 249 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal