Are Saudi Aramco Base Oil Company - Luberef's (TADAWUL:2223) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?

It is hard to get excited after looking at Saudi Aramco Base Oil Company - Luberef's (TADAWUL:2223) recent performance, when its stock has declined 13% over the past three months. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Specifically, we decided to study Saudi Aramco Base Oil Company - Luberef's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Saudi Aramco Base Oil Company - Luberef is:

22% = ر.س972m ÷ ر.س4.4b (Based on the trailing twelve months to December 2024).

The 'return' is the profit over the last twelve months. So, this means that for every SAR1 of its shareholder's investments, the company generates a profit of SAR0.22.

See our latest analysis for Saudi Aramco Base Oil Company - Luberef

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Saudi Aramco Base Oil Company - Luberef's Earnings Growth And 22% ROE

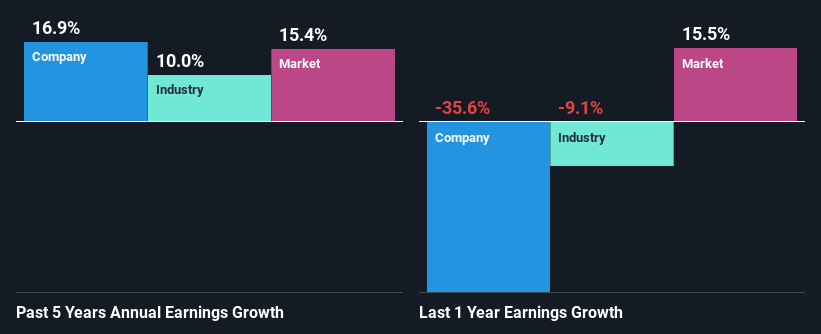

On the face of it, Saudi Aramco Base Oil Company - Luberef's ROE is not much to talk about. However, the fact that the its ROE is quite higher to the industry average of 4.7% doesn't go unnoticed by us. This certainly adds some context to Saudi Aramco Base Oil Company - Luberef's moderate 17% net income growth seen over the past five years. That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. Hence there might be some other aspects that are causing earnings to grow. E.g the company has a low payout ratio or could belong to a high growth industry.

Next, on comparing with the industry net income growth, we found that Saudi Aramco Base Oil Company - Luberef's growth is quite high when compared to the industry average growth of 10% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. What is 2223 worth today? The intrinsic value infographic in our free research report helps visualize whether 2223 is currently mispriced by the market.

Is Saudi Aramco Base Oil Company - Luberef Efficiently Re-investing Its Profits?

The really high three-year median payout ratio of 111% for Saudi Aramco Base Oil Company - Luberef suggests that the company is paying its shareholders more than what it is earning. However, this hasn't really hampered its ability to grow as we saw earlier. That being said, the high payout ratio could be worth keeping an eye on in case the company is unable to keep up its current growth momentum. Our risks dashboard should have the 3 risks we have identified for Saudi Aramco Base Oil Company - Luberef.

While Saudi Aramco Base Oil Company - Luberef has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 89%. However, Saudi Aramco Base Oil Company - Luberef's ROE is predicted to rise to 30% despite there being no anticipated change in its payout ratio.

Summary

In total, it does look like Saudi Aramco Base Oil Company - Luberef has some positive aspects to its business. Especially the growth in earnings which was backed by a moderate ROE. Still, the ROE could have been even more beneficial to investors had the company been reinvesting more of its profits. As highlighted earlier, the current reinvestment rate appears to be negligible. That being so, according to the latest industry analyst forecasts, the company's earnings are expected to shrink in the future. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal