The Price Is Right For DigitalOcean Holdings, Inc. (NYSE:DOCN) Even After Diving 31%

DigitalOcean Holdings, Inc. (NYSE:DOCN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

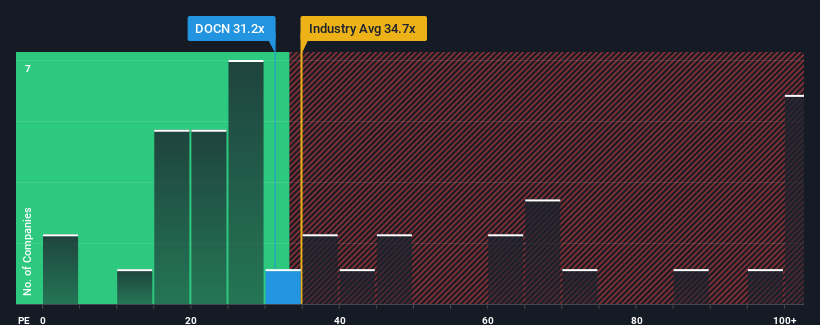

In spite of the heavy fall in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may still consider DigitalOcean Holdings as a stock to avoid entirely with its 31.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's superior to most other companies of late, DigitalOcean Holdings has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for DigitalOcean Holdings

How Is DigitalOcean Holdings' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like DigitalOcean Holdings' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 328%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 18% each year as estimated by the analysts watching the company. With the market only predicted to deliver 11% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why DigitalOcean Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate DigitalOcean Holdings' very lofty P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of DigitalOcean Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for DigitalOcean Holdings that you should be aware of.

If you're unsure about the strength of DigitalOcean Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal