The aftershock of tariffs has not been erased Trump's next trump card: a financial nuclear bomb?

The Zhitong Finance App learned that when US President Trump's ink in the latest round of tariffs has not dried up, various sectors are already waiting hard — the leader, who routinely uses powerful methods to force trading partners to follow suit, may use harsher financial weapons in the next step.

As a global financial center and reserve currency issuer, the US has multiple financial levers, from credit card settlement to dollar supply, all of which may become Trump's tools to coerce other countries.

Although the use of these unconventional weapons would cost the US itself dearly, and may even be counterproductive, observers warn that this extreme situation should not be ruled out. In particular, in the current context where the US is close to full employment, leading to serious labor shortages, if the tariff policy fails to effectively reduce the global trade deficit, the risk of such a financial war will rise significantly.

Barry Eichengreen, professor of political economy at the University of California at Berkeley, said, “I can imagine Trump... getting frustrated and then trying to implement some wacky ideas, even if they have no logic.”

Sea-Lake Estate Agreement

The US government's undeclared plan is to restructure the trade pattern through the depreciation of the US dollar. One way to achieve this goal is to seek cooperation from foreign central banks to jointly revalue the domestic currency.

According to a paper by Stephen Miran, chairman of the Economic Advisory Committee selected by Trump, this may occur as part of the Sea-Lake Manor agreement, which drew on the 1985 “Plaza Agreement” to limit the appreciation of the dollar, and is also related to Trump's Sea-Lake Estate in Florida.

This paper, published in November last year, indicates that the US will use the threat of tariffs and the temptation of US security support to persuade foreign countries to appreciate its currency against the US dollar, while at the same time there are other concessions.

But economists doubt whether such an agreement will be supported in Europe or China, because the current economic and political situation is very different from what it was 40 years ago.

“I think this is extremely unlikely to happen,” said Maurice Obstfeld, a senior researcher at the Peterson Institute for International Economics.

Obstfeld believes that tariffs have been implemented, making them no longer a threat, and America's vague rhetoric on Ukraine has weakened its commitment to global security.

He added that central bankers in the Eurozone, Japan, and the United Kingdom are unlikely to agree to an agreement that would force them to raise interest rates and risk a recession.

Even in Japan, although the government has interfered in the currency market several times over the past few years to support the yen, memories of the 25 years of deflation that have just ended may dampen people's enthusiasm for the yen's sharp appreciation.

US dollar support instruments

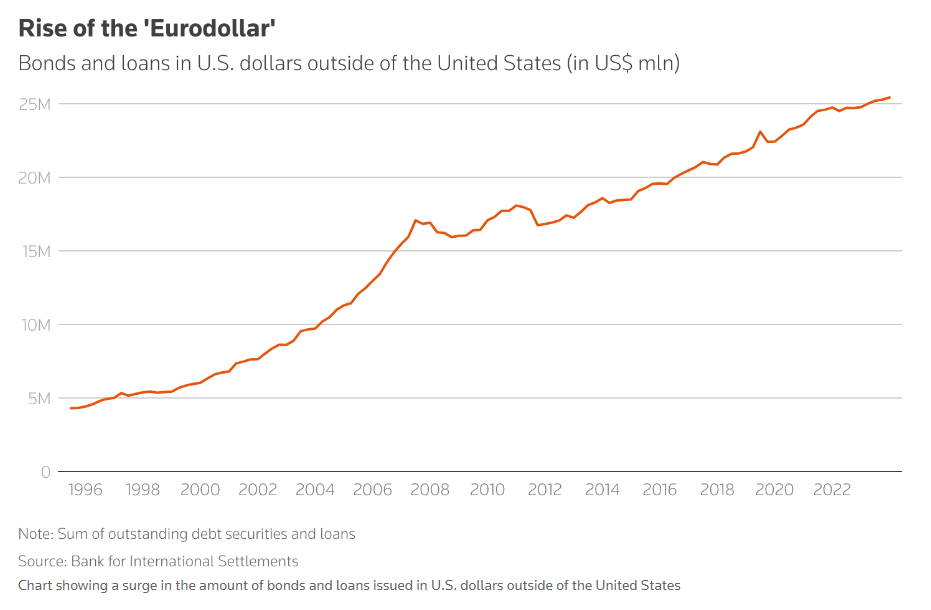

If no agreement can be reached, the Trump administration may be tempted to adopt more aggressive strategies, such as using the dollar's status as a global currency for trade, savings, and investment.

Obstfeld and some regulators and central bank governors said that the authorities may threaten to cut off the currency swap mechanism between the Federal Reserve and foreign central banks — a lifeline that provides the world with dollar liquidity during times of crisis.

Cutting off this source of funding would disrupt the trillion-dollar credit market outside the US, and hit banks in the UK, the Eurozone, and Japan particularly hard.

Of course, these so-called swap lines are entirely controlled by the Federal Reserve, and Trump has never said he wants to control this powerful monetary institution. But his recent move to replace key personnel, including personnel changes in the supervisory authority, has made observers uneasy.

“In a larger negotiation, this could become a nuclear threat, which is no longer unimaginable,” said Spyros Andreopoulos, founder of consulting firm Thin Ice Macroeconomics.

He believes that over time, such actions will weaken the US dollar's position as a reliable global currency.

Payment system secret card

The US has another trump card — its payment giants, including credit card companies Visa (V.US) and Mastercard (MA.US).

Although Japan and China have developed their own electronic payment methods to varying degrees, these two US companies handle two-thirds of credit card payments in the 20 Eurozone countries. Mobile app payments, which are dominated by American companies such as Apple (AAPL.US) and Google (GOOGL.US), account for nearly one-tenth of retail payments.

This transformation has left Europeans at a disadvantage in a huge market worth over 113 trillion euros ($124.7 trillion) in the first half of last year.

If Visa and Mastercard are pressured to stop their services, as they did with Russia shortly after the Russian-Ukrainian conflict, Europeans will have to use cash or tedious bank transfers to make purchases.

“America's hostile stance is a major setback,” said Maria Demertzis, Europe's chief economist at the World Federation of Large Enterprises.

The ECB says this puts Europe at risk of “economic pressure and coercion,” and a digital euro could be a solution. However, plans to launch this digital currency have stalled during discussions and may take years to implement.

European officials are considering how to respond to Trump's actions, but are worried about triggering further escalation. They can levy their own tariffs or take more drastic measures, such as restricting Bank of America's entry into the European Union. However, due to Wall Street's international influence and the risk of retaliation against European banks doing business in the US, it may be difficult to take such aggressive measures.

Despite this, some international banking executives said they are worried that they will be threatened with countermeasures from Europe in the coming months.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal