IPO Foresight | Jiaxin International: With a cumulative loss of 350 million yuan over three years, tungsten ore giants are struggling and waiting to commercialize tungsten ore

In 2024, China's tungsten market experienced sharp fluctuations of “two ends low and middle high”. The annual average price rose by about 15% year on year, black tungsten concentrate (65%) reached a maximum of 156,600 yuan/ton, and the price of ammonium paratungstate (APT) once exceeded 230,000 yuan/ton, hitting a new high of nearly 13 years. Entering 2025, tungsten prices continued to fluctuate at a high level. In February, the price of black tungsten concentrate stabilized at 143,000 yuan/standard ton, and APT remained at 212,500 yuan/ton.

Price increases on the mining side due to tight supply have been gradually transmitted downstream of the industrial chain. Previously, a number of leading tungsten companies, including Zhangyuan Tungsten (002378.SZ), Chinatungsten Hi-Tech (000657.SZ), and Xiamen Tungsten (600549.SH), have successively issued increase notices, and some companies are preparing a new round of price increases.

The market situation is good. Jiaxin International Resources Investment Limited (Jiaxin International Resources Investment Limited, “Jiaxin International Resources Investment Limited” for short), a tungsten mining company rooted in Kazakhstan, once again submitted a statement to the Hong Kong Stock Exchange on March 13, with CICC as its sole sponsor. Previously, the company submitted a statement to the Hong Kong Stock Exchange on August 19, 2024.

The world's fourth largest tungsten ore is expected to be commercially produced in the second quarter of 2025

According to the prospectus, Jiaxin International is focusing on developing the Bakuta tungsten deposit. According to Frost & Sullivan, as of December 31, 2024, it was the world's largest open pit tungsten mine with tungsten trioxide (WO3) mineral resources.

According to Frost & Sullivan's data, as of the same date, the company's Bakuta tungsten mine was also the world's fourth-largest tungsten mine with WO3 mineral resources (including open pit tungsten ore and underground tungsten ore), and has the largest production capacity of designed tungsten ore in the world among single tungsten deposits.

During the record period, Jiaxin International mainly focused on preparing commercial production for the Bakuta tungsten ore project. The project was put into trial production in November 2024 to test and fine-tune the processing process. Commercial production is expected to begin in the second quarter of 2025. The target annual mining and mineral processing capacity for 2025 is 3.3 million tons of tungsten ore.

According to an independent technical report, as of December 31, 2024, according to JORC rules, the estimated mineral resources of Bakuta tungsten ore were about 109.5 million tons of ore containing 0.211% WO3 (equivalent to 231,500 tons of WO3), including 97.6 million tons of controlled resources (0.21% WO3) and 11.9 million tons of inferred resources (0.228% WO3. As of the same day, according to JORC rules, the trusted ore reserves of Bakuta tungsten mine were 70.3 million tons of ore, equivalent to 0.206% WO3. 144,500 tons WO3).

The company holds mining rights for Bakuta tungsten ore (right to mine tungsten ore) in accordance with the subsoil use contract with the relevant authorities in Kazakhstan. The mining area specified in the mining contract is 1.16 square kilometers, and mining at a maximum depth of 300 meters below the surface is permitted. The period is 25 years from June 2, 2015 to June 2, 2040.

On the financial side, the Bakuta tungsten project was in the exploration and development phase throughout the track record period, so the company did not confirm any revenue. In 2022, 2023, and 2024 (hereinafter referred to as the reporting period), the company lost $94.45 million (unit: HKD, same below), $80.129 million, and $177 million for the year/period, with a cumulative loss of $350 million over three years.

According to the company's plan, commercial production is expected to begin in the second quarter of 2025. Once production begins, Jiaxin International plans to mainly sell tungsten products to tungsten processors and end users in China in the short term. Simply put, Jiaxin International now faces two major operating risks: first, the company has no revenue; second, even if the company successfully produces, it faces the risk of customer concentration in the early stages of sales, which has a significant adverse impact on its business, financial situation, and operating performance.

Tight supply continues to fluctuate at a high level of tungsten prices, and abundant minerals may benefit

According to Frost & Sullivan's report, global tungsten reserves increased from about 3.3 million tons in 2018 to 4.4 million tons in 2023, with a compound annual growth rate of 5.9%. In 2023, global tungsten production was 78,000 tons, global tungsten consumption was about 124,400 tons, and the gap was as high as 461,000 tons, reflecting the scarcity and strong demand for tungsten resources. Looking ahead, with the rapid growth of the downstream market, the use of tungsten continues to increase. For example, the photovoltaic (PV) industry also consumes a large amount of tungsten. It is expected that tungsten consumption will reach 151,100 tons in 2028, with a compound annual growth rate of 4%.

Looking at the short term, the Zhitong Finance App believes that the tight supply trend continues, the resonance of loose macroeconomic policies at home and abroad is expected to drive an improvement in demand, and a further rise in tungsten prices is poised to begin, and it may reach a record high.

On the supply side, China's tungsten concentrate supply has been tightened, and global tungsten stocks have dropped to a record low; on the demand side, China's steady growth policy is expected to drive domestic demand recovery, and overseas demand is expected to benefit from Europe and the US's loose fiscal and monetary policies and global supply chain restructuring; combined with rising geopolitical risks, demand for tungsten “safety stocks” may open. It is expected that tungsten concentrate prices will continue to rise further, or reach a record high.

In this context, the allocation value of enterprises with abundant tungsten ore is becoming more and more prominent. CICC Securities once pointed out that at present, Chinese tungsten companies are working at both ends of the “smile curve” of the industry. One is to speed up the injection and development process of upstream tungsten ore resources, increase the level of resource guarantee, and enhance profit elasticity in the process of rising prices; the second is to increase the production capacity layout of tungsten powder, hard alloy tools, and photovoltaic tungsten wire to promote the transformation of the product structure to high-end, and enhance the added value and growth of terminal products.

Focusing on Jiaxin International, the company may benefit from the rising trend of tungsten prices as mineral resources continue to be exploited.

However, in order for the company's tungsten ore project to reach a “predetermined state of use” and maintain normal operation, the company also faces high capital costs and operating costs.

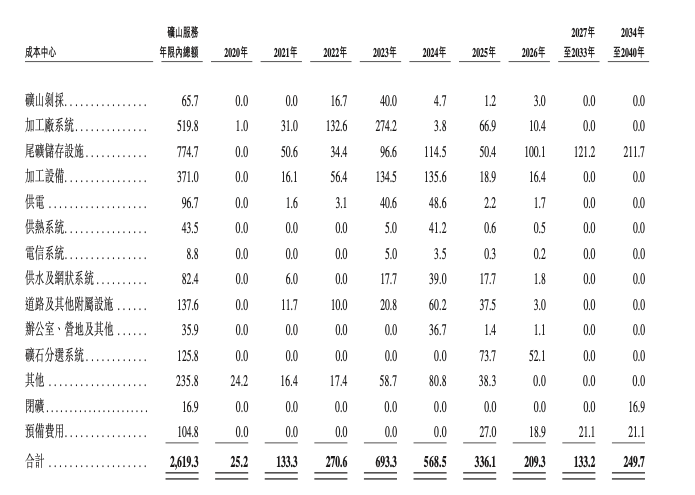

According to the prospectus, Jiaxin International has generated capital costs for the Bakuta tungsten project since 2020, and the total capital cost from 2020 to 2024 is 1,691 billion yuan (RMB, same below). The total estimated capital costs arising from the initial development of the Bakuta tungsten ore project, the subsequent upgrading of the tailings dam and the mine closure are estimated at $2,619 billion, while the capital unit cost for the entire service life of the mine is estimated at 37 yuan/ton of ore and 14,900 yuan/ton of concentrate.

In terms of operating costs, the total operating cash cost of the Bakuta tungsten ore project in 2025 is estimated to be 463 million yuan, of which the unit operating cash cost is 156 yuan per ton of ore and 77,400 yuan per ton of concentrate. By 2027, since the Bakuta tungsten ore project is expected to reach the target production volume of 4.95 million tons/year and is expected to install a second-phase commercially produced ore sorting system, the total operating cash cost is expected to increase to 563 million yuan from 2027, while the unit operating cash cost is expected to drop sharply to 113 yuan per ton of ore and 49,000 yuan per ton of concentrate.

According to the prospectus, as of the end of 2024, Jiaxin International's cash and cash equivalents were HK$41.44 million. Jiaxin International stated in its prospectus that the company currently mainly uses bank loans and internal capital to fund capital expenses. The company's future working capital, payment of other accounts payable, and payment of outstanding debts due will largely depend on the company's ability to generate sufficient cash inflows from operating activities and obtain sufficient external financing.

Jiaxin International also pointed out that due to the company's past net losses and limited capital, there is no guarantee that it will be able to generate sufficient cash flow from operations in the future, or that it will not be able to fund the company's operations at all. The company may have to seek additional financing through equity or debt financing, or may be forced to reduce or delay capital expenditure, so the company may not be able to implement development plans as planned.

In short, the Bakuta tungsten mine owned by Jiaxin International is the fourth-largest tungsten mine with WO3 mineral resources in the world. It has the largest production capacity of engineered tungsten ore in a single tungsten deposit, or has benefited from the upward trend in tungsten prices, and long-term growth can be expected. However, the company still has to face high capital expenses and operating costs. Liquidity risks are prominent, and it will also face the risk of customer concentration in the early stages of commercialization.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal