Global Dividend Stocks Spotlight: 3 Top Picks

As global markets navigate a landscape marked by steady interest rates and mixed economic signals, investors are keenly observing the performance of various indices. In this environment, dividend stocks continue to attract attention for their potential to provide a steady income stream amidst market fluctuations. A good dividend stock often combines strong fundamentals with consistent payout histories, offering resilience in times of uncertainty.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.02% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.17% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.69% | ★★★★★★ |

| Chudenko (TSE:1941) | 3.68% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.49% | ★★★★★★ |

Click here to see the full list of 1468 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

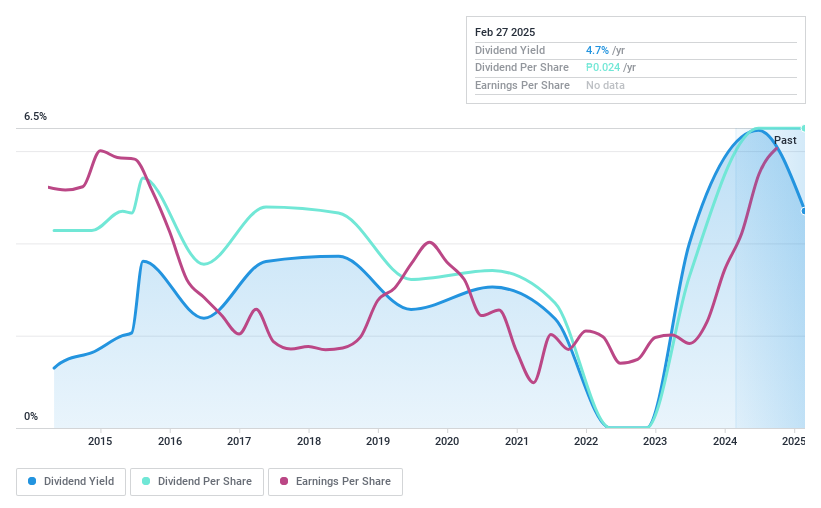

Century Properties Group (PSE:CPG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Century Properties Group, Inc. is a real estate company operating in the Philippines with a market capitalization of approximately ₱7.08 billion.

Operations: Century Properties Group generates its revenue through three main segments: Real Estate Development, which contributes ₱12.10 billion; Leasing, accounting for ₱1.25 billion; and Hotel and Property Management, adding ₱533.15 million.

Dividend Yield: 4%

Century Properties Group's dividend payments have been volatile over the past decade, with a low payout ratio of 12.9% indicating strong earnings coverage. The cash payout ratio of 8.7% further supports dividend sustainability despite an unstable track record. While its dividend yield is lower than top-tier payers in the Philippine market, recent investments in projects like Azure North Estate may enhance financial stability and growth potential, possibly influencing future dividends positively.

- Take a closer look at Century Properties Group's potential here in our dividend report.

- Our expertly prepared valuation report Century Properties Group implies its share price may be lower than expected.

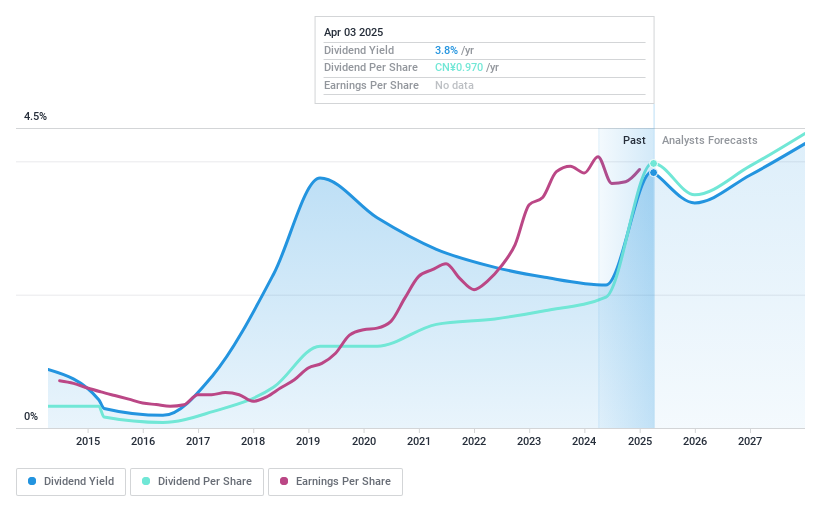

Zhejiang JIULI Hi-tech MetalsLtd (SZSE:002318)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang JIULI Hi-tech Metals Co., Ltd specializes in the production and sales of pipes, welded pipes, pipe fittings, and related products both in China and internationally, with a market cap of CN¥23.63 billion.

Operations: Zhejiang JIULI Hi-tech Metals Co., Ltd generates revenue primarily from Seamless Pipes (CN¥4.28 billion), Composite Pipe (CN¥2.31 billion), Welded Pipes (CN¥1.94 billion), Pipe Components (CN¥784.01 million), and Alloy Materials (CN¥624.61 million).

Dividend Yield: 3.8%

Zhejiang JIULI Hi-tech Metals Ltd announced a cash dividend of CNY 9.7 per 10 shares for 2024, though its dividend reliability is questionable due to volatility over the past decade. Despite a high payout ratio of 62.5%, dividends are not well covered by free cash flows, with a cash payout ratio of 387%. However, the company offers good value with a P/E ratio of 16.1x and recent earnings growth to CNY 1,490.38 million in net income for fiscal year-end December 2024.

- Get an in-depth perspective on Zhejiang JIULI Hi-tech MetalsLtd's performance by reading our dividend report here.

- The analysis detailed in our Zhejiang JIULI Hi-tech MetalsLtd valuation report hints at an deflated share price compared to its estimated value.

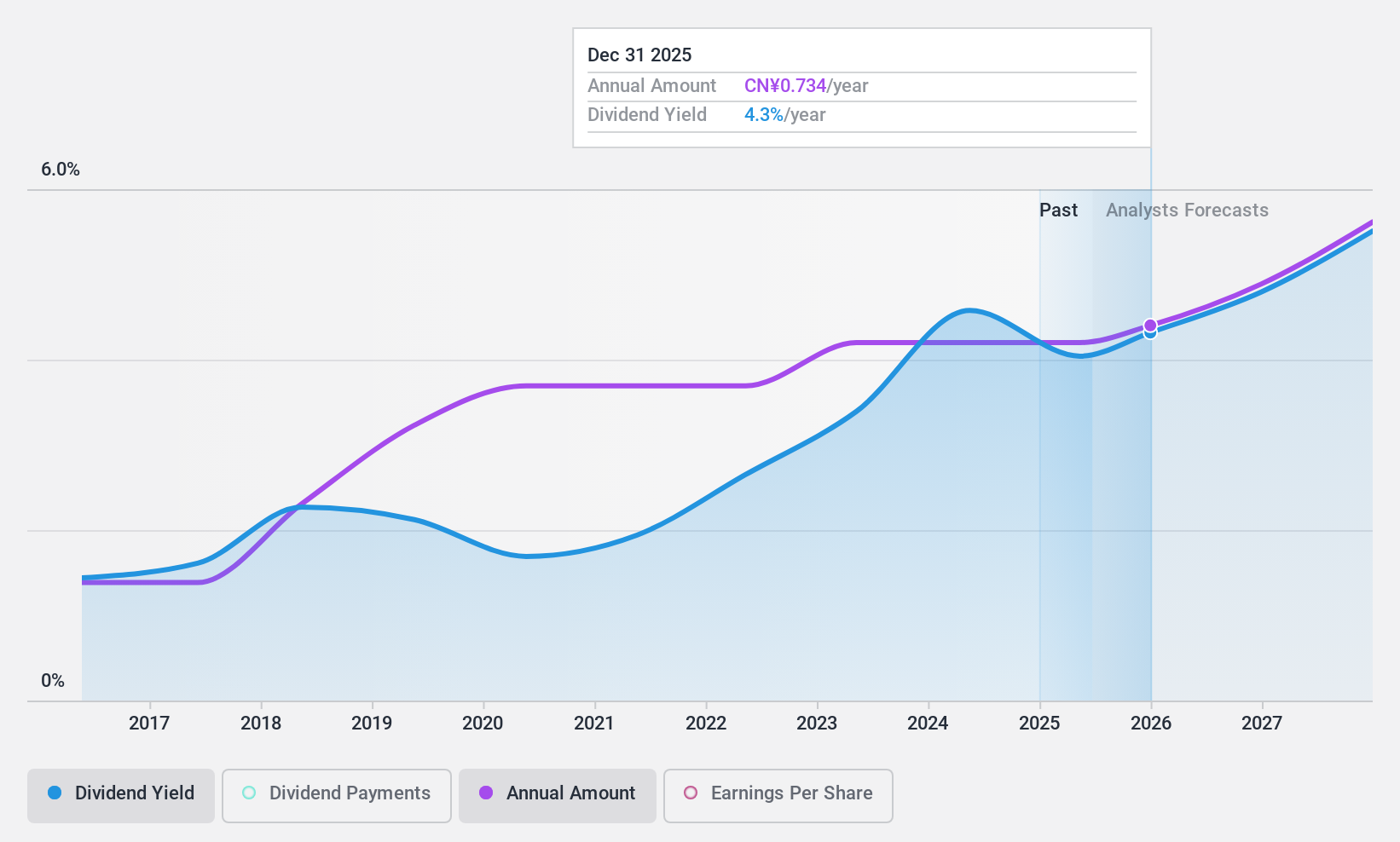

Hefei Meyer Optoelectronic Technology (SZSE:002690)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hefei Meyer Optoelectronic Technology Inc., with a market cap of CN¥14.26 billion, specializes in the development and production of optoelectronic detection and sorting equipment.

Operations: Hefei Meyer Optoelectronic Technology Inc. generates its revenue primarily from the development and production of optoelectronic detection and sorting equipment.

Dividend Yield: 4.1%

Hefei Meyer Optoelectronic Technology's dividend yield of 4.08% places it among the top 25% of dividend payers in China, although its sustainability is questionable due to a high payout ratio of 97.6%. While dividends have been stable and growing over the past decade, they are not well covered by earnings. The company reported a decline in net income to CNY 649.17 million for fiscal year-end December 2024, impacting its ability to maintain current dividend levels.

- Unlock comprehensive insights into our analysis of Hefei Meyer Optoelectronic Technology stock in this dividend report.

- The analysis detailed in our Hefei Meyer Optoelectronic Technology valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Unlock more gems! Our Top Global Dividend Stocks screener has unearthed 1465 more companies for you to explore.Click here to unveil our expertly curated list of 1468 Top Global Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal