France's deficit narrowed beyond expectations, but the road to debt reduction is still long

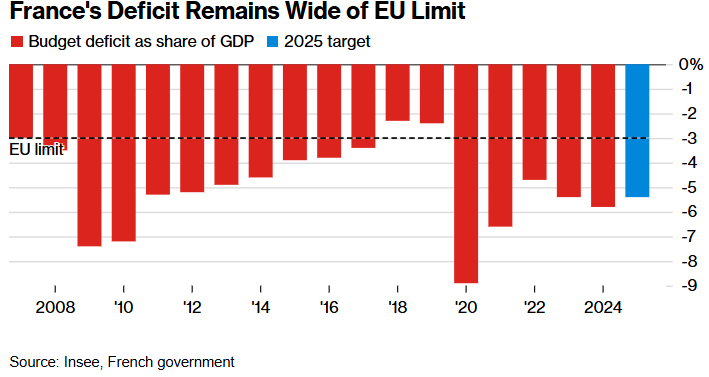

The Zhitong Finance App learned that the latest statistics show that France's 2024 budget deficit is narrower than expected, providing breathing room for the new French government led by Beirut to reduce its debt burden. According to data released by the French statistics agency Insee on Thursday, the budget deficit increased from 5.4% of French economic output in 2023 to 5.8%, but it is better than the 6% deterioration previously predicted by the Ministry of Finance.

France's budget deficit still far exceeds the EU ceiling

Minister of Finance Eric Lombard said on Radio France Inter that national spending was controlled last year, and fiscal revenue increased markedly at the end of the year. However, he stressed that this result is still “bad news” and that the level of deficit is still too high.

After the French government's deficit reduction was drastically thwarted by the COVID-19 pandemic and the inflation crisis, the narrowing of the deficit compared to expectations brought some relief to the French government. The country's financial difficulties coincided with the long-term political uncertainty caused by last year's early general election, which led to a sell-off trend in the European bond market.

This result can be described as providing a better starting point for the French government — its goal is to reduce the size of this year's deficit to 5.4% of GDP, and meet the EU's 3% limit by 2029. But as France's economic growth continues to weaken, and French President Emmanuel Macron's promise to raise defense spending (as part of Europe's plan to restructure defense and armaments), these goals are facing increasingly serious challenges.

Lombard said that even if military spending increases, France will not deviate from the established ideal path of public finance, which means that it is necessary to find room for budget cuts in other fields. On Thursday local time, he said that the French government will evaluate changes in the economic outlook in mid-April, but will still take necessary measures to achieve the 5.4% deficit target in 2025. “As long as debt and deficit issues remain unresolved, we are at risk.” He said in an interview.

Benefiting from the narrowing of the budget deficit beyond expectations, French treasury bonds rose slightly in early trading in the European market, and the trend was basically the same as German treasury bonds. The much-publicized yield difference between French and German 10-year treasury bonds (a measure of risk appetite in the European bond market) has fallen back to about 70 basis points, far below the phased peak of 90 basis points that once soared in December last year.

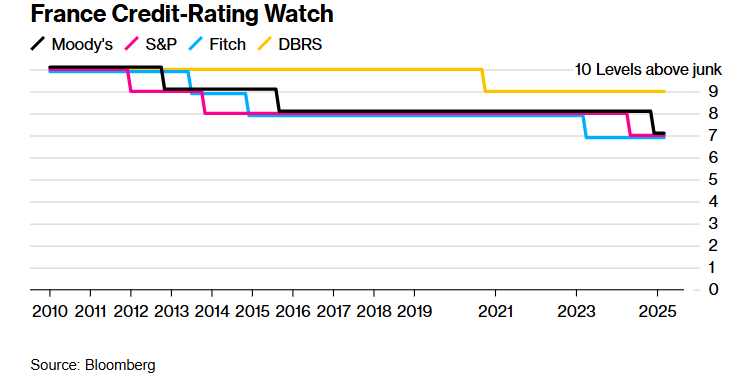

Recently, several international rating agencies issued a warning to the French government: Moody's downgraded France's sovereign debt rating in December last year, and S&P Global and DBRS both gave a “negative outlook” at the beginning of this year.

French Credit Rating Watch

According to Insee's latest statistics, public spending in France increased by 3.9% in 2024 (3.7% in 2023), while tax revenue growth accelerated from 2.2% to 3.1%. France's public debt as a share of economic output rose from 109.8% in 2023 to 113% at the end of last year. The pace of increase is narrower than in previous years, but it is still far higher than 97.9% in 2019 before the pandemic.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal