Asian Market Gems: 3 Penny Stocks With Market Caps Over US$60M

As global markets grapple with tariff fears, inflation, and growth concerns, the Asian market remains a focal point for investors seeking opportunities amid uncertainty. Penny stocks—despite their somewhat outdated name—continue to attract interest due to their potential for value and growth, particularly when supported by strong financials. This article highlights three such stocks in Asia that demonstrate financial strength and might offer intriguing prospects for those looking beyond traditional investment avenues.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.33 | SGD9.2B | ★★★★★☆ |

| Bosideng International Holdings (SEHK:3998) | HK$4.25 | HK$48.71B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.27 | HK$806.18M | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.93 | HK$692.61M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.03 | CN¥3.51B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD40.84M | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.48 | SGD457.62M | ★★★★★★ |

| Interlink Telecom (SET:ITEL) | THB1.46 | THB2.03B | ★★★★☆☆ |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.24 | HK$4.53B | ★★★★★★ |

| Playmates Toys (SEHK:869) | HK$0.61 | HK$719.8M | ★★★★★★ |

Click here to see the full list of 1,164 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Inter Pharma (SET:IP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Inter Pharma Public Company Limited operates in Thailand, focusing on the manufacture, import, and distribution of dietary supplements for both humans and animals, with a market cap of THB2.24 billion.

Operations: The company's revenue segments consist of Human Healthcare at THB1.41 billion, Animal Healthcare at THB293.70 million, and Hospital services at THB197.29 million.

Market Cap: THB2.24B

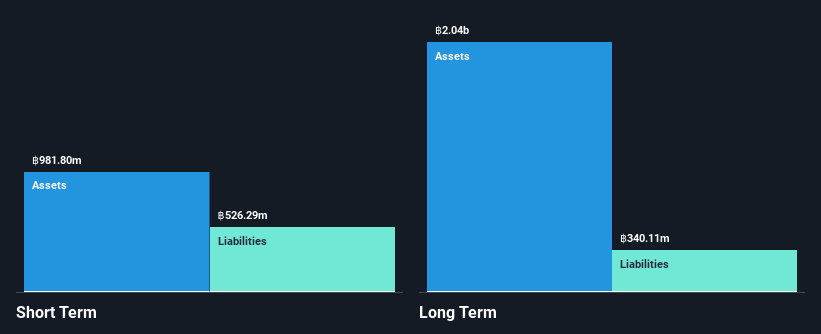

Inter Pharma's financial health presents a mixed picture for penny stock investors. With a market cap of THB2.24 billion, the company has shown revenue growth to THB1.91 billion, yet net income decreased to THB37.28 million from the previous year. Despite high-quality earnings and satisfactory debt levels with a net debt to equity ratio of 5.4%, profitability remains challenged as profit margins declined to 1.9%. Interest payments are well covered by EBIT at 3.8 times, and short-term assets exceed both short-term and long-term liabilities, indicating solid liquidity management amidst volatile share prices and declining earnings trends.

- Click here to discover the nuances of Inter Pharma with our detailed analytical financial health report.

- Examine Inter Pharma's past performance report to understand how it has performed in prior years.

China Fangda Group (SZSE:000055)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Fangda Group Co., Ltd. is engaged in the manufacturing and sale of curtain wall materials both in China and internationally, with a market cap of CN¥3.53 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥3.53B

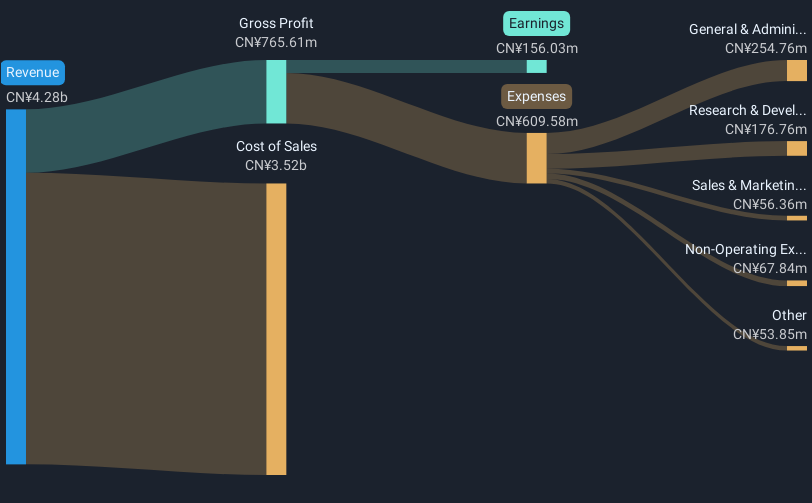

China Fangda Group's financials reveal a complex landscape for penny stock investors. With a market cap of CN¥3.53 billion, the company's price-to-earnings ratio (29.4x) is below the Chinese market average, suggesting potential undervaluation. Its net debt to equity ratio stands at 29.4%, indicating satisfactory debt management, and interest coverage by EBIT is robust at 6 times. However, earnings have declined significantly by 31.5% annually over five years and profit margins have halved from last year to 3.6%. Despite experienced leadership and adequate asset coverage of liabilities, challenges persist in sustaining profitability and growth amidst stable volatility levels.

- Dive into the specifics of China Fangda Group here with our thorough balance sheet health report.

- Gain insights into China Fangda Group's historical outcomes by reviewing our past performance report.

Jiangsu Baoli International Investment (SZSE:300135)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangsu Baoli International Investment Co., Ltd. operates in the investment sector with a market capitalization of CN¥3.89 billion.

Operations: The company's revenue from China amounts to CN¥2.33 billion.

Market Cap: CN¥3.89B

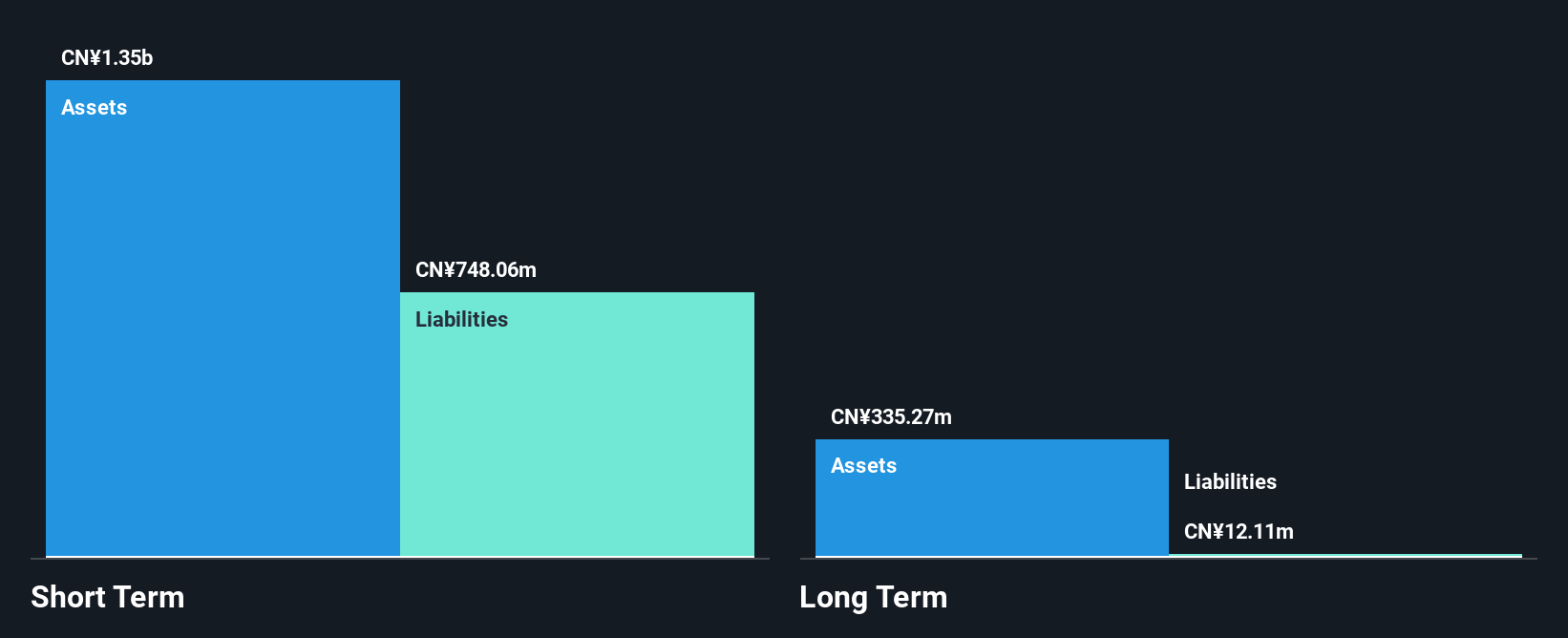

Jiangsu Baoli International Investment's financial profile presents a mixed picture for penny stock enthusiasts. With a market cap of CN¥3.89 billion, the company is unprofitable but maintains over three years of cash runway, supported by positive free cash flow. Despite declining earnings and negative return on equity at -4.89%, the management and board are experienced, with average tenures of 3.5 and 5.3 years respectively. The company's debt to equity ratio has improved over five years from 94.5% to 82.1%, yet net debt remains high at 42%. Short-term assets adequately cover both short- and long-term liabilities, providing some financial stability amidst volatility reduction from 11% to 6%.

- Take a closer look at Jiangsu Baoli International Investment's potential here in our financial health report.

- Explore historical data to track Jiangsu Baoli International Investment's performance over time in our past results report.

Key Takeaways

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 1,161 more companies for you to explore.Click here to unveil our expertly curated list of 1,164 Asian Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

- CRI

- 33.83

- -3.23%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal