Manus accelerates the AI era, and the AI application software sector has set off a “gold rush”?

In the early morning of March 6, China's AI team Monica announced the launch of Manus, the world's first general-purpose AI smart device product. Due to the large model with the same level of performance as Open AI, it set off a heatwave in the primary and secondary markets as soon as it was released.

According to the official website, Manus can help users with tasks such as travel planning, stock analysis, PPT production, and financial report analysis with one click.

Subsequently, Manus quickly became popular in the tech world, and some media even called it “AIAgent's 'GPT moment'.”

Meanwhile, the secondary market also set off a frenzy.

By the close of trading on March 6, AI smart concept stocks such as New Cape, Hande Information, and Dingjie Digital Intelligence had collectively risen and stopped in the A-share market. The rise of AI application software stocks in the Hong Kong stock market was no less impressive. The application software sector rose more than 10%, leading many sectors. Mingyuan Cloud (00909) surged more than 23%, Graffiti Smart-W (02391) rose more than 14%, and Jinshan Software (03888) rose more than 11%. The rest of the concept stocks followed suit.

However, this rise did not last long, and was shattered by doubts from the outside world. Due to Manus's restrictions on inviting closed beta, most viewers and even industry insiders were unable to experience the innovative experience brought by this AI Agent. This move was also questioned by the industry as “hunger marketing+hype.” Under pressure from public opinion, Manus AI partner Zhang Tao has repeatedly clarified that “no marketing budget has been invested” and that using the invitation code mechanism is “a last resort due to limited server capacity.”

Looking at it now, we can't reveal the authenticity of Manus. After all, it is undeniable that the market is eager for AI Agent (artificial intelligence) products.

According to the Zhitong Finance App, since DeepSeek exploded, who can build the next superagent has become the focus of the industry, and investors in the secondary market are also eager to try it out. Who can get the first pot of gold in the “first year of commercial application of AI agents” has become a common issue for investors.

Accelerating the big era of AI applications, the industry ushered in a “singular moment”

In December 2024, the first version of DeepSEEK-v3 was launched and simultaneously open source. On January 20, 2025, the company further released and open-sourced the DeepSeeKR1 model. The model excels in mathematics, programming, and natural language reasoning, and is even comparable to OpenAI's O1 model.

According to relevant media reports, the DeepSeek model is comparable to the world's leading models such as GPT in terms of performance, and far lower than GPT in terms of training costs. DeepSeek's R1 pre-training cost is only 5.576 million US dollars, which is less than one-tenth of the training cost of the OpenAIGPT-4O model.

It is easy to see that the advent of DeepSeek can be described as greatly reducing model call costs, and is an open source model. It is undoubtedly a major cost-benefit for downstream AI applications. It is expected to accelerate the implementation of AIAgent and various downstream vertical “AI+ applications”. Downstream applications are also expected to achieve higher ROI and achieve early profits.

Backed by data. Looking closely at the development history of this wave of AI, we can see that it is probably similar to the mobile internet wave in 10-15, and follows the transmission rules from hardware device software content to scene application.

In the mobile internet wave in 2010-15, the improvement of communication infrastructure construction and the advent of popular products kicked off the prelude to smartphones replacing functional devices. Subsequent, the content industry began to flourish, and traditional industries began to “embrace” the Internet one after another.

According to reports, during the acceleration of the wave, content and application platforms in China were in full bloom. At the same time, as the smartphone penetration rate gradually increased, the number of Chinese mobile netizens and internet time also increased dramatically. According to People's Online and China Internet Communications Network, the number of mobile phone users in China reached 620 million in 2015, and the average weekly Internet time per user increased from 20.5 hours in '12 to 26.2 hours in '15. In this context, applications such as social media, instant messaging, e-commerce, online payments, and games have risen rapidly to meet the growing diversified needs of users. For example, in 2014 and 2015, China's mobile game sales revenue reached 40 billion yuan and 72.4 billion yuan respectively, with year-on-year growth rates of 191% and 81%.

In comparison, judging from the transmission rules of hardware and software content and scene applications, along with DeepSeek setting off an AI boom, AI applications have apparently also accelerated to a period of 1-100.

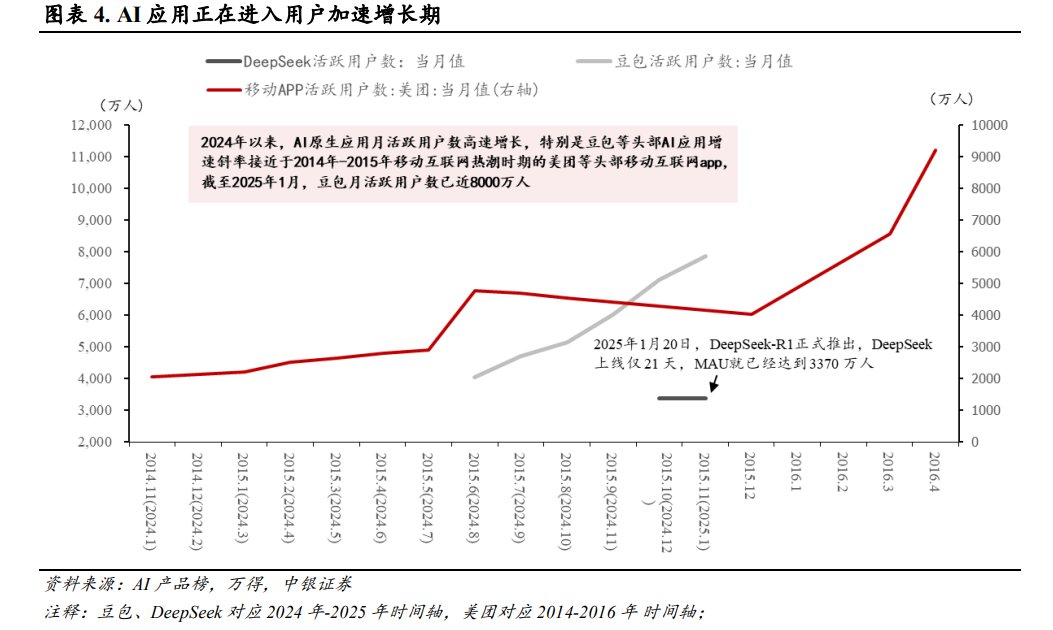

According to BOC Securities, since 2024, the number of active users of AI applications in China has grown rapidly, and the leading application Doubao has become the second-largest MAU AI application in the world, after ChatGPT. As Deepseek attracted great attention from the market in January of this year, its MAU reached nearly 80 million in January 2025.

However, since the second half of 2024, the number of calls to the Doubao Big Model has increased rapidly. The average daily token usage of the Doubao Big Model exceeded 4 trillion dollars in December, an increase of more than 33 times over the May release period.

From the above, it can be seen that the growth rate of AI applications is close to that of leading mobile Internet apps such as Meituan during the 2014-2015 mobile internet boom. Top applications such as Doubao may be expected to break 100 million monthly activity by 2025, and leading AI applications are moving towards a “singular moment” of quantitative transformation to qualitative change. As the number of domestic AI application users is entering a period of accelerated growth, the launch of DeepSeek is expected to further accelerate application-side commercialization.

The upward effect has arrived, how to lay out the AI software application sector?

In fact, like the mobile internet wave in 10-15 years, it is reflected in stock market performance. The stock market also started with hardware devices, gradually spread to software content, and spread to scene applications.

Similar to the beginning of the mobile internet wave in 10-15, hardware-side performance was more certain in 23-24 during the 0-1 phase of the AI application wave, and the increase in stock prices was more obvious.

Take Nvidia, the AI “shovel seller”, as an example. In the AI wave from the end of 2022 to the present, since the computing power sector is the most deterministic, Nvidia has profoundly benefited as a global leader in computing power. In 2023, the revenue of the data center business where Nvidia's AI chips are located increased 137%, accounting for a share of revenue from 39% in '21 to 78% in '23. Since October 2022 (data as of 25/02/25, same below), the biggest increase in Nvidia's stock price reached 1318%.

The same is true for A-share optical module leader Zhongji Xuchuang (300308.SZ). Driven by the explosive trend of AI computing power, optical module performance gradually unleashed. The cumulative net profit of the A-share optical module sector rebounded sharply from -8% in 23Q3 to 101% in 24Q3. The biggest increase in the Wind Optical Module Index since 22/10 was 314%. Among them, the leader Zhongjixu increased 898%.

Therefore, it is not difficult to speculate that with the accelerated implementation of DeepSeek catalytic AI applications, the upward effects of the sector will obviously also be transmitted from hardware devices to software content and scenario applications.

Specifically, based on the implications of the rules of the mobile internet era, it is easier to take the lead in commercialization in areas where application scenarios are clear, business models are easy to verify, investment costs in the industrial chain are low, and user demand is high. Among the different vertical fields of AI applications, AI vertical fields such as office, entertainment, healthcare, education, finance, and e-commerce are probably particularly worthy of focus.

For example, in the AI+ office field, AI technology can be widely used in the office field. AI technology participates in optimizing work processes, improving productivity, and providing a better user experience. Currently, “AI+ Office” is in the early stages of paying user training and accumulation, and the potential for subsequent development cannot be ignored. In the Hong Kong stock market, AI+ office concept stocks such as Jinshan Software (03888) and Kingdee International (00268) may also benefit greatly from this wave of AI.

Summarizing the above, it can be seen that although there is still no answer to whether Manus's exit is hype or real skill, as DeepSeek catalyzes the accelerated implementation of AI applications, the investment effect of AI applications is also becoming more obvious. In the application field, China's huge market and user base will provide fertile ground for AI application innovation. Domestic companies have great potential, and investors can follow the mobile internet wave's development rule that “the stock market market will start with hardware devices, gradually be transmitted to software content, and spread to scene applications”. After all, the principle of “learning from history” will never go out of style.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal