Securities Development Strategy: Eight Important Issues in the Hong Kong Stock Market Recently

The Zhitong Finance App learned that Xingzheng Securities published a research report saying that southbound capital has become one of the main forces to long Hong Kong stocks in this round. This is in stark contrast to the pace of foreign capital inflows, and is more determined in terms of the inflow rate. Judging from the capital flow sector, growth sectors such as AI and pharmaceuticals are popular, while capital from the south continues to flow into the dividend sector. Furthermore, although the current valuation of Hong Kong stocks has risen, the overall value is still within a tinkable range. Compared with US stocks, most Hong Kong stock industries have significant discounts, and some industries have advantages in terms of valuation and profit. Hong Kong stock technology leaders are also significantly discounted compared to US stock technology, and many Hong Kong stock companies have outstanding cost performance compared to their US stock rivals.

1. Who is buying Hong Kong stocks?

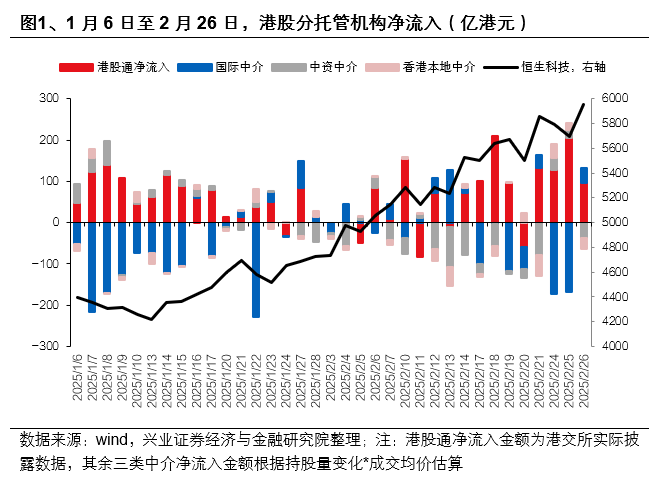

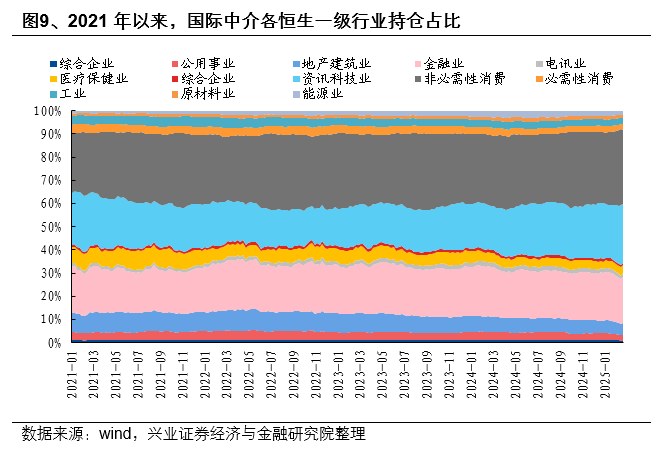

According to the breakdown of Hong Kong stock custodians, southward capital may be one of the main funds to go long on Hong Kong stocks in this round. From January 14 to February 26, the Hong Kong Stock Connect had a cumulative net inflow of HK$167.21 billion, while international intermediaries, Chinese intermediaries and local intermediaries in Hong Kong reduced their positions by HK$78.70 billion, HK$55.46 billion and HK$9.77 billion respectively during the same period.

At the pace, around the Spring Festival, the net inflow of foreign capital increased, but profits stopped in mid-February, while mainland capital continued to move southward. Specifically, DeepSeek triggered a revaluation of Chinese assets by overseas capital. International intermediaries representing foreign capital quickly increased their positions in Hong Kong stocks on January 27, but then began a net outflow on February 17. In contrast, southward capital continues to contribute to the growth of Hong Kong stocks.

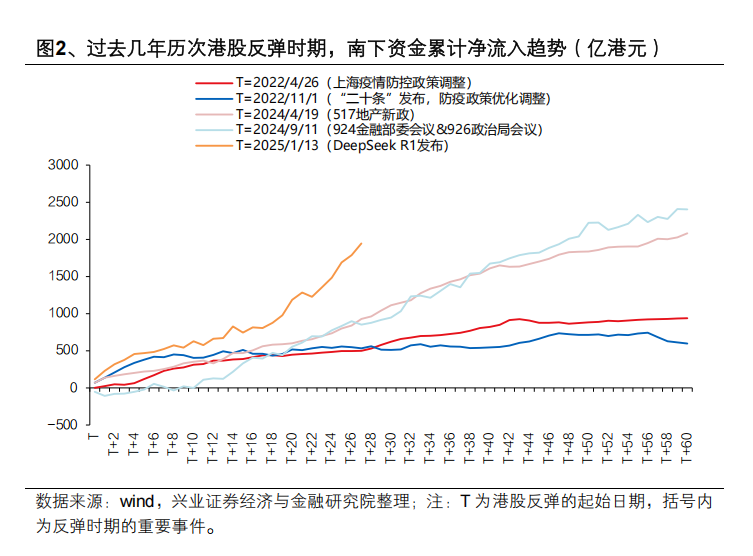

Furthermore, compared to the rebound of Hong Kong stocks several times in the past, this round of capital inflows from the south is more firm. Compared with the four macro-factor-driven rebound in the 22-24 period, since the current round of improvements stemmed more from the iteration of industry trends and corporate profit recovery, and Hong Kong stock positions and valuations were still low even after a sharp rise, the pace of net capital inflows from this round gradually accelerated. In particular, the market environment adjusted by fluctuations in the past week showed the characteristics of “falling more, buying more”.

2. Which sectors are the main inflows of various types of capital into?

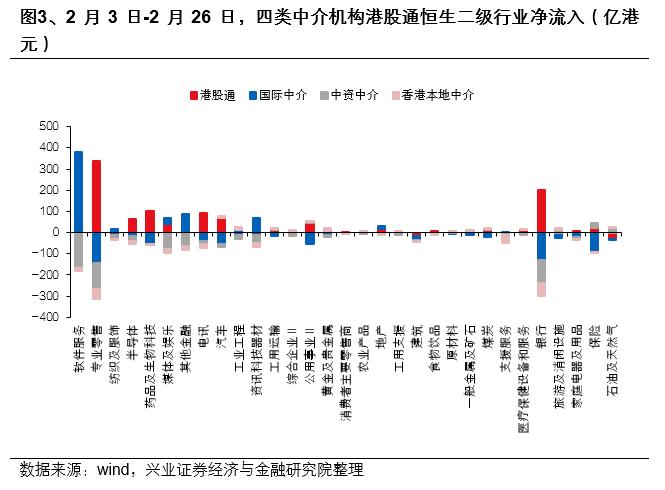

At the industry level, in the hot market of Hong Kong stocks since the Spring Festival, growth sectors such as AI and pharmaceuticals are the main direction for capital inflows, while dividend-related sectors have been cut a lot. According to estimates, from February 3 to February 26, capital was mainly invested in software services, professional retail (mainly Alibaba), pharmaceuticals and biotechnology, media and entertainment, and telecommunications sectors, with net outflows from banking, insurance, construction, textiles and apparel, and industrial engineering.

Although the AI sector is a consensus between Southbound Capital and Foreign Investment, there are differences in the specific allocation process. Foreign capital has greatly increased its allocation to the middle and upstream sectors represented by software services and information technology equipment, while in addition to adding professional retail, telecommunications, semiconductors, etc., it has also added a large number of “AI+” fields, including media and entertainment, healthcare, and automobiles.

Furthermore, it is worth noting that apart from the “AI+” sector, southbound capital continues to flow into the dividend sector and resonates with some Chinese intermediaries and local intermediary funds in Hong Kong. From February 3 to February 26, southbound capital continued to flow into the dividend sector represented by banks, utilities, and insurance, and resonated with Chinese intermediary funds in utilities and insurance.

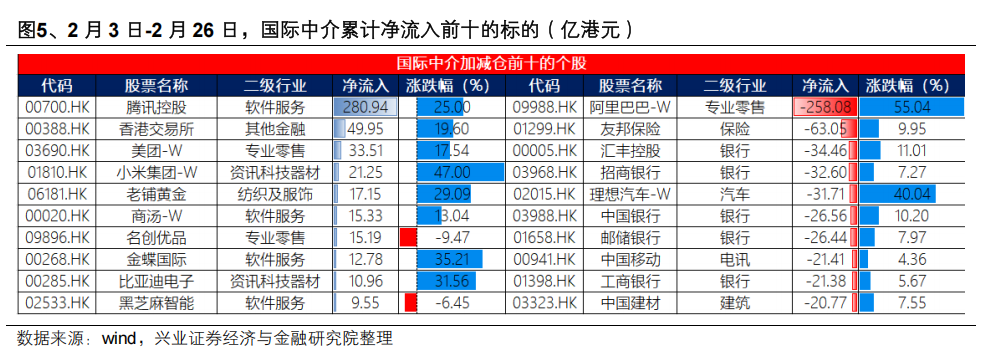

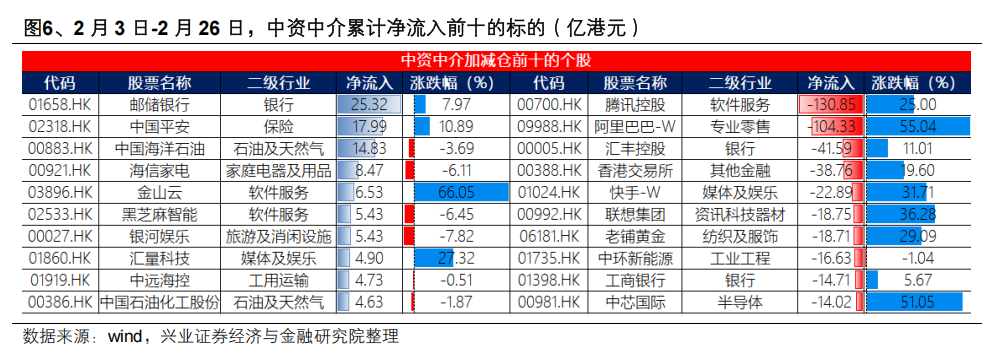

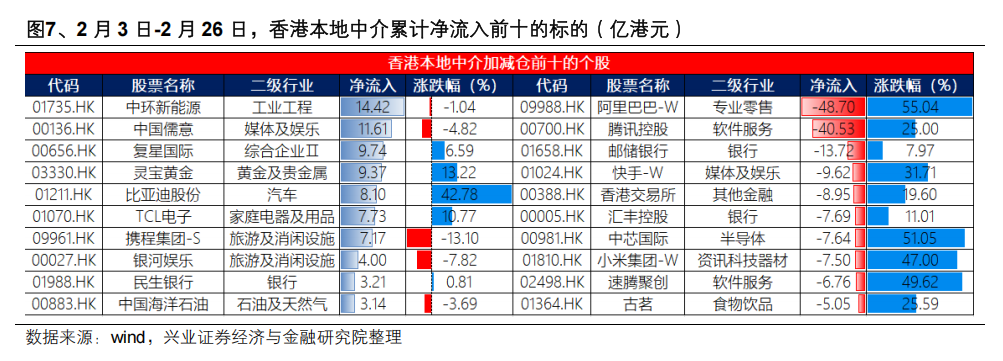

At the individual stock level, judging from the net inflow of the four types of institutions into the top ten individual stocks:

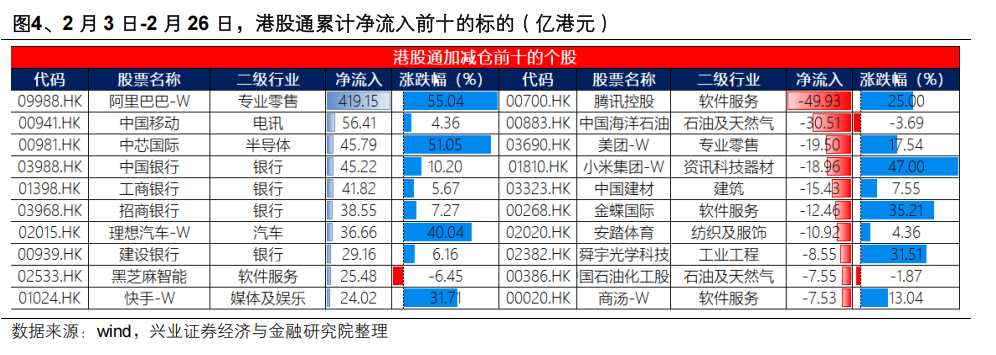

Southbound funding follows the “dumbbell” configuration of “technology+dividends”. Not only are there significant inflows into AI companies such as Alibaba, China Mobile, Kuaishou, SMIC, and Black Sesame Intelligence, but it also continues to flow into high-dividend individual stocks represented by ICBC and Bank of China. However, Hong Kong Stock Connect reduced positions of Tencent Holdings, CNOOC, and Xiaomi Group quite a bit.

Foreign investors have clearly favored technology and consumer companies with unique business models, and reduced their positions more on Alibaba and the financial industry. On the one hand, it has significantly increased its inventory of leading technology companies such as Tencent, Xiaomi, Meituan, Shangtang, Kingdee International, BYD Electronics, and Black Sesame Intelligence. On the other hand, the international community also has a certain fondness for “new consumer” companies, including old gold stores and famous premium products. Furthermore, the reduction in foreign positions was mainly concentrated in financial stocks such as Alibaba, AIA, HSBC Holdings, and China Merchants Bank.

Chinese intermediary capital continues to flow into high-dividend stocks such as finance and petroleum, mainly reducing positions in Tencent Holdings and Alibaba, which are popular recently. The top three stocks with net inflows in the Chinese intermediary range were Postbank, Ping An of China, and CNOOC, which reduced their positions more than Tencent Holdings, Alibaba, and HSBC Holdings.

Local intermediaries in Hong Kong have more diversified and “niche” capital allocations, but they also mainly reduced positions with Tencent Holdings and Alibaba. Local intermediaries in Hong Kong have mainly increased their holdings in Central New Energy, China's Ruyi, Fosun International, and Lingbao Gold, with net outflows to Alibaba and Tencent Holdings on a large scale.

3. Where are the Hong Kong stock positions of various types of capital?

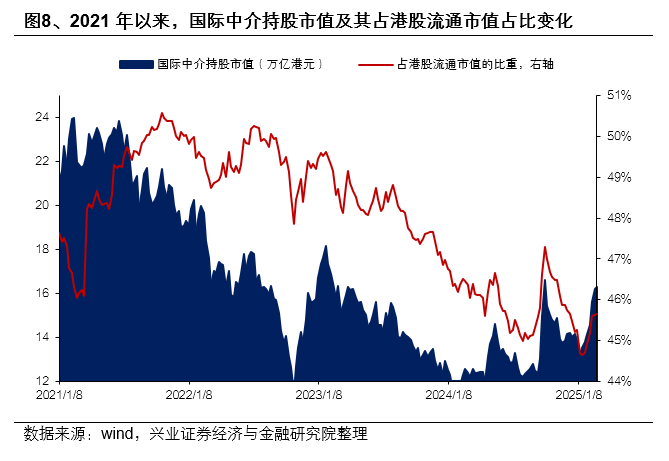

(1) The amount of Hong Kong stocks held by foreign investors is at a moderate level since 21, while the share of Hong Kong stock holdings is at an historically low level. As of February 26, the market value of shares held by international intermediaries was HK$16.30 trillion, accounting for 45.65% of the market value of Hong Kong stocks in circulation, which is in the lower quantile of 11.1% since 2021. Looking at the market value of shares held in February '21 and January '23, the market value of foreign shareholding may still have room to increase by HK$1.87/7.70 trillion. Looking at the share market value of shares held during the peak period of 23 and 21, under the assumption that the Hong Kong stock market value remains unchanged, there may still be room for foreign investors to increase their holdings by HK$1.41/0.24 trillion.

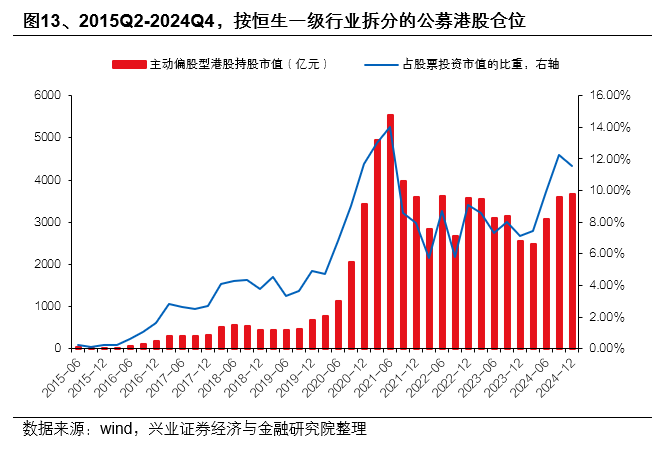

(2) Mainland public funds

As of 2024Q4, the publicly traded Hong Kong stock position was 11.5%, and there is still some room for improvement from the historical high. As of the fourth quarter of 2024, active equity funds invested in Hong Kong stocks had a market value of 367.558 billion yuan under full holdings, accounting for 11.5% of the total share investment market value. Assuming that its Hong Kong stock position returns to the highest level in history, it is estimated that there will still be an increase of more than 70 billion dollars based on the 24Q4 shareholding scale.

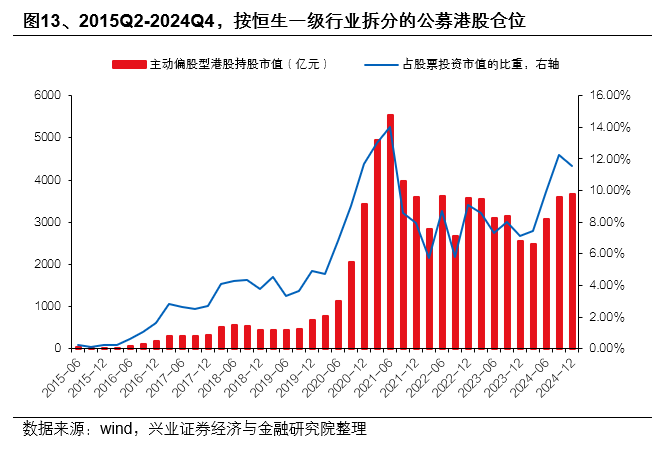

(3) Non-public Hong Kong Stock Connect

Thanks to the large inflow of capital from the South over the past few years, the market value of Hong Kong Stock Connect's holdings, excluding public funds, exceeded HK$3.4 trillion in the fourth quarter of last year. As of 24Q4, after excluding the market value of Hong Kong stocks invested by non-QDII public funds, the market value of remaining mainland capital holdings through Hong Kong Stock Connect was HK$3012.48 billion, accounting for 87.9%. Assuming that 24Q4 insurance's position on Hong Kong stocks is 10%-30%. According to the estimated market value of stock and fund investments in the insurance capital usage balance, insurance holdings account for about 13%-40% of Hong Kong Stock Connect. This means that half or more of the capital in Hong Kong Stock Connect may come from other investors such as retail investors, private equity, and bank wealth management.

4. What is the structure of Hong Kong stock holdings of various types of capital?

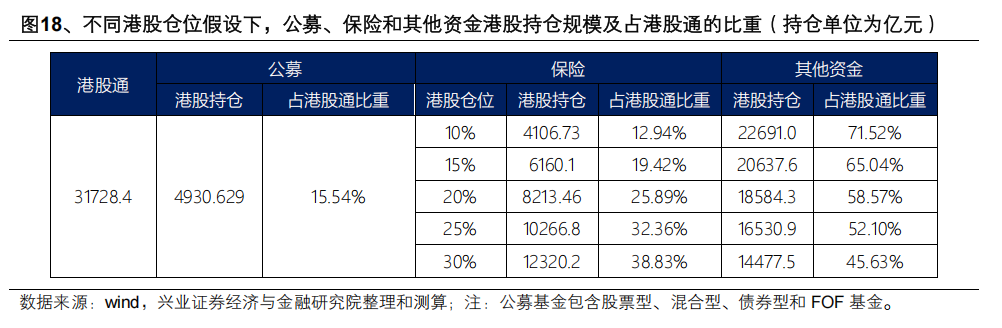

(1) Foreign investors prefer information technology, optional consumer and financial industries, accounting for nearly 80% of total positions. As of February 26, the top 5 major international intermediary industries were non-essential consumption, information technology, finance, real estate construction, and industry. Also, in the long run, although foreign capital has flowed out of Hong Kong stocks in the past few years, the combined share of IT and optional consumption positions has continued to rise, all of which are comparable to the levels of February '21 and January '23.

(2) Mainland public funds

Active equity funds can choose consumption and information technology for long-term heavy positions. In terms of the top ten major stocks, as of the fourth quarter of last year, the top five major public offerings in Hong Kong stocks were information technology, optional consumption, healthcare, energy, and industry. However, due to increased allocations to the dividend sector in the past few years, the current position of active biased equity funds in the technology internet sector (IT industry+Alibaba+Meituan, same full text) has just returned to the level of the first quarter of '23, and there is still room for a 2.86% increase in position since the highest point in 21Q1.

(3) Non-public Hong Kong Stock Connect

The non-public Hong Kong Stock Connect mainly focuses on finance, IT and optional consumption. As of 24Q4, the top five major capital industries of Hong Kong Stock Connect after excluding public offerings were finance, information technology, optional consumption, telecommunications and energy. Compared to public funds, the allocation ratio of the rest of the mainland capital going south to the dividend sector is even more remarkable. The non-public Hong Kong Stock Connect account for 27.19% of the total holdings of IT+Alibaba+Meituan, which is lower than the 21Q1 and 23Q1 levels, and there may be room for further position adjustments.

5. Which individual stocks are heavily invested in various types of capital? (1) Foreign investment Since 2021, the top ten major foreign stocks have all been the leaders in technology+finance. As of February 26, the top 5 international brokerage industries were Tencent Holdings, Alibaba, Xiaomi Group, Meituan, and AIA. Since 2021, foreign investors have also had a fixed preference for individual stocks. The top ten major stocks have been relatively stable. In particular, Tencent Holdings and Alibaba have occupied the top two major positions for a long time. Currently, most heavy stock positions are higher than those of February '21 and January '23. However, it is worth noting that since April 2024, the share of the top five/top ten heavy stock holdings of international intermediaries has soared, which may indicate that the concentration of foreign shareholding has continued to rise, mainly embracing leading Hong Kong stocks in technology and finance.

(2) Mainland public funds

The public offering of Hong Kong stocks has fluctuated quite a bit, but preferences for Tencent and Meituan are relatively stable. As of 24Q4, the top five major holdings of active equity funds were Tencent Holdings, Meituan, CNOOC, Xiaomi Group, and Alibaba. Compared with foreign heavy stocks, the industry allocation of publicly traded Hong Kong stocks is more diversified and more varied. Furthermore, compared to 21Q1 and 23Q1, there is still plenty of room for improvement in public offering positions in technology leaders such as Tencent Holdings, Meituan, Xiaomi, and Alibaba.

(3) Non-public Hong Kong Stock Connect

The non-public Hong Kong Stock Connect favors high dividend targets such as finance, energy, and operators. As of 24Q4, after excluding the public offering, the top five major stocks held by Hong Kong Stock Connect were Tencent Holdings, China Mobile, CNOOC, China Construction Bank, and Industrial and Commercial Bank.

6. After the rise, what is the current valuation level of Hong Kong stocks?

Judging from the absolute valuation of the Hang Seng Index, as of February 26, the Hang Seng Index PE_TTM was 10.36, respectively, at a quantile level of 65.1% in the past five years, slightly lower than the high stock price high on January 27, '23, and still had a 40.8% discount from the high on February 17, '21.

Judging from Hang Seng Technology's absolute valuation, as of February 26, Hang Seng Technology's PE_TTM was 24.69 respectively, which is in the lower quantile level of 29.6% in the past five years. Compared with January 23, there is still room for improvement of over 130%, and a 50.3% discount compared to February 17, '21. Looking at the Hang Seng Index ERP, as of February 26, the Hang Seng Index ERP (based on 10-year US Treasury interest rates, full text) was 5.4%, at the fraction level of 6.7% in the past five years. It has broken down the average -1 times standard deviation, which is comparable to the level of January 23, and still has room for 1% decline compared to February 17, '21 (assuming the 10-year US Treasury interest rate remains unchanged, the implied room for valuation increase is 11.3%).

Looking at the Hang Seng Technology Index ERP, as of February 26, Hang Seng Technology ERP was -0.2%, at the fraction level of 30.4% in the past five years. It has not broken through the average -1 times standard deviation, but it is still below the level of February '21, and there is still room for 1.6% decline compared to January 27, '23 (assuming the 10-year US Treasury interest rate remains unchanged, the implied valuation increase is 65.7%). Judging from the relative valuation of the Hang Seng Index compared to the S&P 500, as of February 26, the Hang Seng Index was 0.38 compared to the S&P 500, which is in the middle low quantile of 38.5% in the past five years. According to current US stock valuation estimates, the Hang Seng Index still has 35.7% room for improvement compared to January 27, '23, and 13.3% room compared to February '21. Judging from the relative valuation of Hang Seng Technology compared to Nasdaq 100, as of February 26, Hang Seng Technology had a PE of 0.70 compared to Nasdaq 100, which is in the middle low quantile of 32.9% in the past five years. According to current US stock valuation estimates, Hang Seng Technology still has room for improvement of 199.4% compared to January '23, and 69.7% room compared to February '21.

7. Looking at industry segments, how is the valuation of Hong Kong stocks compared to US stocks?

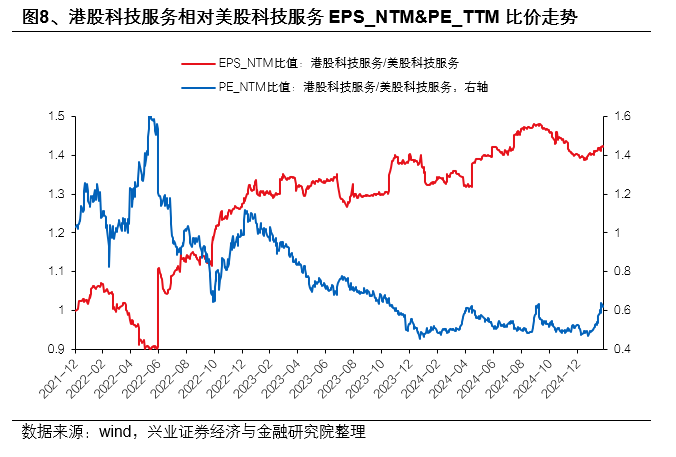

Comparing the 25-year PE and PB expectations for Hong Kong stocks and US stocks, we found significant discounts in most Hong Kong stock industries. Specifically, the Hong Kong stock trading and retail sectors (including Alibaba), raw materials, finance, and energy are discounted by more than 50% compared to US stocks, while some Hong Kong stock industries, such as electronic technology, medical services, and medical technology, are valued higher than their US counterpart industries. Looking further at the PE-G framework, most Hong Kong stock industries represented by the Internet have discounted valuations compared to US stocks, and the 25-year EPS growth rate is superior. Among them, as the main line of the AI market and the core technology service industry of Hong Kong stocks (including Tencent, NetEase, Baidu, Alibaba Health, Jinshan Cloud, etc.), its EPS advantage continues to increase compared to similar US stocks (including Microsoft, Oracle, IBM, Palantir, Servicenow, etc.), but valuation discounts continue to expand. In addition, industries such as raw materials, energy, logistics services, finance, utilities, transportation and commercial services also have valuation and profit advantages over similar industries in US stocks.

8. From a leading perspective, how is the valuation of Hong Kong stocks compared to US stocks?

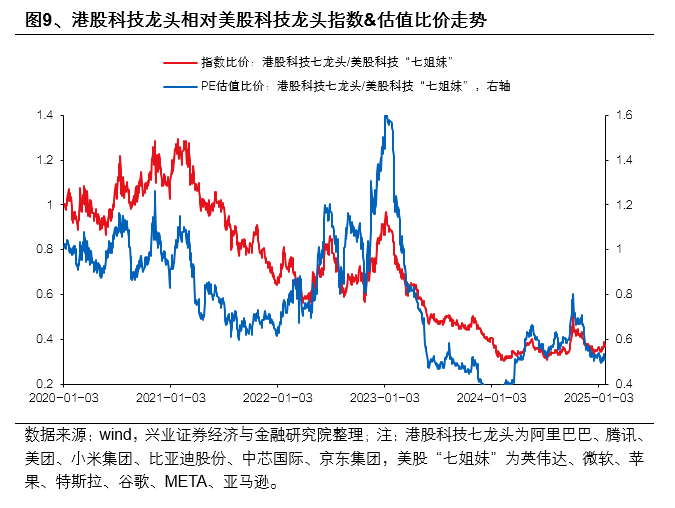

Overall, Hong Kong tech leaders are significantly discounted compared to US tech stocks. As of February 26, the seven leading technology companies in the Hong Kong stock market had a PE of 0.71 compared to the “Seven Sisters” (see chart 10 notes for the list of individual stocks), which is in the middle quartile of 44.2% in the past five years.

According to current US stock valuation estimates, the top seven technology companies in the Hong Kong stock market still have 117.9% room for improvement compared to January '23, and 55.8% room compared to February '21. Looking specifically at individual stocks, based on a bottom-up analysis of Hong Kong stock companies with high market capitalization and characteristic businesses in various industries, whether looking at the expected PB or PE for 25 years, most of them can relatively undervalue the benchmark US stocks. Among them, companies such as Ideal Auto, BYD, JD, ICBC, CNPC, Alibaba, Baidu, and Anta are still more cost-effective than US stocks.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal