US Stock IPO Outlook | Microbus: The pain of business transformation behind the sharp 70% drop in revenue from the “customized chartered bus service platform” launched in Hangzhou

In 2024, the mobile mobility sector set off a huge wave of capital, and many companies embarked on the path of listing. Examples include Qi Chuxing, My Little Pony Zhixing, Wenyuan Zhixing, etc.

At the beginning of 2025, the one-stop customized chartered bus industry is also entering the capital market. Recently, WEBUS INTERNATIONAL LIMITED (hereinafter referred to as “microbus”), the actual controlling shareholder of Zhejiang Youba Technology Co., Ltd. from Hangzhou, Zhejiang, updated its prospectus at the US Securities and Exchange Commission (SEC), under the stock code WETO, to be listed on the US NASDAQ. It was secretly filed with the US SEC on September 23, 2022, and then publicly disclosed the prospectus on February 10, 2023.

According to some sources, this company, which started with “customized buses,” may be rewriting the rules of the global travel game. What are its fundamentals?

Revenue fell sharply by about 70%, focusing on “small but beautiful” growth

According to the prospectus, Microbus uses the “Mobility as a Service” (“MaaS”) business model to identify and resolve inefficiency issues associated with inflexible or poor quality mobile solutions for customers around the world in different scenarios through the company's integrated digital platform. The company provides customized commuter shuttle services, chartered bus and bus services, and group travel services for customers' business and leisure trips.

Microbus has a wide variety of online channels, including apps, official websites, WeChat and Alipay applets. These online channels make it easy for users to make reservations and enquire about services anytime, anywhere. At the same time, Microbus has also connected with the three major domestic online travel agency platforms Ctrip, Flying Pig, Tongcheng, and has established certified partnerships with Xiaohongshu. Through cooperation with these platforms, Microbus can better promote its services and attract more users.

In addition to online channels, microbus also has a wide range of offline channels. Strategic business cooperation with more than 50 cities and counties in Zhejiang Province has enabled microbus to reach various regions and provide convenient travel services for local residents. Travel agencies, online bus reservation platform Gotobus, and help desks set up at transportation stations such as Hangzhou High Speed Rail Station and Airport also provide users with more reservation and consultation channels.

Microbus has more than 11,000 dispatchable vehicles in China, which provides it with a strong service guarantee. Whether traveling within or across cities, microbuses can quickly deploy vehicles to meet users' needs. Overseas, around 8,000 drivers provide chartered bus services, which makes the microbus service coverage all over the world.

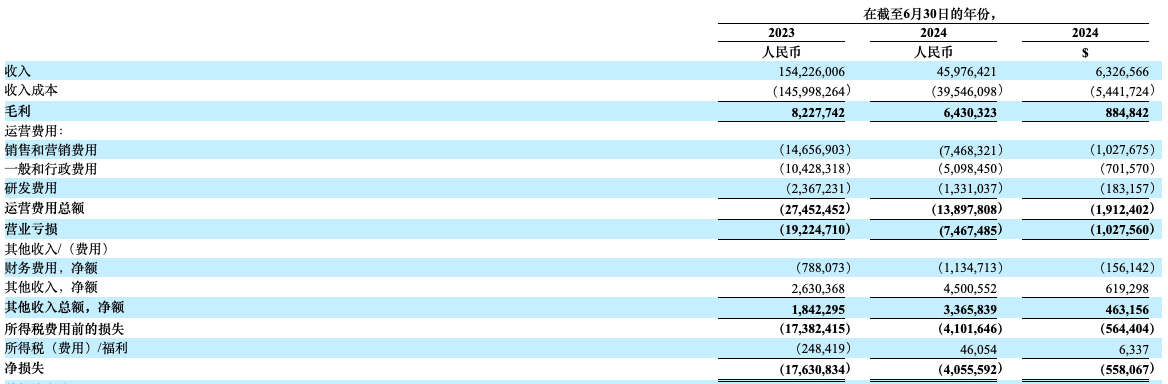

In the past fiscal year 2023 and 2024 fiscal year (the fiscal year settlement date is June 30 of each year, hereinafter referred to as the reporting period), microbus' revenue was 154 million yuan (unit: RMB, same below) and 46 million yuan, respectively. Net losses corresponding to a 70% sharp drop in revenue were 176.308 million yuan and 4,0555 million yuan respectively, which is hard to hide continued losses.

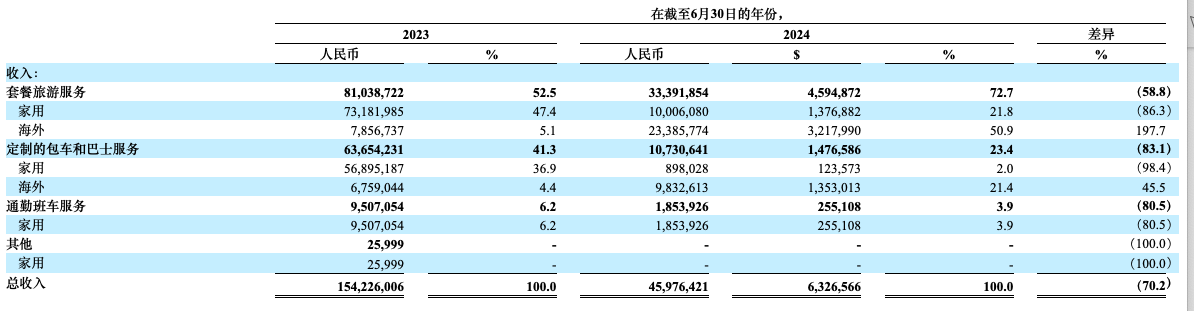

By business, revenue from package tours during the reporting period was 81.0387 million yuan and 33.3919 million yuan, down 58.8% year on year, mainly due to a decline in the domestic market; revenue from customized chartered buses and bus services was 63.6542 million yuan and 10.7306 million yuan respectively, down 83.1% year on year; revenue from commuter shuttle services was 9.5071 million yuan and 1.8539 million yuan respectively, down 80.5% year on year. The overall contraction of the business, in particular the decline in package travel services, which account for more than 50% of revenue, led to a marked decline in the company's revenue. Furthermore, behind the contraction of the main business is the narrowing of the scale of business in the domestic market. The company said that in order to optimize long-term financial indicators and adjust commercial considerations for brand positioning, we have adjusted our business strategy to focus more on package travel services provided at higher gross margins in overseas markets.

What is encouraging is that the gross margin of package tours increased significantly, at 4.1% and 14.5%, respectively; while the gross margin of customized charter services increased even more significantly, from 5.4% in FY2023 to 20.6% in FY2024. The increase in gross margin drives an increase in the company's profitability.

In addition to increased profitability, improvements on the cost side have also led to a narrowing of Microbus' losses. During the reporting period, the company's total operating expenses were 27.4525 million yuan and 13.8978 million yuan respectively, down 49.38% year on year, of which sales and marketing expenses fell 49% to 7.4683 million yuan; general and administrative expenses fell 51% to 5.0985 million yuan; and R&D expenses fell 46% to 1,389,800 yuan.

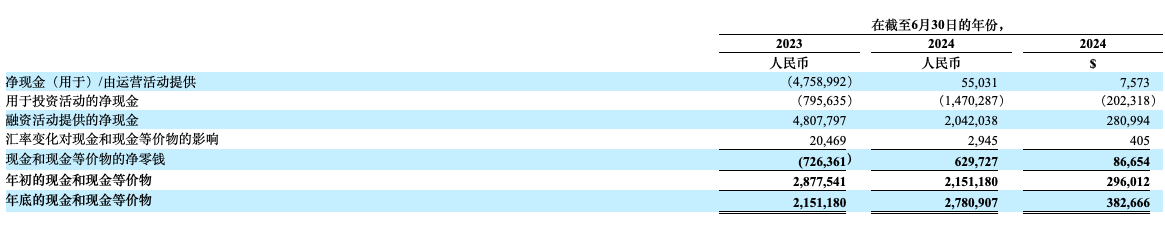

There is no doubt that the effect of the fee reduction is remarkable. The company's net cash flow in fiscal year 2024 turned positive, at 55 million yuan, and -4.759 million yuan in fiscal year 2023. Cash and cash equivalents were $2.1511 million and $2.7809 million respectively during the period, showing a slight increase.

At the expense of business scale and focusing on “small but beautiful” growth, how long can microbus continue to grow?

The outlook is optimistic, but competitive pressure remains

Judging from industry development support, the current microbus industry is mainly about “coexistence of opportunities and challenges”.

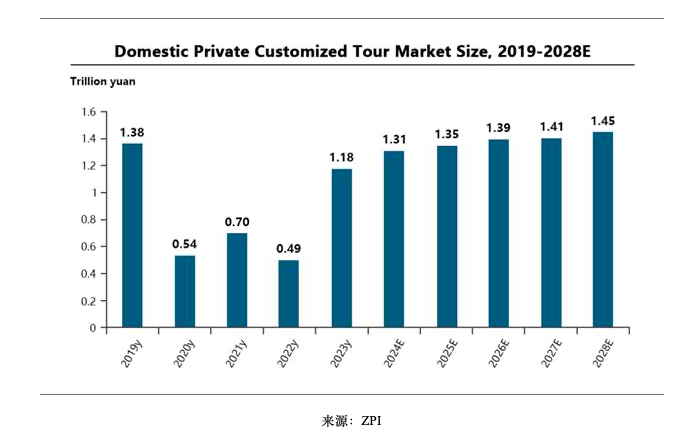

The private group market has shown a strong growth trend in recent years and is expected to maintain a high growth rate in the next few years. As the scale of China's outbound travel market continues to expand, middle and high-end consumer groups continue to rise, private groups are becoming more and more popular due to their personalized and high-quality service characteristics. According to the “2023 Travel Consumption Report”, private car tours account for 24% of total travel product bookings. Private car tour revenue reached 1.18 trillion yuan in 2023, and is expected to increase to 1.45 trillion yuan by 2028.

Furthermore, in terms of overseas markets, the overseas Chinese chartered private group tour market is estimated to be around US$8.7 billion in 2023. As the demand for outbound travel from Chinese tourists continues to grow, so does the demand for travel products that provide services in Chinese. As a result, the overseas Chinese chartered private group tour market is expected to maintain rapid growth in the next few years. By 2028, the market size is expected to reach approximately $18.1 billion.

As far as microbus is concerned, this is the “opportunity” side, and it is clearly the main reason why it uses a low price strategy to seize market share for customized chartered buses and group tours.

However, looking closely at its prospectus, the “challenges” microbus faces are also very obvious under the fiercely competitive market pattern.

Specifically, there are hundreds of online shared travel service platforms in China, and the overall online shared travel service market shows a highly competitive and highly fragmented pattern. According to the previous prospectus, as of the first half of 2022, Microbus ranked second in the market, while the total revenue of the top five online group mobile service platforms was only 232.6 million yuan, which is enough to show the high degree of fragmentation in this market.

Furthermore, in the US market, Microbus is also facing competition from established local rivals. The American long-distance bus supplier Greyhound (Greyhound Bus), which has been in business for more than 100 years, was acquired by the German transportation application platform FlixMobility in October 2021. As a result, FlixMobility has further penetrated the US market.

At this point, Microbus said in a warning risk that the company needs to compete with a large number of companies of different sizes, including divisions or subsidiaries of large companies, which may have more financial resources and a larger customer base than the company. If these competitive pressures cause the company's products to lose market share or profit margins to decline, the company's business, financial position, and operating results may be significantly adversely affected.

In summary, Microbus chose to reduce the scale of revenue and focus on improving profits, thereby beautifying financial data. However, the transformation pain behind the sharp decline in business scale and competitive pressure in the industry will still make investors worried about its growth.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal