Chow Tai Fook Jewellery Group (SEHK:1929) Eyes Growth with Product Innovation and International Expansion

Chow Tai Fook Jewellery Group (SEHK:1929) has demonstrated resilience in maintaining a strong operating profit of $6.8 billion, a 4% year-on-year increase, despite facing a 32.1% decline in earnings and a challenging market environment. The company's strategic focus on brand transformation, product innovation, and expansion into international markets, alongside a promising e-commerce growth, positions it well for future success. This report will cover key areas such as financial health, growth opportunities, strategic challenges, and potential risks impacting the company's trajectory.

Unique Capabilities Enhancing Chow Tai Fook Jewellery Group's Market Position

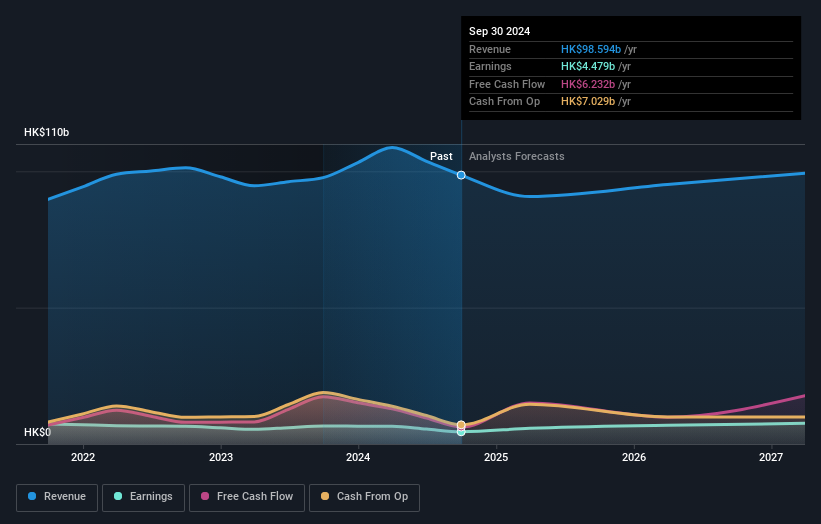

The company's ability to maintain a resilient operating profit, even in challenging environments, is noteworthy. Operating profit stood strong at $6.8 billion, marking a 4% increase year-on-year, as highlighted by Managing Director Siu-Kee Wong. This resilience is complemented by a significant improvement in gross profit margins, expanding to 31.4%, showcasing effective cost management and pricing strategies. Furthermore, the group's brand transformation and product innovation efforts have generated positive momentum, aligning with consumer demand and enhancing market presence. These strategic initiatives, alongside a strong forecasted return on equity of 25.5% over the next three years and earnings growth projected at 18.6% annually, underscore the company's financial health. The trading of shares significantly below estimated fair value suggests potential undervaluation, adding another layer of strength to the company's market position.

Strategic Gaps That Could Affect Chow Tai Fook Jewellery Group

The company faces several strategic challenges. The past year saw a 32.1% decline in earnings, coupled with a reduction in net profit margins to 4.5% from 6.8% the previous year. This decline is partly attributed to a 20.4% drop in revenue, as reported by Siu-Kee Wong, exacerbated by the revaluation of gold loan contracts due to volatile gold prices. Additionally, the high net debt to equity ratio of 93.3% poses a financial risk, while dividend payments remain volatile with a payout ratio of 111.5%. These factors highlight the need for improved financial stability and operational efficiency.

Growth Avenues Awaiting Chow Tai Fook Jewellery Group

The company is poised to capitalize on several growth opportunities. The focus on optimizing the product portfolio with exquisite design and craftsmanship is expected to drive future growth. Furthermore, the e-commerce segment has shown stability, with its contribution to Mainland RSV increasing by 1% to 5.6%, presenting a promising avenue for expansion. International markets also offer potential, as the company actively seeks growth opportunities overseas, led by the recent appointment of a General Manager for International Markets. Analysts predict a 21.6% increase in stock price, reflecting optimism about the company's growth trajectory.

Key Risks and Challenges That Could Impact Chow Tai Fook Jewellery Group's Success

The company must navigate several external threats. Macroeconomic uncertainties and externalities continue to affect the business environment, as noted by Siu-Kee Wong. Additionally, record gold prices have dampened consumer sentiment, leading to a slowdown in demand for gold jewelry. The company must remain agile in response to changing market dynamics, optimizing its store network by streamlining underperforming stores. With revenue growth forecasted at only 2.2% per year, slower than the Hong Kong market's 7.7%, addressing these challenges is crucial for sustaining long-term success.

Conclusion

Chow Tai Fook Jewellery Group's ability to sustain a strong operating profit and expand gross profit margins highlights its effective cost management and strategic pricing, positioning it well for future growth. The company's focus on product innovation and international expansion, coupled with a forecasted earnings growth of 18.6% annually, suggests a positive growth trajectory. Furthermore, trading significantly below its estimated fair value suggests that the current market price does not fully reflect the company's potential, offering an attractive opportunity for investors. However, addressing financial stability and adapting to macroeconomic uncertainties will be crucial for maintaining long-term success and capitalizing on growth opportunities.

Taking Advantage

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal