Stock Trend Capital And 2 Other TSX Penny Stocks To Watch

Over the last 7 days, the Canadian market has remained flat, but it is up 21% over the past year with earnings forecast to grow by 16% annually. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—can still offer intriguing opportunities. When backed by strong financials and solid fundamentals, these stocks can present a compelling mix of value and growth potential that larger firms might miss.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.74 | CA$173.17M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$275.23M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.39 | CA$311.07M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$584.03M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.66M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.17 | CA$214.74M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$28.74M | ★★★★★★ |

Click here to see the full list of 964 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Stock Trend Capital (CNSX:PUMP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stock Trend Capital Inc. is an investment company that primarily focuses on investments in the Canadian cannabis and artificial intelligence industries, with a market cap of CA$3.30 million.

Operations: The company reported a revenue segment in Corporate and Development amounting to -CA$0.61 million.

Market Cap: CA$3.3M

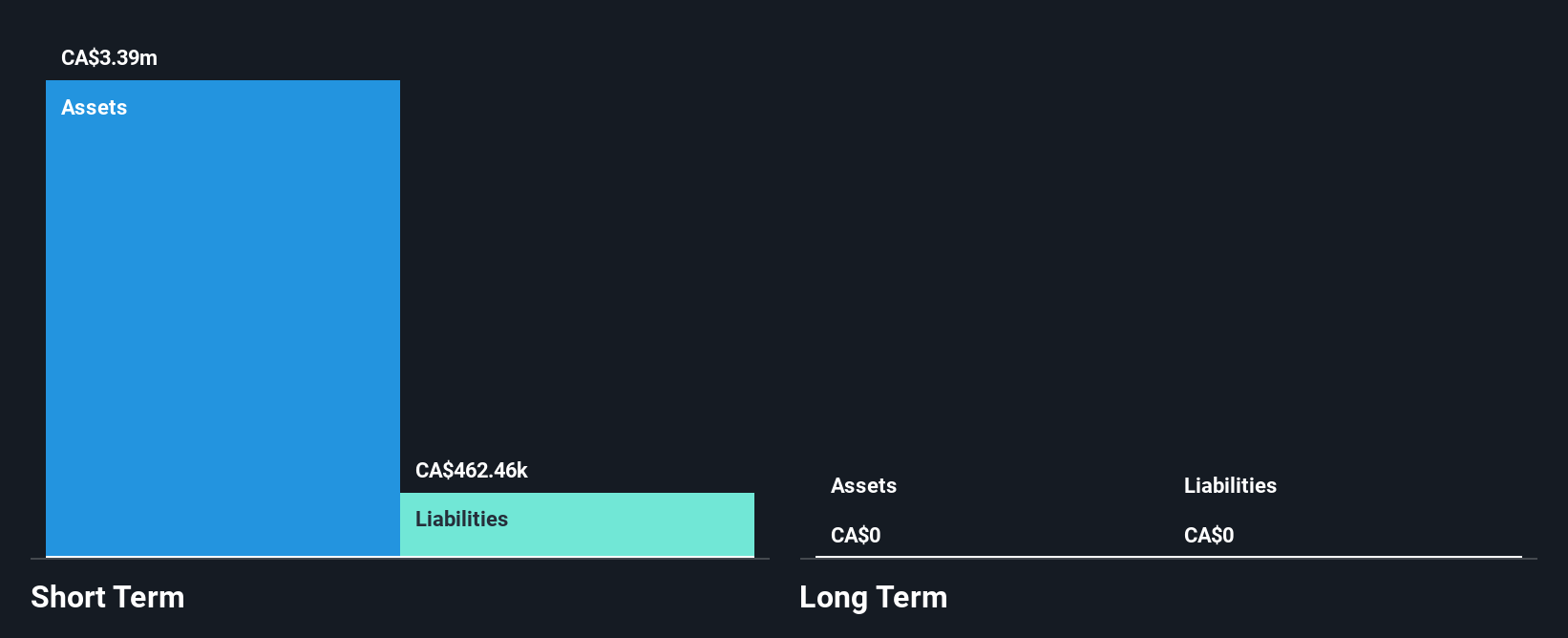

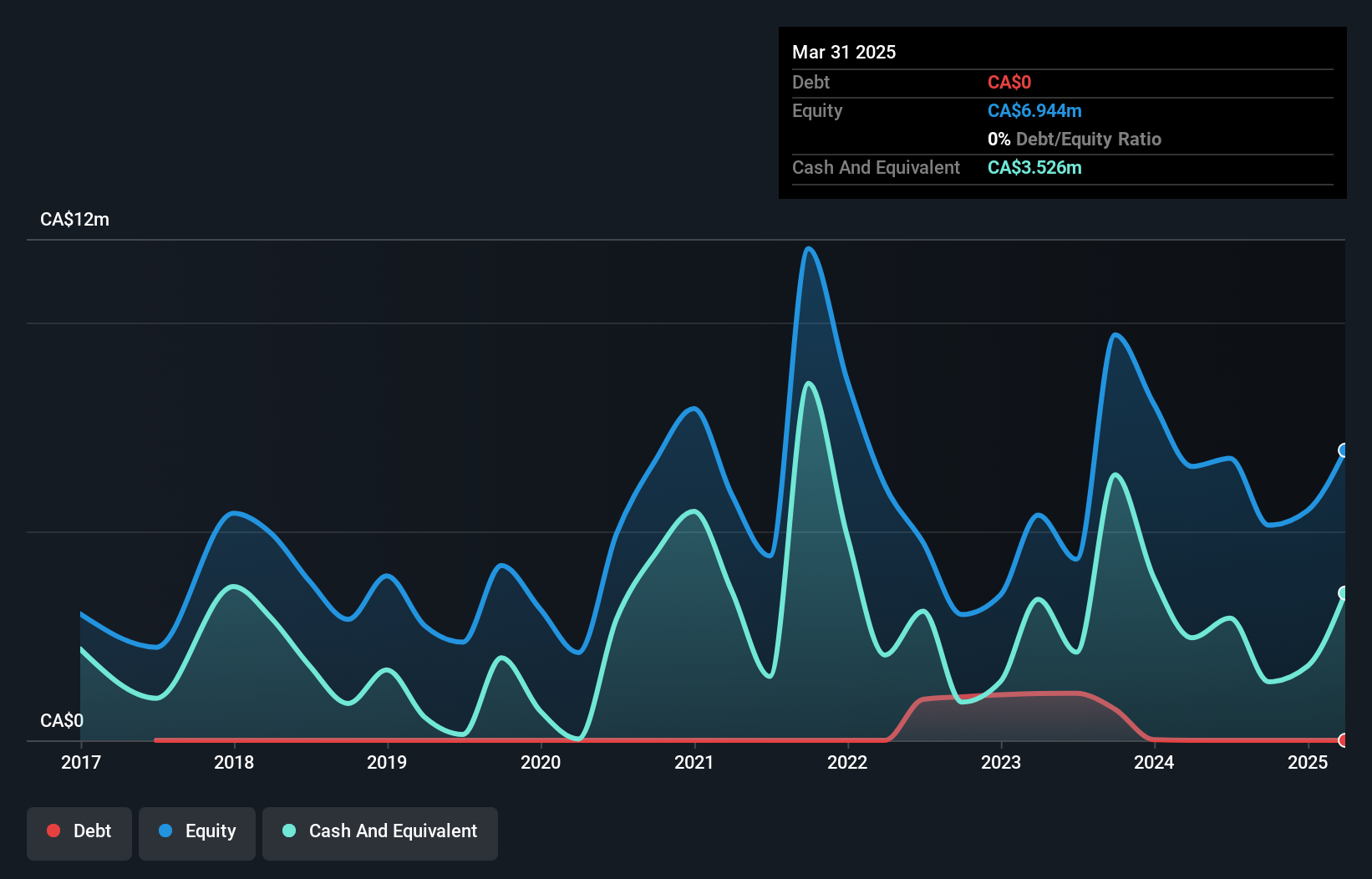

Stock Trend Capital Inc., with a market cap of CA$3.30 million, is pre-revenue, primarily investing in the Canadian cannabis and AI sectors. It reported negative revenue of CA$0.61 million for its Corporate and Development segment. The company has no debt and sufficient cash runway for over two years if free cash flow grows at historical rates, but it remains unprofitable with a negative return on equity of -55.56%. Despite reducing losses by 62.5% annually over five years, its share price is highly volatile with increased weekly volatility from 50% to 83% over the past year.

- Take a closer look at Stock Trend Capital's potential here in our financial health report.

- Evaluate Stock Trend Capital's historical performance by accessing our past performance report.

Aldebaran Resources (TSXV:ALDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aldebaran Resources Inc. is involved in acquiring, exploring, and evaluating mineral properties in Canada and Argentina, with a market cap of CA$324.54 million.

Operations: Aldebaran Resources Inc. currently does not report any revenue segments, focusing instead on the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina.

Market Cap: CA$324.54M

Aldebaran Resources Inc., with a market cap of CA$324.54 million, is pre-revenue, focusing on mineral exploration in Canada and Argentina. The company remains debt-free but faces financial challenges with less than a year of cash runway and a net loss of CA$1.34 million for the fiscal year ending June 30, 2024. Despite stable weekly volatility at 9%, its negative return on equity highlights ongoing unprofitability, exacerbated by earnings declining annually by 32.7% over five years. Recent developments include being dropped from the S&P/TSX Venture Composite Index and presenting at the 121 Mining Investment Conference in London.

- Click to explore a detailed breakdown of our findings in Aldebaran Resources' financial health report.

- Examine Aldebaran Resources' past performance report to understand how it has performed in prior years.

Cabral Gold (TSXV:CBR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cabral Gold Inc. is a mineral exploration and development company focused on gold properties in Brazil, with a market cap of CA$49.34 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$49.34M

Cabral Gold Inc., with a market cap of CA$49.34 million, is pre-revenue and focused on expanding its gold resources in Brazil's Cuiú Cuiú Gold District. Recent trenching at the Jerimum Cima target revealed promising gold-in-oxide mineralization, suggesting potential for resource growth. The company remains debt-free but has diluted shareholders by 6.7% over the past year to raise capital, impacting share value. Despite having sufficient cash runway for only five months based on free cash flow estimates, Cabral recently secured additional funding through a private placement to support ongoing exploration efforts and enhance its resource inventory.

- Click here and access our complete financial health analysis report to understand the dynamics of Cabral Gold.

- Learn about Cabral Gold's historical performance here.

Turning Ideas Into Actions

- Discover the full array of 964 TSX Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

- TER

- 77.42

- +0.75%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal