3 ASX Growth Companies With High Insider Ownership And Up To 32% ROE

The Australian market has shown positive momentum, rising 1.2% over the last week and 9.8% in the past year, with earnings forecasted to grow by 13% annually. In such a promising environment, identifying growth companies with high insider ownership can be particularly advantageous as these firms often exhibit strong alignment between management and shareholder interests, potentially leading to robust returns on equity (ROE).

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Telix Pharmaceuticals (ASX:TLX) | 16.1% | 38.1% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.5% |

| Catalyst Metals (ASX:CYL) | 17% | 75.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 49.4% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 106.8% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 77.9% |

Let's explore several standout options from the results in the screener.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Flight Centre Travel Group Limited (ASX:FLT) is a global travel retailer serving both leisure and corporate clients across various regions, with a market cap of A$4.80 billion.

Operations: Flight Centre Travel Group generates revenue primarily from its leisure segment (A$1.28 billion) and corporate segment (A$1.06 billion).

Insider Ownership: 13.3%

Return On Equity Forecast: 22% (2026 estimate)

Flight Centre Travel Group's revenue is forecast to grow 9.3% annually, outpacing the Australian market's 5% growth rate. The company became profitable this year and its earnings are expected to grow significantly at 21.1% per year, surpassing the market average of 13.2%. Trading at a 34.5% discount to estimated fair value, Flight Centre also boasts a high forecasted Return on Equity of 22.3%.

- Navigate through the intricacies of Flight Centre Travel Group with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Flight Centre Travel Group is priced lower than what may be justified by its financials.

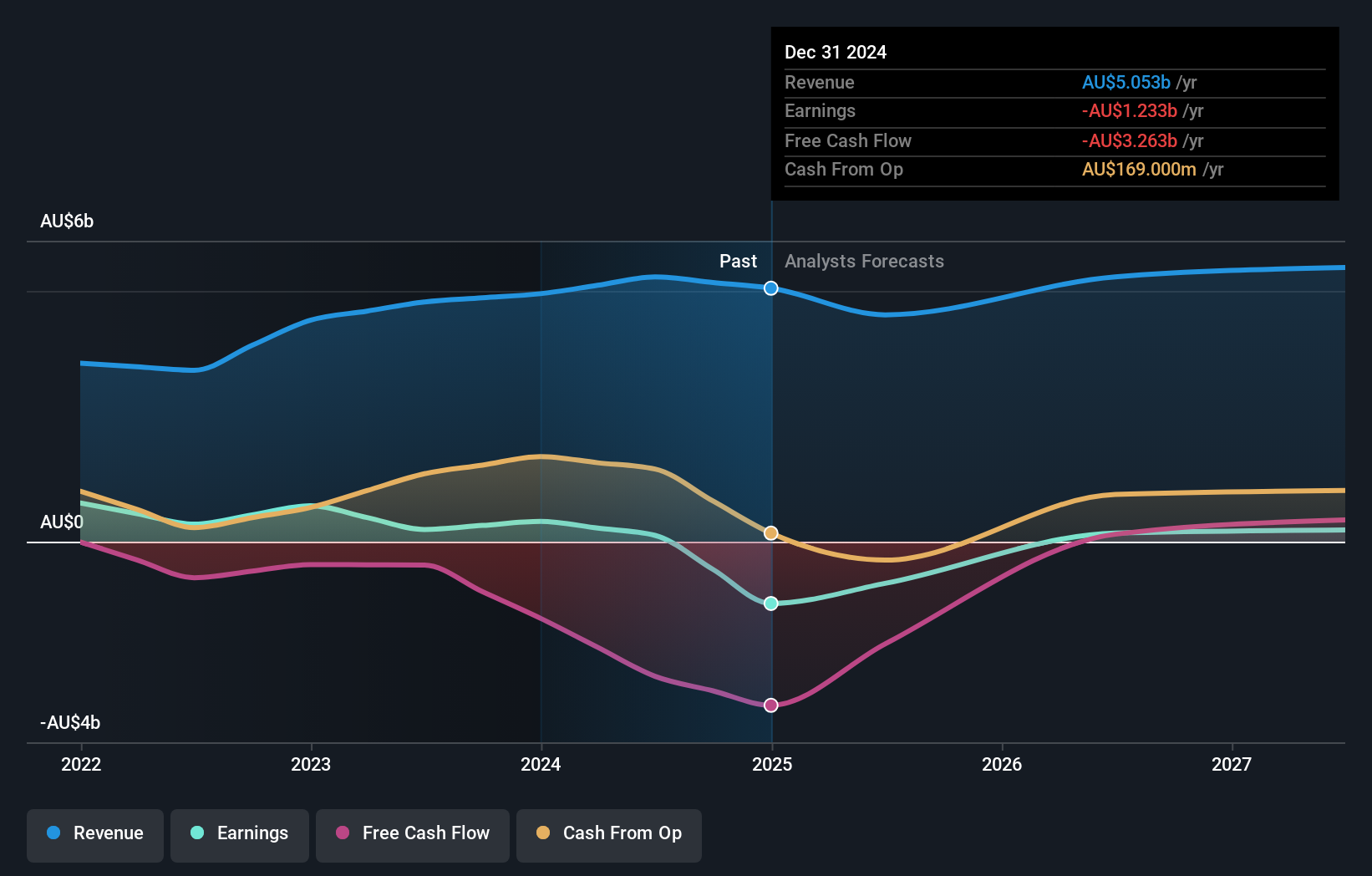

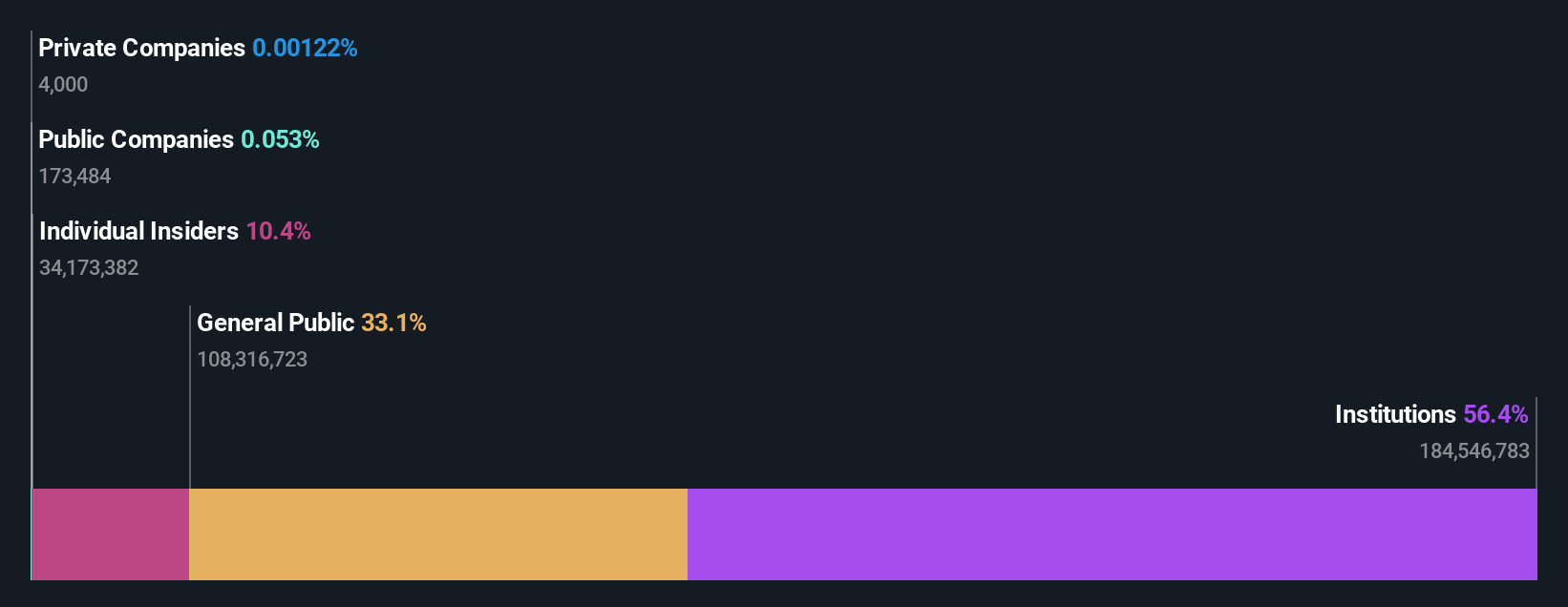

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$10.53 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: The company's revenue segments include A$1.60 billion from Lithium, A$2.50 billion from Iron Ore, and A$2.82 billion from Mining Services.

Insider Ownership: 11.6%

Return On Equity Forecast: 25% (2026 estimate)

Mineral Resources' revenue is projected to grow at 10.2% annually, outpacing the Australian market's 5% growth rate. Earnings are forecasted to increase by 19.25% per year, higher than the market average of 13.2%. Despite trading at a significant discount of 60.3% below fair value estimates, profit margins have declined from last year's 16.3% to 7.9%. The company’s Return on Equity is expected to reach a robust 24.8% in three years.

- Unlock comprehensive insights into our analysis of Mineral Resources stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Mineral Resources shares in the market.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$6.71 billion.

Operations: The company's revenue segments include Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Insider Ownership: 12.3%

Return On Equity Forecast: 33% (2027 estimate)

Technology One's earnings grew by 13.1% over the past year and are forecasted to increase by 14.78% annually, outpacing the Australian market's 13.2%. Revenue is expected to grow at 11.5% per year, faster than the market average of 5%. The Price-To-Earnings ratio of 61.2x is below the industry average of 63.5x, indicating good value relative to peers. Recent board appointment of Paul Robson aims to leverage his SaaS expertise for strategic growth and innovation initiatives globally.

- Dive into the specifics of Technology One here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Technology One's current price could be inflated.

Taking Advantage

- Gain an insight into the universe of 90 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal