It can increase by 22%! Goldman Sachs backs Nvidia, but former deputy Soros threw cold water

A report released by Goldman Sachs on Tuesday showed that although Nvidia's stock price has risen 81% so far this year, there is still plenty of room to rise.

Goldman Sachs raised Nvidia's price target from $1,000 to $1,100, which means the stock will rise another 22% from current levels.

Goldman Sachs said that considering Nvidia's rapid growth rate and the persistence of this growth trend over the next few years, Nvidia's valuation is still relatively attractive compared to its peers.

Goldman Sachs analyst Toshiya Hari said, “We believe that the earnings per share increase will push the stock up again, especially considering that Nvidia's price-earnings ratio is 35 times, which is only a 36% premium over the stock portfolio we studied, compared to the median premium of 160% over the past 3 years.”

Hari was particularly encouraged by recent comments from big tech giants, who said on an earnings call that they will invest more in artificial intelligence (AI) infrastructure in 2025, following increased investment in 2024.

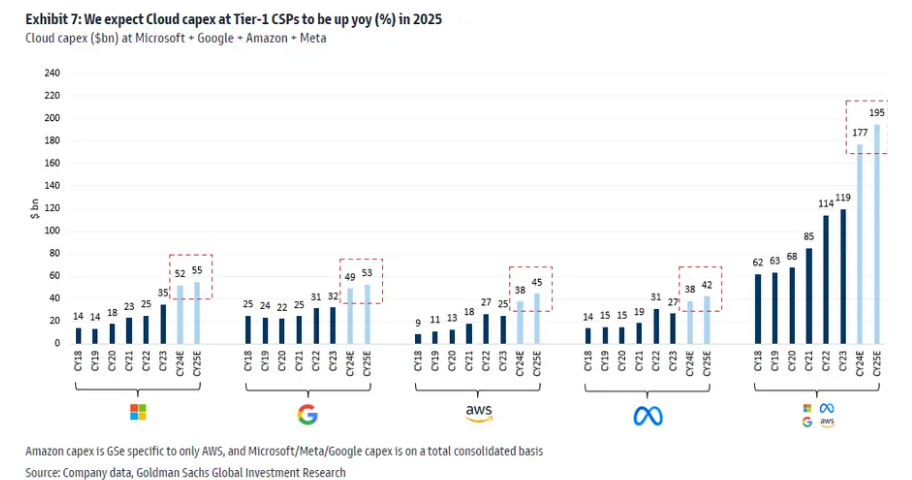

According to Goldman Sachs estimates, the four technology companies Microsoft, Google, Amazon AWS, and META invested as much as 177 billion US dollars in cloud computing this year, far higher than the 119 billion US dollars last year, and will continue to increase to 195 billion US dollars in 2025. (As shown in the figure below)

These investments should drive Nvidia's continued revenue and profit growth, especially as the company's next Blackwell AI chip is due to be released later this year.

Here are some recent positive comments from tech giants:

1. TSMC reaffirms its near- and long-term outlook for the AI market, and expects server AI processor revenue to more than double year-on-year.

2. Supertech giants such as Amazon and META have indicated or hinted that although the base for AI-related capital investment is already very high in 2024, it will continue to increase in 2025.

3. Some AI hyperscale enterprises and enterprise software companies emphasized the early signs of AI monetization.

4. AMD raised the 2024 revenue forecast for its AI-focused GPU chip Mi300 from US$3.5 billion to US$4 billion.

5. Driven by increased demand for AI servers, Ultramicrocomputer reported that the company's revenue growth was strong, and the backlog of orders reached a record high.

Hari said that although AMD's new chips and self-developed chips from big tech companies are beginning to erode Nvidia's GPU business, this isn't enough to knock the company down.

“We believe Nvidia will remain a de facto industry benchmark for the foreseeable future, given Nvidia's competitive advantage in hardware and software capabilities, the installation base and ecosystem it has built over decades, and its pace of innovation now and in the coming years,” Hari said.

Meanwhile, some investors still doubt whether AI has been overhyped. Among them, there is no shortage of famous people, such as Stanley Druckenmiller (Stanley Druckenmiller), the founder of the hedge fund Duquesne Capital (Duquesne Capital).

The billionaire investor told CNBC on Tuesday that he has reduced his Nvidia stock holdings not because he has lost faith in this popular stock, but rather reflects his current hesitation about investing in AI because his enthusiasm for the subject is already a bit excessive.

Drucken Miller said further growth in the industry may take “4-5 years from now,” and “as a result, AI is probably a bit overrated now, but that's not the case in the long run.”

Nvidia has become the core of emerging AI technology, and most of the software runs on the company's chips. Since ChatGPT first launched in November 2022, Nvidia's stock price has soared by more than 561%.

Drucken Miller is one of the heavyweights driving the company's stock price up on Wall Street. He said in June of last year that Nvidia shares are worth holding for at least a few years. At the time, his remarks were at odds with a group of analysts who thought the company was overvalued. Turns out he was right; the company's stock price was only half of the current price of around $900 at the time.

However, Drucken Miller now said, “We did cut our Nvidia holdings and many other positions at the end of March,” and pointed out that its stock price pulled back when it reached current levels that month. “We just needed a break; many of the things we recognised have now been accepted by the market.”

The former Soros deputy said AI will remain the focus of investment in the next few years because it will have an impact similar to the Internet at the beginning of this century. Over the past year, Drucken Miller has also held positions in large AI stocks such as Microsoft and Alphabet.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal