A major state-owned asset is the cornerstone, winning the starting line for listing, and asking (02438), can it go further?

On April 24, Go Out and Ask (02438) officially landed on the Hong Kong Stock Exchange, completing a spectacular transformation from “AIGC Star Company” to “Hong Kong Stock AIGC First Share”.

According to the Zhitong Finance App, when you go out and ask, it was oversubscribed 117.39 times during the global distribution and placement period.

Previously, there were two major local state-owned capital investments, and later oversubscribed by more than 100 times. The officially listed door-to-door inquiry clearly won the starting line. Next, investors are most concerned about how far they can run in the future.

According to the IPO placement information asked, the company sold 84.568 million shares globally, publicly sold 42.284 million shares, sold 42.284 million shares internationally, and overallotted 12.685 million shares. The final number of shares sold internationally was 54.969 million shares. The final offering price was HK$3.8 per share.

For an AIGC company, if it wants to anchor its value and determine its future growth potential, it must be implemented in technology, products, and commercialization. Technology and products are the core, and commercialization is the driving force. This is not only a yardstick for investors to invest, but also the core and foundation for the market's evaluation of AIGC enterprise value. The 100 times oversubscription in the market this time is reflected in investors' recognition of the certainty and development space for future growth when they go out and ask about future growth.

Star shareholders gathered to serve as the cornerstone of major state-owned assets

Going out and asking about listing has added a major value target to the current Hong Kong stock AIGC sector, filling the gap in the Hong Kong stock market in the AIGC field.

As the earliest starting AI company in China and focusing on AIGC technology with the highest revenue, and one of the few AI companies with the ability to build large general models across Asia, Go Out and Ask has attracted the attention of the market and investment institutions since its establishment, and has received investment endorsements from many well-known investment institutions and well-known companies in the industry.

According to the Zhitong Finance App, it has received a total of 7 rounds of financing since its establishment. Its investor lineup includes many well-known professional investment funds at home and abroad, such as SIG Haina Asia, Sequoia China, and Zhenge Fund, as well as a corporate investor team led by Google, Goertek, and Yuanmei Optoelectronics.

Judging from the post-investment valuation, at the time of Series A financing in February 2013, the valuation for questions was 5.1 million US dollars, and reached 757 million US dollars in September 2019. In 6 years, the company's valuation increased 147.4 times.

In addition, they also brought in 2 major cornerstone investors before going out and asking about the listing. According to the company's prospectus, Zhongguancun International Co., Ltd. and Nanjing Jingkaiju Innovation Investment Partnership will participate in this IPO offering as cornerstone investors, with a cumulative subscription scale of HK$95 million.

Through traceability of the equity structure, it was discovered that Zhongguancun International Co., Ltd. is wholly owned by Zhongguancun International Holdings Co., Ltd., a wholly-owned subsidiary of Zhongguancun Development Group. Meanwhile, Zhongguancun Development Group is a state-owned enterprise established by the Beijing Municipal Government.

Another cornerstone investor, Jingkai Juzhi's sole general partner and fund manager, is Xingang Gaotou. The only limited partner is Nanjing Xingang Hi-Tech Park Development Co., Ltd., which holds 99.0099% of the shares of Jingkai Juzhi and also holds 100% of Xingang Gaotou's shares. Nanjing Xingang High-tech Park Development Co., Ltd. is a subsidiary of the Finance Bureau of the Nanjing Economic and Technological Development Zone Management Committee that indirectly holds 100% of the shares. The ultimate beneficiary of Jingkai Juzhi is the Finance Bureau of the Nanjing Economic and Technological Development Zone Management Committee.

In other words, the Beijing Municipal Government and the Nanjing Economic and Technological Development Zone Finance Bureau are behind the cornerstone investors introduced this time.

In fact, industrial investment platforms with local state-owned assets have been emerging at an accelerated pace in recent years, and more and more are participating as cornerstone investors in Hong Kong stocks. Statistics show that in 2023, a total of 47 Hong Kong stock IPOs introduced cornerstone investors, of which 19 had state-owned backgrounds, accounting for 40%; according to the classification of cornerstone investors and investment amounts, among the 154 cornerstone investors participating in the Hong Kong stock IPO in 2023, local real estate investors reached 38, with an investment amount of about HK$4.592 billion, accounting for the highest share of the total investment amount, reaching 29.82%.

In fact, investment platforms with a state-owned background do not fully pursue financial returns; more, they also achieve the goals of local industrial development and the related demands of state-owned shareholders; moreover, since the withdrawal cycle for direct investment of state-owned funds is long, they can also actively participate in strategic placement and fixed growth with better liquidity, which is more beneficial to the stability of the enterprise's market value.

It is worth mentioning that from a distribution perspective, most of the companies with state-owned assets as the cornerstone are hard technology companies. Take Jingkai Juzhi, which is one of the cornerstones of this trip. In the “Nanjing Municipal Action Plan to Promote the Development of the Computing Power Industry” recently released in March of this year, Nanjing proposed that by 2025, the scale of the computing power industry will exceed 350 billion yuan. At the same time, create rich application scenarios and cultivate demonstration application projects in the fields of industry, finance, medical care, transportation, energy, education, cultural tourism, e-commerce, etc.

Looking at the corresponding business, going out to ask is also accelerating AIGC's empowering exploration of consumer electronics, finance, insurance, real estate, etc. It can be seen that as a cornerstone investor who goes out to ask questions, it is in line with the local government's industrial development direction, and also shows the local government's approval of compliance development and business prospects from the side.

Multiple advantages of “technology+competition+hematopoiesis” open up the valuation ceiling

Behind the development of the AIGC industry, competition between technology and racetracks has never stopped. Currently, major AIGC companies around the world are increasing investment in R&D to compete for the market after the technology is formed. The reason why we stand out from the competition when we go out and ask is because the company has multiple advantages of “track+competition+hematopoiesis”. This makes it almost impossible to replicate the success of going out and asking.

In recent years, with the gradual maturity of the three underlying capabilities of computing power, algorithms, and data, generative AI has entered a period of accelerated growth. In this context, fully understanding the company's competitive advantages on the technology product side and commercialization level helps investors to deeply understand the appreciation potential of going out and asking.

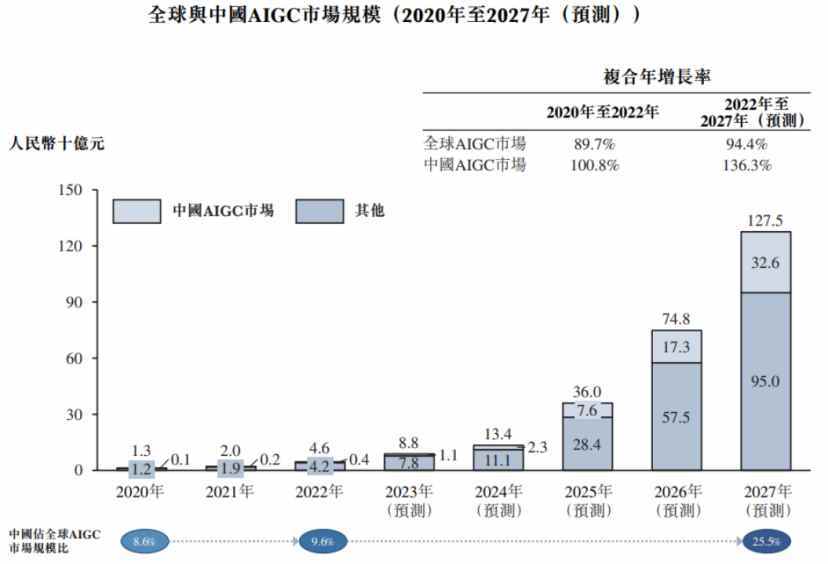

On the eve of the explosion of the AIGC blue ocean market, which is currently a major AI industry segment, it has a high growth ceiling. According to Insight Consulting's report, the total potential market volume of China's AIGC market is expected to reach approximately RMB 32.6 billion by 2027.

The reason why it has a stable foothold in the AIGC market is its excellent core management team, high AIGC technical barriers, comprehensive AIGC commercial products, and stable hematopoietic capacity.

Being able to go out and ask questions through several waves of AI still stands at the cutting edge of the industry, and is inseparable from its core management and international team.

The Zhitong Finance App learned that when I went out to ask the founder Li Zhifei, a PhD in computer science from Johns Hopkins University, a former Google headquarters scientist, natural language processing and artificial intelligence expert, he is also one of the main developers of Joshua, the world's mainstream open source software for machine translation.

Relying on the strong technical reserves and commercial acumen of the core management, Inquire has always been at the forefront of global AIGC technology development. It has become one of the few AI companies in Asia with the ability to establish general models, and one of the earliest AI companies in Asia focusing on AIGC technology with the highest revenue.

At the international level, Li Zhifei, the founder of the company, paid more attention to international talent recruitment. As a result, he was able to establish an experienced full-stack AI internationalization team. In order to go out and ask, he has accumulated deep technical accumulation in the AIGC field, built strong competitive barriers, and has the ability to quickly adapt to steep changes in technology with low R&D costs, and the ability to quickly adapt to steep changes in technology.

From a technical perspective, in recent years, the company has continuously increased investment in R&D to expand its leading edge. In 2023, the company's R&D expenditure reached 155 million yuan. Currently, the number of R&D teams that go out to inquire has exceeded half of the total number of employees in the company; at present, they have obtained a total of 681 AI-related intellectual property rights, including 593 AI-related patents approved and 88 AI software copyrights, building a strong technical barrier.

From a product side perspective, unlike companies on the market that specialize in large cost models (such as Kimi), go out and ask questions that rely on the self-developed “sequence monkey” multi-modal large model, and simultaneously launched the AIGC product matrix for creators, including four CoPilot applications, as well as an AI digital employee application for the B-side. Currently, the company has more than 15 million users worldwide, covering content creators, businesses and consumers.

Currently, by creating an AIGC multi-modal product matrix covering multiple scenarios, going out and asking has formed a complete AIGC ecosystem closed loop integrating technology, products, and commercialization, and this full-stack layout has become its core differentiating advantage.

Furthermore, going out and asking questions has also been thoroughly arranged at the level of international commercialization. The company reached a strategic cooperation with the international giant and shareholder Google to promote the overseas listing of smart software and hardware products including the TicWatch smartwatch and the overseas version of “Dupdub” from the “Magic Sound Workshop”. In particular, “DupDub” has now provided services to more than 40 countries and regions around the world, and has been successfully selected for the “AI Product List” overseas star list.

On the financial side, from 2021 to 2023, when you go out and ask, you achieved revenue of about 398 million yuan, 500 million yuan, and 507 million yuan, respectively. Deconstructing the company's revenue is easy to see. Currently, AI software has become the company's main source of revenue.

During the reporting period, the business revenue increased sharply from 60 million yuan to 343 million yuan, with a compound annual growth rate of 140%; among them, the company's revenue from AIGC solutions grew rapidly, showing strong growth momentum. From 2021 to 2023, they were 6.822 million yuan, 398.57 million yuan, and 118 million yuan respectively, with a compound annual growth rate of over 300%. At the same time, its share of revenue also rose sharply from 15.0% in 2021 to 67.7% in 2023. The rise in the AI software business has also spurred an acceleration in the company's gross margin. In three years, the company's gross margin soared from 30.12% in 2021 to 64.3% in 2023.

Excellent hematopoietic ability is the best proof of ability to withstand risks when going out. Recently, there has been ongoing global debate over expectations of the Federal Reserve's interest rate cut. Just after Federal Reserve Chairman Powell made a statement on April 16 this year (interest rate cuts will take longer), the market's expectations of the Fed's interest rate cut have further weakened, and the market expects the Fed to cut interest rates for the first time or postpone it until 2025. Therefore, for most unprofitable AIGC startups around the world, it is still unknown when the general environment for financing the cold winter will improve. In this context, going out and asking about stable hematopoietic ability is undoubtedly a strong support for its valuation.

In summary, compared to competitors competing on a single track in the AI industry, having a complete AIGC ecosystem allows them to have a wider corporate moat when they go out and ask questions. Stable hematopoietic ability also makes them more resilient to risks, and the continuous growth of the company's internal value space is more powerful.

Investment institutions' oversubscription by more than 100 times has shown their expectations for future investment value space growth when they go out and ask questions. This highlights that not only has a high starting point for listing, but the future growth of the company is also limitless. It has a continuous driving force driving stock price growth, and is worth holding for a long time by investors.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal