The price of gold has repeatedly reached new highs. Using annual report data to explore gold opportunities?

Under the influence of multiple factors such as geopolitical risks and pressure to recover from the global economy, the price of gold soared in 2023, hitting record highs several times, and became one of the best-performing commodities in the investment market. According to statistics, the average gold price reached 194.54 US dollars/ounce in 2023, which is 8% higher than in 2022. By the end of 2023, the cumulative increase in gold prices for the whole year had reached about 13%.

Driven by the strong trend in gold prices, individual gold-related stocks in the secondary market have generally experienced significant increases in the past year. Looking at the annual reports disclosed by listed companies in the Hong Kong stock gold sector, it can be seen that in 2023, 4 out of 5 companies achieved a double increase in revenue and profit. Only China Gold International (02099) saw a 58% year-on-year decrease in sales revenue due to the suspension of operations in some mining areas, and net profit also changed from profit to loss.

As of 2024, the popularity of gold remains unabated, both in the consumer market and in the investment market. On March 15, the international spot gold price reached 2,169 US dollars/ounce, up 5.4% from 2,058 US dollars/ounce on the first trading day of this year, up 13% from the same period last year; the Spring Festival holiday boosted gold consumption. According to data from the Ministry of Commerce, sales of gold, silver and jewelry from key monitoring retail companies increased by more than 10% year-on-year.

Looking ahead, many investment banks are optimistic about the 2024 gold price trend. For example, Goldman Sachs has raised its 2024 average gold price forecast to 2,180 US dollars, and Citi predicts that the price of gold may rise to 2,300 US dollars/ounce in the second half of 2024. Natasha Kaneva, head of global commodity research at J.P. Morgan Chase, said that the price of gold may reach 2,500 US dollars/ounce this year.

At a time when the popularity of gold continues to be high, can many individual gold stocks “dance with the wind”? How can investors find these investment opportunities?

Most companies have recorded high performance growth and frequent mergers and acquisitions

Judging from the performance of individual stocks related to Hong Kong gold, the year-on-year revenue growth rate of Shandong Gold (01787) reached 17.83%, and the net profit growth rate also reached 86.57%, the highest of the five companies. The largest was Zijin Mining (02899). Last year's revenue reached 293.4 billion yuan, up 8.54% year on year, while net profit to mother reached 21.12 billion yuan, up 5.38% year on year.

Rapid expansion and “racecourse land” were still popular themes in the gold industry this year. For example, Shandong Gold completed 480,000 meters of prospecting projects, invested 570 million yuan in prospecting capital, and added 36.6 tons of gold metal to prospecting; Zijin Mining completed overseas deliveries of the Rosebel Gold Mine in Suriname and the Hamagotai Copper and Gold Mine in Mongolia. The company's cash used to purchase and build fixed assets, intangible assets and other long-term assets reached a record high of about 34 billion yuan throughout the year.

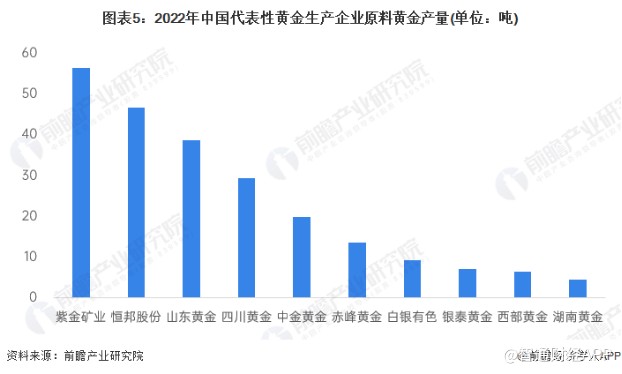

Since gold has scarce properties, and gold sales are mainly limited by production, the resource endowment situation of the company's mines will significantly affect the room for future performance growth. Judging from the raw gold production output of representative gold producers in 2022, Zijin Mining produced 56.36 tons of gold, ranking first; Shandong Gold's gold production was 38.67 tons, ranking third.

By the end of 2023, Zijin Mining had become the largest producer of copper, zinc and gold minerals in China (including overseas production). The company's gold resources and production capacity ranked first among major listed mining companies in China and Asia, and the top ten in the world. According to data from the China Gold Association, the company's mines produced about 68 tons of gold in 2023, which is equivalent to about 23% of China's total volume.

In contrast, Shandong Gold is slightly inferior in terms of overseas layout, and its mining resources are mainly located in Shandong Province in China. Shandong is the province with the largest gold reserves and production in China. Among the top ten mines in China, including Jiaojia Gold Mine, Sanshandao Gold Mine, Xincheng Gold Mine, Linglong Gold Mine, and Dayin Gezhuang Gold Mine, are all located in Shandong Province, accounting for half of the country.

According to the Zhitong Finance App, in 2023, Shandong's gold mineral gold production completed 41.78 tons (including production after Yintai Gold was merged into the company's statement), an increase of 3.10 tons over the previous year, an increase of 8.03%, which is equivalent to 14.06% of the total mineral gold volume of domestic mining companies in 2023.

In the context of the boom in the gold industry, several gold and jewelry brands have chosen IPOs since 2023. On November 10, 2023, Laopu Gold disclosed its IPO prospectus on the Hong Kong Stock Exchange; in January 2024, the China Securities Regulatory Commission website published a filing notice on Mengjinyuan's overseas offering and listing. Zhou Liufu, which previously submitted a statement to the Shenzhen Stock Exchange in February 2023 and plans to be listed on the main board of the Shenzhen Stock Exchange, has withdrawn its IPO application. According to some market sources, it plans to switch to the Hong Kong stock market.

Gold prices continue to rise, and gold stocks are expected to usher in opportunities to “make up for growth”

Gold has long been regarded as a safe-haven asset with value preservation properties, and as a scarce precious metal, it also naturally has some monetary functions, so the strength or weakness of the US dollar will have a direct negative impact on the dollar valuation of gold.

As far as the medium- to long-term time dimension is concerned, in the face of declining US dollar credit, central banks' gold reserves are rising year after year, which will provide firm support for the upward trend in gold prices. According to data from the World Gold Council, the country's central bank's gold purchase volume continued to rise in 2023. The annual net purchase volume was 1,037 tons, a decrease of only 45 tons from the record high in 2022. Among them, the central banks of China, Poland, and Singapore ranked in the top three for gold purchases. By the end of February 2024, China had increased its gold reserves for 16 consecutive months.

In terms of mineral resource reserves, Zijin Mining, Hengbang Co., Ltd. (002237.SZ), Shandong Gold, and Sichuan Gold (001337.SZ) are among the top listed companies. From a business perspective, companies that account for a high share of the gold business benefit more from the rise in gold prices.

According to the Zhitong Finance App, among many gold companies, Shandong Gold's business is highly concentrated. Its gold business revenue accounts for more than 90% of total revenue all year round, making it the leading company that accounts for the highest share of the gold business of listed domestic companies.

In contrast, Zijin Mining's revenue consists mainly of mineral copper and mineral gold. In 2023, sales revenue from the gold business only accounted for 42.09% of total revenue (after offset), and gross profit accounted for 25.35% of the Group's total gross profit. The company currently holds about 75 million tons of copper, 3,000 tons of gold, 10 million tons of zinc (lead), 15,000 tons of silver, and an equivalent of more than 13 million tons of lithium carbonate. When valuing it, the development prospects of the non-gold business also need to be taken into account.

In the short term, when the Fed cuts interest rates will disrupt the price of gold. Once the Federal Reserve's interest rate falls, dollar-denominated gold will become more attractive to international buyers. Furthermore, in the face of inflationary pressure from the US and Europe, gold will become a powerful tool to resist inflation. Recently, Powell and other Federal Reserve officials have repeatedly reiterated their wait-and-see attitude towards interest rate cuts, adding some uncertainty to interest rate cuts, yet the market still generally expects the Fed to cut interest rates two to three times during the year.

Judging from the latest price-earnings ratio, the international price-earnings ratios of Lingbao Gold (03330), Zijin Mining, and China Gold are relatively low. Among them, Zijin Mining's valuation was affected by the company's non-gold business, while Lingbao Gold's revenue scale was relatively small, and gold ingot production fell 7.34% year on year in 2023 due to environmental policy controls.

According to the Zhitong Finance App, the annual report shows that the Lingbao Gold Smelting Division recorded losses of 9.5 million yuan, and the Kyrgyzstan Mining Division and the Inner Mongolia Division each depreciated by about 106 million yuan and 48 million yuan, which dragged down the company's performance. With the subsequent rise in gold prices and improvements in the company's performance, there will be plenty of room to “make up for the increase”.

China Gold International is the only overseas listing platform for China Gold Group, focusing on gold and copper mining. In 2022, its gold business accounted for about 75.8% of revenue. The company's performance in 2023 changed from profit to loss, mainly due to the suspension of operations in the Jiama mining area. Since December 15, 2023, the Jiama mining area has gradually resumed operations. According to the company's latest forecast, the Jiama mine can obtain approval from the government to resume work in early May 2024. After approval, the Jiama mine will resume production with a daily processing capacity of about 34,000 tons/day according to the design scale of the Phase II plant.

Furthermore, from the perspective of group asset injection, China Gold Group is expected to continue to provide resource support to listed companies. In the future, with the injection of high-quality mineral resources and a recovery in mining production, the company is also expected to usher in an opportunity for an upward shift in valuation.

In addition to mining stocks, gold jewelry stocks such as Zhou Dasheng (002867.SZ) and Lao Fengxiang (600612.SH) are also expected to follow large fluctuations in gold prices. In 2023, Lao Fengxiang had a net increase of 385 stores; from April to September 2023, Lukfook Group (00590) had a cumulative net increase of 184 stores, while Zhou Daifu (01929) had a cumulative net increase of 183 stores worldwide during the same period. The large-scale expansion clearly reflects the optimism of many gold jewellery brands about future results.

However, it is worth noting that rising gold prices will also increase the cost of gold brands, and high premiums on gold jewelry will affect consumers' enthusiasm for buying. This can be seen from the fact that gold brands' gross margins are generally low. In 2023, the gross margins of Lao Fengxiang and Meng Jinyuan were less than 10%, while the gross margins of Chow Tai Sang and Chow Tai Fu, leaders in the industry, were only around 20%.

Currently, the gold bull market atmosphere is strong. Although there is still uncertainty about the Fed's monetary policy, as global geopolitical risks continue to ferment, the safe-haven properties of gold are becoming more prominent, and the trend of global central banks allocating more gold will also drive the upward trend in the gold price cycle. Under such circumstances, leading companies with rich mining resources are expected to benefit, and some relatively undervalued individual stocks also have a cost performance advantage. After the negative factors affecting performance subside, it is expected to usher in an opportunity for value revaluation.

- TTOO

- 0.1311

- -5.72%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal