Two “mysterious” private equity firms rarely reduced their holdings in Kweichow Moutai (600519.SH) Duan Yongping: We haven't sold a single share!

The Zhitong Finance App learned that on the evening of April 2, Kweichow Moutai (600519.SH) disclosed its 2023 annual report. At the same time, the positions of the two “mysterious private equity” companies surfaced. By the end of 2023, Jinhui Rongsheng and Ruifeng Huibang private equity firms held a total of 146.735 million shares of Kweichow Moutai, a decrease of 3.296,300 shares from 17.968 million shares at the end of the third quarter. The two private equity firms mentioned above reduced their holdings by 12.33% and 24.43%, respectively. Earlier, it was rumored that the two private equity funds mentioned above were related to Duan Yongping, a well-known investor. On the 3rd, Yongping responded on social platforms that he did not sell Kweichow Moutai.

Specifically, Kweichow Moutai's annual report shows that Jinhui Rongsheng No. 3 Private Equity Investment Fund reduced its holdings of Kweichow Moutai by 1,114,300 shares in the fourth quarter of last year, and its holdings fell to 7.9225 million shares at the end of the period.

The Ruifeng Huibang No. 3 Private Equity Investment Fund reduced its holdings of more Kweichow Moutai shares. It reduced its holdings by 2.182 million shares in the fourth quarter of last year, and the number of shares held at the end of the period fell to 6.751 million shares.

Prior to that, these two funds were basically inaccessible, and they had held Kweichow Moutai for many years. According to the data, Jinhui Rongsheng No. 3 Private Equity Investment Fund became the top ten tradable shareholders of Kweichow Moutai in the 2019 interim report. As of the 2023 report, it has held positions continuously for 19 quarters. Previously, the fund had increased its holdings of Kweichow Moutai several times. The data shows that in the past 19 quarters, the fund increased its holdings for 11 quarters, and remained unchanged for 6 quarters.

Ruifeng Huibang No. 3 Private Equity Investment Fund appeared among the top ten tradable shareholders in Kweichow Moutai in the fourth quarter of 2018. As of the 2023 report, it has held positions continuously for 21 quarters. Previously, the fund also increased its holdings of Kweichow Moutai several times. The data shows that in the past 21 quarters, the fund increased its holdings for 16 quarters and remained unchanged for 3 quarters.

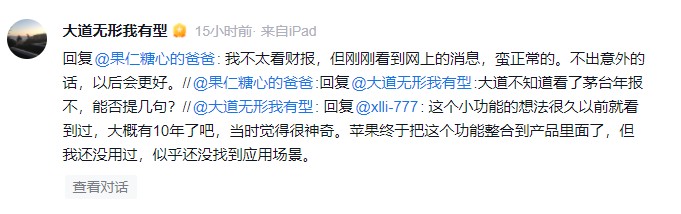

As a well-known investor, Duan Yongping has always focused on investing in US stocks, but he is most optimistic about A-share companies, Kweichow Moutai, and holds a certain percentage of their positions. According to the internet, the two private equity funds mentioned above are related to Duan Yongping. In response, on the morning of April 3, Duan Yongping said on social media: “Kweichow Moutai, we didn't sell any shares.” Furthermore, Duan Yongping also mentioned Maotai's annual report, “If there are no surprises, the future will be better.”

According to Kweichow Moutai's annual report data, the company's total revenue in 2023 was 15.56 billion yuan, up 18% year on year, of which it achieved operating income of about 147.694 billion yuan, up 19.01% year on year; total profit surpassed 100 billion yuan for the first time, reaching 103.663 billion yuan, of which net profit to mother was 74.734 billion yuan, up 19% year on year. In the secondary market, Kweichow Moutai opened higher on April 3. As of the closing report, the closing report was 1715.11 yuan/share, up 0.07%.

On April 3, Citigroup Research reported maintaining Kweichow Moutai's “buy” rating, with a target price of 2,272 yuan. Citi said that Kweichow Moutai's net profit in 2023 increased 19% year on year, higher than previous preliminary data; sales growth in the fourth quarter accelerated to 20%, up from 13% in the third quarter; the dividend payout rate for 2023 increased to 76%, higher than 52% in 2022; and the company's total revenue growth target for 2024 is around 15%. With higher profit visibility, a solid balance sheet, and excellent operating cash flow, Maotai remains a core asset in the Chinese consumer sector that is attractive to investors.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal