Have interest rates been cut only 2 times this year? Economists disagree with the Federal Reserve!

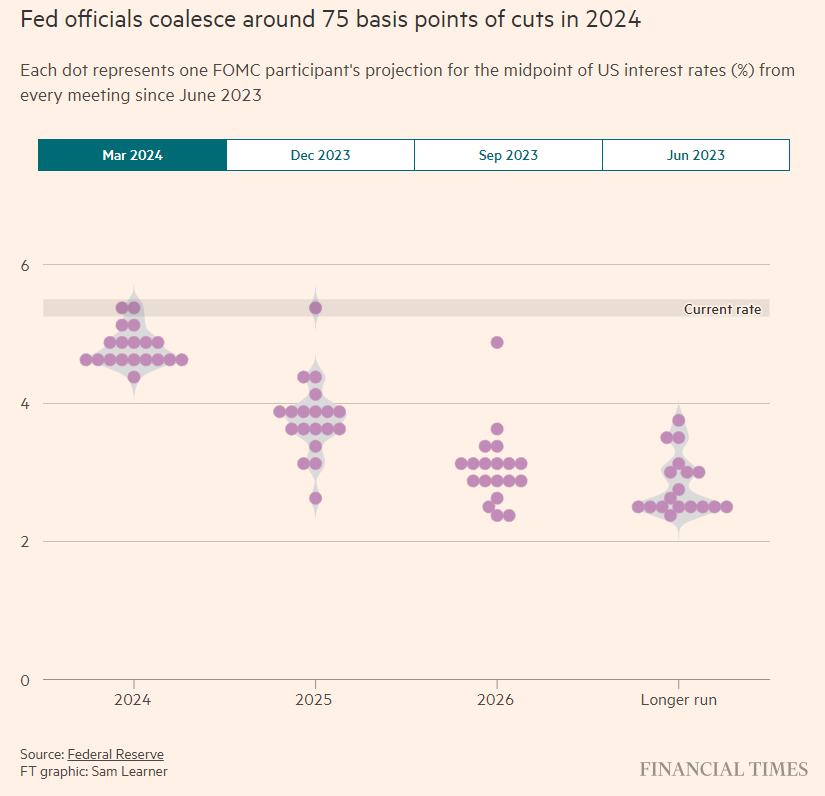

Foreign media American economic columnist Claire Jones (Claire Jones) pointed out that when Powell said in December of last year that the Federal Reserve would cut interest rates by 25 basis points 3 times in 2024, the market interpreted that it was possible to cut interest rates up to 6 times. After 3 months, investors' interest rate cut expectations became completely consistent with the Federal Reserve's views.

However, many economists disagree with the Fed's forecast of three interest rate cuts.

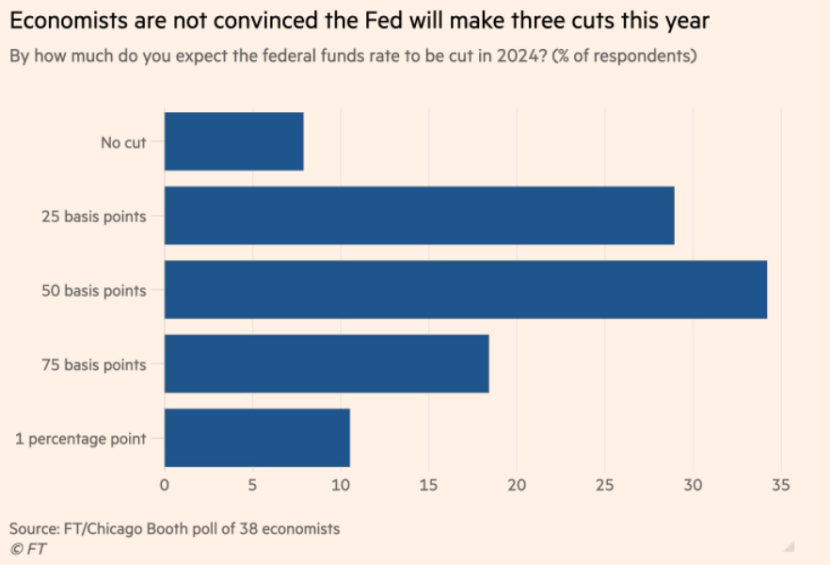

In the week before the March meeting of the Federal Open Market Committee (FOMC), foreign media and the University of Chicago Booth School of Business conducted a survey of 38 economics experts to ask their views on the direction of the US economy this year. The results show that these academics are more hawkish than interest rate setters and investors, and most expect interest rate cuts no more than 2 times.

Jones said that now that the market has received FOMC forecast data, he wants to use this to compare the differences between the survey results and the bitmap in more depth.

Through comparative analysis, Jones hopes to reveal differences in policy expectations between economists and interest rate makers in the face of the latest batch of generally positive economic data for the US economy, and their different risk appetite in judging whether to cut interest rates.

First, here are the economists' answers when asked how many times the Federal Reserve will cut interest rates this year:

So how did this disagreement come about?

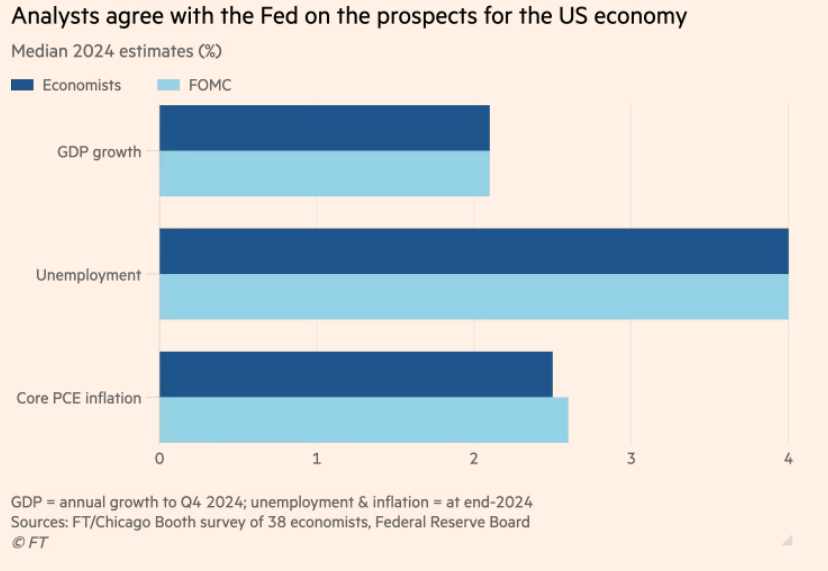

Obviously, this is not because they have different views on the economic outlook. In fact, when comparing economists' estimates of economic growth, inflation, and unemployment this year with FOMC forecasts, one might think that economists are more inclined to cut interest rates.

The economists who participated in the survey were even slightly pessimistic about the outlook for the next three years — when asked what the highest unemployment rate would reach in the next three years, the most common answer was between 4.5% and 5%. The FOMC, on the other hand, expects the unemployment rate to reach only 4.1% during the forecast period 2024 to 2026.

Economists also believe that a recession is less likely this year, and that core personal consumption spending (excluding food and energy products) is relatively unlikely to rise above 3%. This echoes the statements of Federal Reserve officials. They all believe that inflation will not rebound sharply, and given the strong performance of the US economy, they are more patient in waiting for more signs that inflationary pressure is slowing down.

Jones said, “Therefore, the biggest difference between the two sides is that the Federal Reserve is willing to risk cutting interest rates while core inflation remains at a high and unsettling level. ”

Since monetary policy has a lagging effect, and it usually takes about 18 months for policy changes to fully affect the economy, it is not necessarily wise to wait until inflation falls to just 2% before taking action.

Jones said that although the two sides have similar views on the recent economic outlook, they disagree on whether the Federal Reserve will cut interest rates by 75 basis points this year. On the face of it, Federal Reserve officials do have a clear tendency to ease — at least when comparing their interest rate preferences to what economists think.

By the time investors get the next round of survey results and a new bitmap, they'll get May's CPI data, as well as more core PCE data. This data should better help investors determine how many times it is more appropriate to cut interest rates.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal