US economic expectations in 2024 have risen sharply, and options trading highlights concerns about interest rate hikes

Economists have once again lowered their forecasts for the US recession because they expect a strong job market and strong consumer spending to support stronger economic growth in the short term.

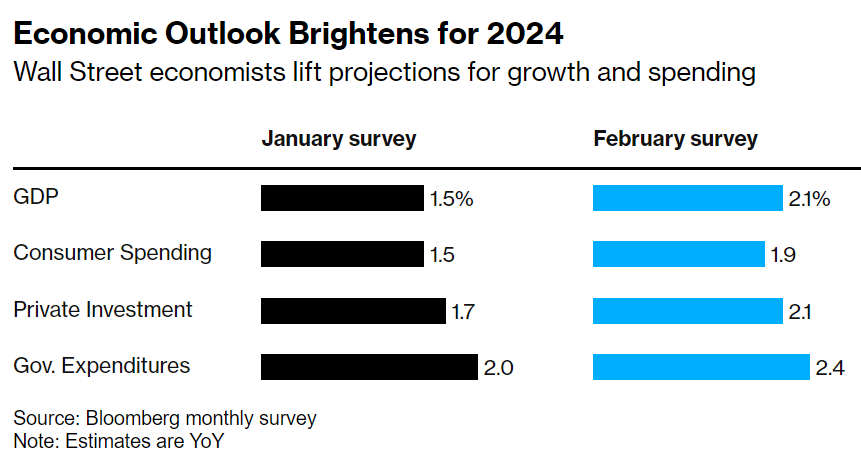

Bloomberg's latest monthly survey of economists shows that due to rising household demand and government spending, the US economy is expected to grow at an annualized rate of 2.1% this year, higher than the 1.5% forecast last month. Respondents currently expect consumer spending (two-thirds of GDP) to increase by more than 0.5% each year over the next two years compared to last month's forecast.

Although forecasters generally expect the US economy to lose some momentum after the major events of 2023, the still strong labor market and declining inflation continue to support basically stable household demand. Given this continued resilience, respondents now expect the unemployment rate to peak at 4.1% later this year, lower than the 4.2% forecast last month. They also expect US employers to add more jobs by 2026.

The economy's continued growth helps explain why economists now think the probability of a recession next year is 40%, the lowest level since mid-2022. These forecasts peaked at 65% in the first half of 2023, when the Federal Reserve was about to end its most aggressive cycle of rate hikes in 40 years.

“The US economy remains the envy of the world,” said James Smith of EconForecaster LLC. “Real economic growth and employment growth have remained strong, while both inflation and interest rates have declined.”

Interviewees expect the Federal Reserve's favorite inflation index, the personal consumer spending price index (PCE), to rise by an average of 2.2% in 2024, slightly higher than last month's forecast. They expect the so-called core PCE, which excludes food and energy, to grow by an average of 2.4% this year.

Although inflation expectations will slow further, economists now expect the Federal Reserve to keep interest rates high for a longer period of time. They now expect to cut interest rates by 25 basis points only once in the third quarter of this year, compared to the results of the previous survey 2 times.

The survey was conducted from February 16 to 21, and the respondents included 72 economists.

At present, bond traders have surrendered to the Federal Reserve, giving up hope that interest rates will be cut drastically this year. In the options market last Friday, some even dared to bet that the Federal Reserve would further tighten monetary policy. In a put-condor structured options trade, if the Federal Reserve's overnight interest rate reaches the range of 5.625% to 5.875% before the contract expires in December, the transaction will obtain the maximum profit. The current interest rate is 5.33%.

However, the premium for this bet is only $750,000, which is a very small amount for about 30,000 option positions linked to the guaranteed overnight financing rate. Therefore, it may be set up by a large institution or investor to protect against external risks, or it may even be an adjustment to existing hedging.

But in any case, this is another sign of increased anxiety in the US bond market since higher-than-expected inflation data disrupted expectations of interest rate cuts from the Federal Reserve. This isn't the only recent deal that goes against consensus views. In the US Treasury futures market over the past two trading days, there have been a series of major transactions that oppose the steeper and worsening yield curve. If the Federal Reserve starts to push down short-term interest rates, a steeper and worsening yield curve is likely to occur.

- SSDIY

- --

- 0.00%

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal