Amazon (AMZN.US) AWS operating profit surged 38%, breaking the question! Generative AI is gradually being integrated into core products

The Zhitong Finance App learned that US tech giant Amazon (AMZN.US) announced strong results for the fourth quarter of 2023 on Friday morning and announced operating profit prospects that exceeded analysts' expectations. This shows that Amazon's efforts to cut costs and focus on high-yield service products under the leadership of CEO Andy Jassy (Andy Jassy) have received positive feedback. These efforts are reshaping this once major technology company. Overall, the holiday shopping season helped the e-commerce giant's online revenue exceed expectations, while Amazon's AWS cloud service revenue jumped 13%, greatly easing analysts' concerns about the slowdown in demand for Amazon Cloud services and the declining growth rate. Advertising business revenue has accelerated for four consecutive quarters.

In terms of performance expectations that the market is most concerned about, as of the fiscal quarter in March, Amazon expects operating profit to reach 8 billion US dollars to 12 billion US dollars, and total revenue is expected to reach a maximum of 143.5 billion US dollars (expected range of 138 billion US dollars — 143.5 billion US dollars), reflecting a total revenue growth rate of 8% to 13%. According to data compiled by the agency, the latest forecast given by Amazon is in line with analysts' expectations. The average operating profit analyst forecast is about 9.12 billion US dollars, while the total revenue forecast is 142 billion US dollars.

According to the latest financial data, in the fourth quarter of 2023, Amazon achieved a 14% year-on-year increase in total revenue to US$170 billion, an increase of about twice as much as expenditure, indicating that cost reduction measures boosted profits without hindering performance growth. Among them, Amazon's online revenue for the fourth quarter increased 9% year over year to US$70.5 billion, exceeding analysts' average expectations. Amazon's Q4 net profit reached 10.6 billion US dollars. Compared with only 278 million US dollars in the same period last year, GAAP earnings per share jumped from 0.03 US dollars in the same period last year to 1 US dollar, higher than analysts' average expectations of $0.80.

Bloomberg Intelligence analyst Poonam Goyal (Poonam Goyal) said after Amazon's results were announced: “Amazon gave an optimistic first-quarter performance outlook, and driven by strong growth in online business, cloud services, and advertising business, Amazon's fourth quarter performance was steady, and operating profit was boosted. We expect the company's profits to expand further in 2024, driven by AWS cloud computing services and 20% or more in advertising revenue. Amazon's AWS operating profit margin is close to 30%, while the advertising business profit margin is close to 50%.”

With strong quarterly earnings reports and an optimistic performance outlook, Amazon's stock price once rose nearly 10% during after-hours trading in New York. U.S. stocks closed at $159.28 on Thursday, up 2.63%. After surging 81% in 2023, the stock has accumulated a cumulative increase of more than 5% this year.

The holiday shopping season helps Amazon expand online revenue, and AWS dispels doubts with strong performance

Judging from Amazon's financial data, consumer demand was strong during the holiday shopping season at the end of 2023. Amazon's online revenue for the fourth quarter of 2023 increased 9% year-on-year to US$70.5 billion, exceeding analysts' average expectations. Amazon's operating profit for the fourth quarter increased to 13.2 billion US dollars, a year-on-year growth rate of 383%. The average analysts' expectations were 10.5 billion US dollars. Amazon's daily profit for the same period last year was only 2.7 billion US dollars.

Amazon's core retail business—online store revenue is expanding at an accelerated year-on-year rate

Jesse Cohen (Jesse Cohen), a senior analyst from Investing.com, said: “Most importantly, despite concerns plaguing the tech industry and the e-commerce retail sector that Amazon focuses on, Amazon's performance is unexpectedly strong.” “Financial results show that ongoing cost reduction measures are having a positive impact on Amazon's business prospects.”

Amazon, under Andy Jassi's leadership, has been working to cut expenses, including more than 35,000 jobs, to increase profits while resisting competition from new global e-commerce forces Temu and TikTok.

Amazon's layoff plans aren't stopping at the moment. Amazon announced earlier this month that it would lay off a total of hundreds of employees in its Prime video streaming and studio business and Twitch game streaming service. In November of last year, the company drastically cut jobs in the music and games department, as well as positions in the business unit responsible for its voice control assistant Alexa. Amazon said that as of 2023, the company had about 1.53 million full- and part-time employees, down 1% from the same period last year.

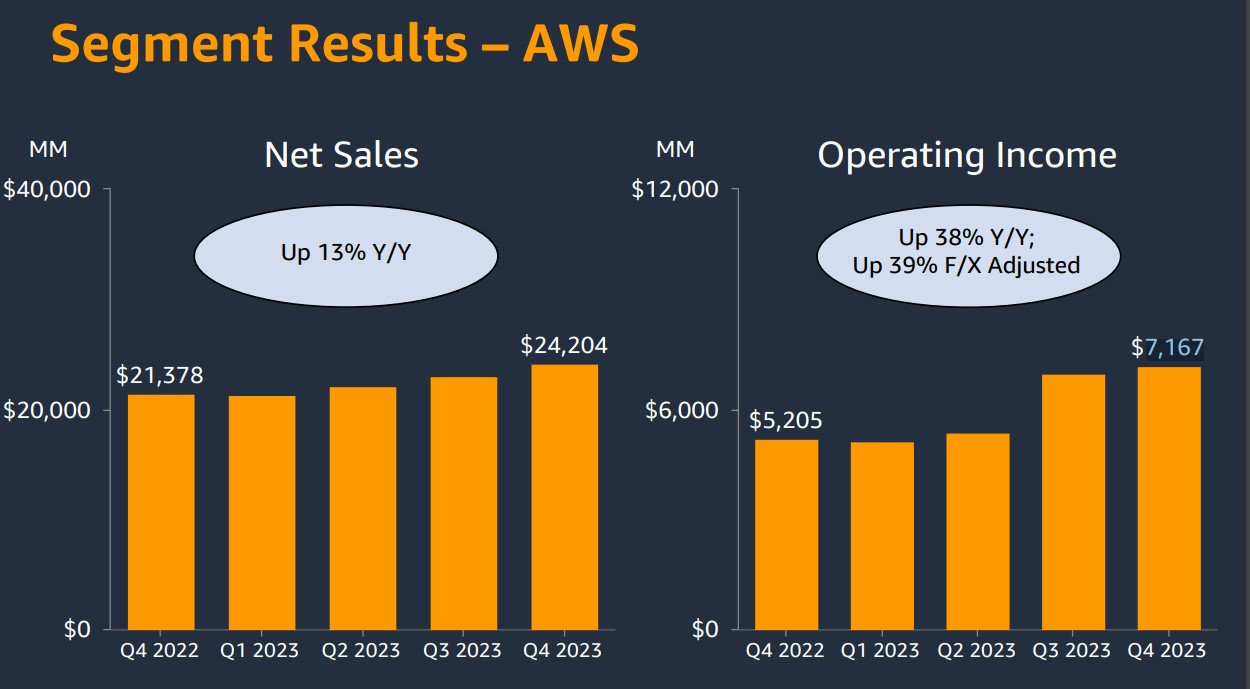

An even more significant “earnings advantage” is that the company's most profitable Amazon AWS (Amazon Web Service) cloud computing service experienced a sharp rebound after several quarters that left investors very disappointed. According to financial data, AWS cloud services achieved a 13% year-on-year increase in revenue to US$24.2 billion in the fourth quarter. The operating profit of AWS cloud services in Q4 reached 7.167 billion US dollars, a year-on-year growth rate of 38%.

Under the month-on-month revenue and operating profit benchmarks, AWS cloud services also achieved month-on-month growth for three consecutive quarters, greatly easing analysts' concerns about the slowdown in demand for Amazon Cloud services and doubts that the growth rate is falling. This increase surpassed the increase in AWS revenue over the past few quarters.

However, Sky Canaves (Sky Canaves), a senior analyst from Insider Intelligence, said that this “moderate acceleration trend” still raises some lingering doubts about whether AWS cloud computing services can gain a foothold in fierce competition with competitors such as Microsoft Azure and Google Cloud. Statistics show that Amazon AWS leads the global market share of cloud computing services, followed by Microsoft Azure cloud services.

In order to diversify total revenue sources, Seattle-headquartered Amazon stepped up the advertising business layout for merchants to place advertisements on its shopping site, and began advertising for merchants on its Prime Video streaming service last month. In the three months ending December 31 of last year, Amazon's advertising business revenue increased 27% year over year to 14.7 billion US dollars, achieving accelerated ad revenue growth for four consecutive quarters.

Analyst Kanavis said: “The highly profitable advertising business has been boosted by strong demand from rapidly growing third-party market sellers.”

Additionally, Amazon's general and administrative expenses fell by about 10% in the fourth quarter, while marketing and sales expenses were roughly the same as in the same period last year. Technology and content spending (including software developer salaries and server GPUs and other hardware expenses) increased by only 6%, down from a high 38% increase in early 2023.

Is AI expected to become Amazon's trump card “revenue generator” in the future?

Amazon Chief Financial Officer Brian Olsavsky (Brian Olsavsky) expressed optimism about the growth rate of AWS this year. Olsavsky said that people seem to be very interested in Amazon's AWS cloud services, as well as generative artificial intelligence products on the AWS platform. “We're starting to see customers reduce their cost optimization efforts and shift discussions more towards re-engaging with cloud migration trends they may have put on hold in recent years,” he said.

With the succession of generative artificial intelligence applications centered on consumer applications, such as ChatGPT and Google's BARD, more and more technology companies around the world are participating in the boom in deploying AI technology, and Amazon is no exception. Similar to Microsoft's AI product strategic deployment plan, Amazon is also trying to incorporate generative AI as a major tool into its core products, such as AWS cloud computing services and the Amazon.com e-commerce shopping platform.

Amazon has now deeply integrated generative AI-related technology into its AWS cloud computing services, demonstrating a series of positive developments in AWS in basic models, computational enhancements, storage, and networking.

AWS previously launched Amazon Bedrock, a comprehensive generative AI service that enables customers to access basic models (FMs) from leading AI companies using a single API. These models are pre-trained and can be applied to a variety of core uses, from search to content creation to drug discovery. Amazon Bedrock is designed to help users easily access and utilize high-performance Foundation Models (FMS) from leading AI companies such as AI21 Labs, Anthropic, Cohere, Meta, Stability AI, and Amazon. By providing unified API access to these models, Amazon Bedrock gives developers the flexibility to use different FMS and upgrade to the latest model versions with extreme ease. Specific uses include a variety of uses, from text generation to image generation, conversation generation, etc.

Amazon Bedrock also provides the differentiated ability to create management agents that can perform complex commercial tasks without writing a single line of code. Amazon Bedrock allows AWS customers to securely integrate and deploy generative AI capabilities into familiar AWS services without managing any infrastructure hardware.

Similar to ChatGPT, Amazon Bedrock provides generative artificial intelligence capabilities, but is broader in scope and is not limited to AI text generation. It supports invoking the user's data-specific adjustment model to provide a differentiated and personalized user experience. For example, users can fine-tune models, use enhanced retrieval generation (RAG) to provide more relevant FM responses, or create agents to perform complex tasks across corporate systems. Amazon Bedrock also supports features such as fine-tuning, model call logging, pre-provisioned throughput purchases, and support for multiple AWS regions.

Earlier before the financial report was announced, Amazon announced that it was testing a generative artificial intelligence shopping assistant called Rufus, and emphasized that the assistant “has received training related to all of Amazon's product catalogs and shopping assistance functions, etc.,” and conducted cooperative testing work with some key customers using the Amazon mobile app.

According to the general opinion of Wall Street analysts, Amazon's stock price is expected to resume strong gains after a difficult start in 2024, or gradually improve and return to the record for the highest stock price in history set more than two years ago. Companies such as Bank of America, Citigroup, Deutsche Bank, Goldman Sachs, and J.P. Morgan ranked it the most popular e-commerce or internet stock in 2024, while Oppenheimer and Roth MKM rated it as the most popular large-cap stock. Wall Street businesses' bullish confidence in Amazon's stock price outlook mainly comes from artificial intelligence. They believe Amazon is expected to be in the best position in this wave of global artificial intelligence competitions with self-developed AI chips and innovative generative AI products that are deeply bundled with the AWS cloud platform.

According to expected data compiled by the investment research platform Seeking Alpha, Wall Street analysts rated Amazon as a “strong buy,” with an average target price of $183.85, which means a potential increase of 15.43% over the next 12 months, and is getting closer to the highest stock price in Amazon's history — $188.65 set in July 2021, and the highest target price is as high as $230. Damo recently released a research report stating that it is optimistic about Amazon's stock price trend, and the target price for a 12-month period is 185 US dollars.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal